Portfolio Summary Updated

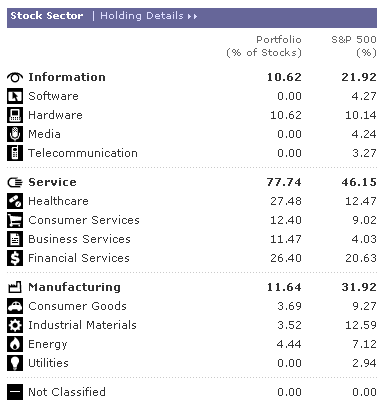

The portfolio summary and quality growth screen have been updated. The Moose Pond portfolio is diversified across eight industries.

Performance for 2004

The following table shows the performance of Moose Pond Investors through December 31, 2004. Total return is the return from the start of the portfolio on October 4, 2000. All returns are shown on an annualized basis.

|

Stocks

Only |

Stocks

& Cash |

VG 500

Fund |

S&P 500

|

Russell 2000

|

Unit

Value |

|

| 2004 |

16.1%

|

13.8%

|

10.3%

|

10.88%

|

17.0%

|

$13.256

|

| 2003 |

35.1%

|

23.1%

|

30.7%

|

28.7%

|

47.3%

|

$11.802

|

| 2002 |

-23.4%

|

-19.1%

|

-21.5%

|

-22.1%

|

-20.5%

|

$9.707

|

| 2001 |

37.9%

|

13.8%

|

-10.3%

|

-11.9%

|

2.5%

|

$11.970

|

| Total |

14.6%

|

10.3%

|

7.8%

|

Since uninvested cash reduces overall return, the table shows both overall performance of the portfolio and, separately, performance of the stocks in the portfolio. Portfolio Record Keeper and bivio.com were used to make these calculations. The table also shows the IRR that would have resulted from making identical investments in Vanguard’s S&P 500 index fund.

Winners and Losers

Our winners for the year have been: FDS (+46.7%), LNCR (+41.2%), COF (+37.0%), PDCO (+36.4%), and CBH (+28.5%). Our losers for same period have been: PFE (-24.8%), PAYX (-10.9%), INTC (-15.3%), UTSI (-5.5%), and FNM (-3.9%).

Historical Performance

The following table shows the performance of Moose Pond Investors through December 18, 2004. Total return is the return from the start of the portfolio on October 4, 2000. All returns except YTD are shown on an annualized basis.

|

Stocks

Only |

Stocks

& Cash |

VG 500

Fund |

S&P 500

|

Russell 2000

|

Unit

Value |

|

| 2001 |

37.9%

|

30.8%

|

-10.3%

|

-11.9%

|

2.5%

|

$11.970

|

| 2002 |

-23.4%

|

-21.1%

|

-21.5%

|

-22.1%

|

-20.5%

|

$9.707

|

| 2003 |

35.1%

|

27.9%

|

30.7%

|

28.7%

|

47.3%

|

$11.802

|

| YTD |

11.6%

|

10.5%

|

10.3%

|

7.4%

|

15.3%

|

$12.615

|

| Total |

12.6%

|

10.5%

|

10.4%

|

$12.867

|

Since uninvested cash reduces overall return, the table shows both overall performance of the portfolio and, separately, performance of the stocks in the portfolio. Portfolio Record Keeper was used to make these calculations. The table also shows the IRR that would have resulted from making identical investments in Vanguard’s S&P 500 index fund.

Our Top 10 Winners and Losers

Our all time winners have been: LOW (+186%), JCI (+140%), PDCO (+84%), ORLY (+77%) and COF (+72%). Our losers have been: OCA (-61%), CTS (-35%), INTC (-31%), PFE (-28%), and MRK (-16%). Of the losers, we are still holding INTC, PFE and MRK.

Report for November 2004

Annualized Return (IRR): 7.6% YTD and 9.0% since Oct. 5, 2000

Summary Report | PERT | Trend Report | Offense Report | Defense Report

At the end of November, the Moose Pond Investors’ portfolio had the following weighted averages: projected total return of 21.4%, projected average return of 14.7%, upside / downside ratio of 4.1 to 1 and a relative value of 91.8. These are all very good averages. The portfolio has 7.6% of its assets in cash.

