Carnival Corp. & PLC

The October 2005 Better Investing magazine featured Carnival Corp. (CCL) as a stock to study. Here is a PowerPoint presentation and a stock selection guide analyzing Carnival from the NAIC DC monthly stock to study presentation. The presentation is also here in pdf format.

Here is the bottom Line: Carnival is a quality stock. Value Line financial strength is B+ and earnings predictability is 80, and RQR is 69.6 It currently has an upside/downside ratio of 3.5 and a relative value is 110. It has an estimated total return of 17.8% and projected average return (PAR) of 12.8%. Carnival is a hold. It might be a buy if the PAR was a little higher (greater than 15%).

Investors Financial Services

Investors Financial Services Corp. (IFIN) declined 13% for the quarter and 33.2% year to date. It is our second worst performing stock for the year. UTSI is the worst. The drop in IFIN stock price resulted from declining earnings growth. We looked at IFIN two months ago. This is a relook.

On July 17, Investors Financial cut its earnings forecast. The company gave 2005 earnings guidance of $2.30 a share, with core earnings flat with the year-ago $2.09. The company said 2006 core earnings would rise 8%-10%. Analysts had forecast earnings of $2.50 a share for 2005 and $2.98 for 2006. See page 2 of the second quarter earnings report for the companies explanation.

The announcement predictably drove the stock price down, although the market had already discounted the decline in earnings growth with the stock price slowly declining since February. See IFIN price chart. The bottom feeders of the securities bar immediately filed multiple class actions alleging that management had misled shareholders with false optimism prior to the reduced earnings guidance. The filing of class actions under the Securities Exchange Act of 1934 whenever a company announces bad news has become a cottage industry that ought to be closed. The litigating attorneys frequently settle these class actions for their fees and expenses and some minimal compensation to the shareholders. Most of these class actions are a wasteful drain on an overburdened legal system and on the finances of the targeted companies.

Morningstar rates IFIN with three stars, a narrow moat, and a “D” in stewardship, and concludes that it is fairly valued at $35. (It’s current price is $32.90). Manifest Investing gives IFIN a quality rating of 64 and estimates a PAR as 21.2%. The Investors Advisory service also has IFIN as a buy up to $53.

The company’s core business offers a wide range of administration services to mutual fund complexes, investment advisors, family offices, banks, and insurance companies. That business seems to be solid although it operates in a very competitive environment. The company’s banking services have suffered the same slow down as other banks due to flatter yield curve and narrower investment spreads. The market has probably over reacted to the news in July. Our current stock selection guide shows a projected average return of 19.4%. IFIN is a hold for now. However, we have four financial stocks, CBH, FITB, COF and IFIN. We may want to consider pruning back.

Manifest Investing

Manifest Investing was founded by two NAIC members. Their web site uses Value Line data to estimate 5-yr projected average return and stock quality.

The Manifest Investing “dashboard” is very similar to our portfolio summary. In fact, we borrowed the idea from them of displaying PAR and quality as two of the primary metrics for portfolio management.

Sometimes you will find differences in the value of PAR shown on the Manifest Investing dashboard and our portfolio summary. We use the NAIC stock selection guide to calculate PAR. This requires the application of some judgment. In contrast, Manifest Investing uses a formula that applies Value Line data. Manifest Investing relies on the judgment of the Value Line analysts. Both appoaches are helpful. When there is a significant difference in PAR, we should try and understand why that has occurred.

The Manifest Investing dashboard updates automatically to reflect current stock prices. Our portfolio summary is updated monthly. You might find it helpful to review both. The dashboard link in the “About” section (upper left) will take you to the Manifest Investing dashboard for our portfolio.

PE Expansion & Contraction

When a stock appreciates in value, how much of that appreciation comes from earnings growth and how much comes from PE expansion? (Note: PE expansion occurs when buyers are willing to pay a higher price for the same amount of earnings. The price per share / earnings per share or “PE” ratio increases.)

Clearly, PE expansion was a major factor in the stock market gains that occurred between 1982 and 1999. Crestmont Research has an interesting chart on its web site that shows year end PEs for the S&P 500. The chart is arranged to show secular (long term) bull and bear markets.

Over the 17 year period from 1982 to 1999 (which Crestmont Research and others characterize as a bull market), the average PE for the S&P 500 rose from 7 to 42. At an annualized rate, the average PE increased 12.8%. This is a significant PE expansion for the market as a whole. For the 10-year period from 1989 to 1999, the average PE rose from 17 to 42, an annualized increase of 9.5%. And, for the 5-year period from 1994 to 1999, the average PE rose from 21 to 42, an annualized increase of 14.9%.

During these periods, any basket of stocks that generally had the characteristics of the S&P 500 would have increased significantly in value due to PE expansion alone. Earnings growth and overall market PE expansion together provided some impressive gains during the 1982-1999 period.

There is not much an individual investor can do about PE expansion or contraction. PE expansion and contraction are long term cyclical events that happen to the market as whole. Market PEs have been contracting for the last several years. The current PE for the S&P 500 is around 17. Declining high and low PEs since 1999 can be observed on the SSGs of many stocks.

What does this all mean for the average investors? First, PE expansion is something we can hope for but, like the weather, can’t do much about. Second, PE contraction seems more likely than PE expansion for the market over the next few years and possibly longer. Just look at the historical market PEs. Will the current market PE contraction stop at 17 or continue to 15, 12 or 7, and, if so, when will it stop? Third, the current market PE contraction makes achieving a 15% annualized return even more of a challenge.

Calculating Portfolio Return

There are a number of different ways to measure portfolio performance. Perhaps the most accurate method compares the annualized internal rate of return (IRR) for the portfolio with an index fund such as the Vanguard Index 500 Fund or the Vanguard Total Stock Market Fund. As we are using the term, IRR means the annualized rate of return for the portfolio taking into account the timing of all member investments and withdrawals. See answers.com for a more complete definition. Prior to the age of computerized spreadsheets, this calculation was somewhat tedious. (What ever happend to VisiCalc and SuperCalc?!)

A very clever spreadsheet created by a long term NAIC member does exactly that. (The Bivio website will generate a similar report called the performance benchmark.) Using data that shows the purchase and sale of member shares, the spreadsheet calculates the annualized internal rate of return for the club. It also calculates the annualized internal rate of return if the same funds had been invested in either the Vanguard Index 500 Fund or the Vanguard Total Stock Market Fund.

Here are the results comparing Moose Pond Investors with these two index funds for the period from 6 October 2000 to 5 August 2005:

- Moose Pond Investors -> 7.4%

- Vanguard Index 500 Fund -> 6.9%

- Vanguard Total Stock Market Fund -> 8.6%

Our return is line with these index funds. It also takes into account expenses such as brokerage fees and commissions. As we go forward, we hope to beat both indices. The spread sheet with the calculations for Moose Pond Investors is here.

Energy Stocks

Natural gas and oil prices have continued their steady increase. Unlike oil shortages in the past that were in large part politically driven, world-wide demand for energy has driven long-term commodity oil prices over $60 a barrel. Oil prices are not likely to come down significantly in the near future.

Natural gas and oil prices have continued their steady increase. Unlike oil shortages in the past that were in large part politically driven, world-wide demand for energy has driven long-term commodity oil prices over $60 a barrel. Oil prices are not likely to come down significantly in the near future.

Since traditional NAIC analysis focuses on earnings growth, it does not work particularly well with energy stocks. The value of an oil or natural gas company depends in large part on the value of the company’s reserves. Proven reserves are the real assets. Kurt Wulff of McDep Associates evaluates and ranks energy stocks based on the value of their reserves. He also computes several other ratios that are helpful in comparing oil and gas producers.

Using information about a company’s reserves, Wulff calculates a “McDep ratio” for each company. A McDep ratio of 1.00 represents a present value that assumes a long-term oil price of $40 per barrel. Companies with a McDep ratio less then 1.00 are undervalued (assuming future prices return to $40 per barrel). They are very undervalued if long term oil prices remain above $40 per barrel.

We currently own one oil stock, Chevron (CVX). It is classified as mega cap company and represents 3.8% of our portfolio. It has appreciated 10.9% since we bought it earlier this year and it pays a 3.1% dividend. We should consider increasing our energy-related holdings, perhaps owning one or two producer/refiners or independent producers. The current edition of McDep Associates’ weekly newsletter, the Meter Reader, ranks oil and gas producers using the McDep ratio. Lukoil Oil Company (LUKOY), Anadarko Petroleum Corp. (APC) and Encore Acquisition Company (EAC) have the lowest McDep ratios in their respective industry categories.