Report for October 2004

Annualized Internal Rate of Return (IRR): 2.2% YTD and 6.7% since Nov. 2000

Summary Report | PERT | Trend Report | Offense Report | Defense Report

At the end of October, the Moose Pond Investors portfolio had the following weighted averages: projected total return of 21.4%, projected average return (PAR) of 16.1%, upside / downside ratio of 4.6 to 1 and a relative value of 92.2. These are all very good averages. The portfolio has 8% of its assets in cash, part of which we will deploy this month.

Defense and offense alerts.* Several of our stocks have fallen short of the sales growth targets for the trailing twelve months. (See defense report above.) These stocks include Fannie Mae, Affiliated Computer Services and Harley-Davidson. One other stock in the portfolio to watch closely is UTStarcom.

* A defense alert means that a stock’s current sales or earnings growth has fallen below the growth rates that were projected for that stock. We look at changes in growth rates for the both current quarter and the trailing twelve months. In both cases, we compare current sales and earnings with the corresponding period on year earlier. An offense alert means that a stock’s projected average return has fallen below our desired return for that stock.

Report for September 2004

Annualized Internal Rate of Return (IRR): -1.5% YTD and 5.37% since Nov. 2000

Summary Report | PERT | Trend Report | Offense Report | Defense Report

At the end of September, the Moose Pond Investors portfolio had the following weighted averages: projected total return of 21.0%, projected average return (PAR) of 16.1%, upside / downside ratio of 4.6 to 1 and a relative value of 92.2. These are all very good averages. The portfolio is nearly fully invested in stocks with 5.2% of assets in cash.

In September, we purchased additional shares of Intel and Pfizer. The big price movers in our portfolio this month were Fannie Mae (-14.8%) and Capital One Financial (+9.1%) and Lowes (+9.4%). (But remember, it’s not price movement but stocks fundamentals that matter in the long term!)

Defense and offense alerts.* Several of our stocks have fallen short of the sales growth targets for the trailing twelve months. These stocks include Capital One Financial (3.0% vs. 14%), Harley Davidson (7.1% vs. 12%), and Affiliated Computer Services (8.4% vs. 14%). Also, Brown & Brown is below our target projected average return (12.3% vs. 15%). Other stocks in the portfolio to watch closely are UTStarcom and Fannie Mae.

* A defense alert means that a stock’s current sales or earnings growth has fallen below the growth rates that were projected for that stock. We look at changes in growth rates for the both current quarter and the trailing twelve months. In both cases, we compare current sales and earnings with the corresponding period on year earlier. An offense alert means that a stock’s projected average return has fallen below our desired return for that stock.

Report for August 2004

Internal Rate of Return (IRR):

2.33% year-to-date and 6.09% since Oct 2000

Summary Report |

PERT |

Trend Report |

Offense Report |

Defense Report

The portfolio has the following weighted averages: total return of 20.7%, projected average return (PAR) of 15.8%, upside / downside ratio of 4.5 to 1 and a relative value of 93.2. These are all good averages. The portfolio is almost fully invested in stocks with only 5% cash.

This month we purchased initial positions in Amgen and Bed, Bath and Beyond. We also purchased additional shares in UTStarcom and Commerce Bank Corp.

All of the club’s transactions have been loaded into NAIC’s Portfolio Record Keeper (v.5). The program calculates internal rates of return accurately and also generates a number of useful reports. See the Appraisal Report and the Performance Report for this month.

PERT Report

What is the Portfoilio Evaluation and Review Technique (PERT) Report? (Here is a recent PERT report for Moose Pond Investors.) The following description is borrowed from the NAIC Toolkit manual.

“The PERT report is the first defensive weapon in your portfolio management arsenal. This report deals with two main issues. The foremost is the trend in the companies’ performance; of lesser importance is a current value assessment of the stocks. A third item—of interest, but of least importance—is the stock’s dividend and yield. That information is found in the first and third column of the report, on either side of the company’s name.

“Columns 5 through 8 represent the heart of the PERT Report. They reveal, respectively, the percentage difference in quarterly earnings per share, quarterly pre-tax profits, quarterly sales, and the trailing 12-months’ earnings per share over the same figures for a year ago.

“While quarterly changes are not, in themselves, important enough to warrant taking some immediate action, they are significant alert signals to detect the possible onset of longer-term trends.”

Report for July 2004

Value per unit on Friday, July 23, 2004: $11.67

Performance Benchmark (YTD IRR): -2.1% for club, -3.9% for S&P 500

Summary Report | PERT Report

| Trend Report | Offense Report | Defense Report