Give some thought to adding energy holdings to the portfolio in the near future. Owning some stocks with proven energy reserves, especially ones that pay a dividend, seems like a prudent investment.

Wal-Mart Stores

Wal-Mart Stores (WMT) is the company that many love to hate, but they still shop there. Wal-Mart frequently shows up in screens for quality growth stocks and is another company to consider buying. Using NAIC criteria, WMT is a buy up to $60.20 (current price is $49.32). Projected average return over the next 5 years is 14.7%. See the annotated stock selection guide for more details. The SSG assumes 11% revenue growth based on Value Line.

Wal-Mart Stores (WMT) is the company that many love to hate, but they still shop there. Wal-Mart frequently shows up in screens for quality growth stocks and is another company to consider buying. Using NAIC criteria, WMT is a buy up to $60.20 (current price is $49.32). Projected average return over the next 5 years is 14.7%. See the annotated stock selection guide for more details. The SSG assumes 11% revenue growth based on Value Line.

About Wal-Mart. The company Sam built has become the world’s largest retailer. Diversification into grocery (Wal-Mart Supercenters and Neighborhood Markets), international operations and membership warehouse clubs (SAM’S Clubs), has created greater opportunities for growth. Wal-Mart notes on its website that unlike some corporations whose financial growth does not translate into more jobs, Wal-Mart’s phenomenal growth has been an engine for making jobs.

As of July 31, 2005, the Company had 1,276 Wal-Mart stores, 1,838 Supercenters, 556 SAM’S CLUBS and 92 Neighborhood Markets in the United States. Internationally, the Company operated units in Argentina (11), Brazil (150), Canada (261), China (48), Germany (88), South Korea (16), Mexico (711), Puerto Rico (54) and the United Kingdom (292).

Quality. Wal-Mart is off the charts — in a good way — on quality. The RQR quality rating is 80.4. Value Line rates Wal-Mart an “A++” for financial strength and 100 for earnings predictability. That is as good as it gets. Section 2 of the SSG shows great consistency in pretax margin and return on equity. Both of these are hallmarks of good management in a quality company.

What Others Are Saying. Standard & Poors rates Wal-Mart five stars with an investibility quotient of 100 and a target price of $59. Morningstar also rates Wal-Mart five stars with a wide economic moat and a fair value of %58.00. It gives management a stewardship grade of A. Morningstar’s bull and bear comments summarize the views of a number of analysts.

Bulls Say

- Wal-Mart still has plenty of room to grow. Roughly half its Supercenter stores are in a dozen Southern states, leaving plenty of room to expand in the Northeast and California.

- The company plans to boost margins by focusing on global sourcing, especially in China. This could serve to offset potential increases in labor costs.

- International operations have strong growth potential. We expect this area to contribute one third of Wal-Mart’s growth over the next five years.

Bears Say

- While Wal-Mart still has plenty of room to grow, it is possible that the company has grown so large that it will be difficult to manage that growth.

- Wal-Mart’s ability to undersell its competitors stems partially from its low labor costs. Unionization could have dire consequences for the company.

- New-store growth could be pinched as the company digs deeper into urban areas where real estate is more expensive and wage costs are higher. Additionally, the company could face resistance from activists as it tries to move into choice urban areas.

- A federal judge recently approved a class-action sexual-discrimination lawsuit against Wal-Mart. This doesn’t mean that the courts are siding with the plaintiffs, and the case could drag out for years. Still, investors should be cognizant that a Wal-Mart loss could result in a big cash payout and potentially raise the company’s labor costs.

Bottom Line. Wal-Mart is one of the highest quality growth companies and is a buy up t0 $60.20.

Jack Henry & Associates

Jack Henry & Associates (JKHY) is a stock that frequently shows up in screens for quality growth stocks and is another company to consider buying. Using NAIC criteria, JKHY is a buy up to $23.10 (current price is $18.52). Projected average return over the next 5 years is 18.3%. See annotated stock selection guide for more details. The SSG assumes a 13.5% revenue growth based on Value Line.

Jack Henry & Associates (JKHY) is a stock that frequently shows up in screens for quality growth stocks and is another company to consider buying. Using NAIC criteria, JKHY is a buy up to $23.10 (current price is $18.52). Projected average return over the next 5 years is 18.3%. See annotated stock selection guide for more details. The SSG assumes a 13.5% revenue growth based on Value Line.

Jack Henry & Associates provides integrated computer systems and processes ATM and debit card transactions for banks and credit unions. It describes itself as:

A technology provider for the financial industry. That’s the simplest way to describe what we do. But it hardly describes what Jack Henry & Associates is really about. We’re about solutions and support. We’re about building relationships and making things work. We’re about doing the right things for our customers, no matter what. It began as a vision, and it’s become our tradition.

A substantial amount of JKHY’s revenue, about 60%, comes from recurring sales. The company has a strong customer focus. Its several corporate aircraft are used to transport customer support teams — not company executives. Great concept!

Value Line rates JHKY’s financial strength “B++” and earnings predictability as 75 (out of 100). Its RQR quality rating is 61 — a little lower than the Moose Pond Investors portfolio average. Given the high projected average return and the that fact that JKHY is a medium size company, the lower quality rating is acceptable. Morningstar gives JKHY a rating of five stars and a wide economic moat. It estimates fair value at $22 assuming a growth in revenue of 11.5%. (Lowering the sales growth rate in the SSG to 11.5% results in a PAR of 16.3%).

Bottom Line. JKHY is a strong buy up to $23.10.

Kohl’s Corporation

Here is one of several stocks for consideration. Kohl’s Corporation (KSS) keeps popping up on screens for quality growth companies. Kohl’s operates 669 family-oriented specialty department stores in virtually all areas of the U.S. except the Pacific Northwest and Florida. It sells name-brand merchandise with emphasis on value pricing. The fundamentals look good for Kohl’s with a projected average return over the next five years of 16.2%. Value Line rates Kohl’s financial strength “A” and earnings predictability 85 (out of 100). Value Line also projects revenue growth at 17%. Kohl’s has an RQR quality rating of 80.4. See annotated stock selection guide.

Here is one of several stocks for consideration. Kohl’s Corporation (KSS) keeps popping up on screens for quality growth companies. Kohl’s operates 669 family-oriented specialty department stores in virtually all areas of the U.S. except the Pacific Northwest and Florida. It sells name-brand merchandise with emphasis on value pricing. The fundamentals look good for Kohl’s with a projected average return over the next five years of 16.2%. Value Line rates Kohl’s financial strength “A” and earnings predictability 85 (out of 100). Value Line also projects revenue growth at 17%. Kohl’s has an RQR quality rating of 80.4. See annotated stock selection guide.

Different analysts have different expectations for Kohl’s. For example, the First Call analysists’ consensus for the 5-year earnings growth rate is 19.2%. In contrast, Morningstar only gives Kohl’s a mediocre rating. MS rates Kohl’s with three star and puts it’s fair value at $51.00 (below its current price of $55.63.) MS has assumed 12% revenue growth. The attached SSG assumes 17% based on the Value Line estimate. (Note: PAR on the SSG would drop to 11.2% with 12% sales growth.) More interesting are MS’ bull and bear comments.

Bulls Say

- Kohl’s has recovered after its 2003 missteps. Although revenue growth continues to be a little disappointing, margins and inventory levels recovered nicely.

- Kohl’s still has plenty of room to expand into new and existing markets, so it should be able to open stores at a brisk pace over the next few years.

- Earnings have grown faster than sales, thanks to widening margins. MS expects the company to continue to leverage its SG&A spending as the store base expands, but increasing competition may make it tougher to expand gross margins.

- Kohl’s off-the-mall format distinguishes it from the rest of the department-store industry, which is dominated by mall-based stores that consumers have found less convenient in recent years.

Bears Say

- Recent lackluster same-store sales results illustrate that Kohl’s is not immune to slowdowns in consumer spending.

- Some traditional department-store chains have copied elements of the firm’s strategy in an effort to regain lost share, so competition may continue to heat up.

- Retail powerhouse Wal-Mart is coming on strong in apparel retail. Wal-Mart’s operational efficiency trounces that of Kohl’s.

- The company stumbled in late 2003, cluttering stores with excessive inventory and creating a less-pleasant shopping environment. Management is correcting the problem, but this shows that smart executive teams can still falter.

Bottom line. KSS is a quality growth stock. Whether it falls into the buy zone depends on the assumed revenue growth. Based on the Value Line estimates for growth and net profit margins, KSS is a buy up to $62.

Replace Any Stocks?

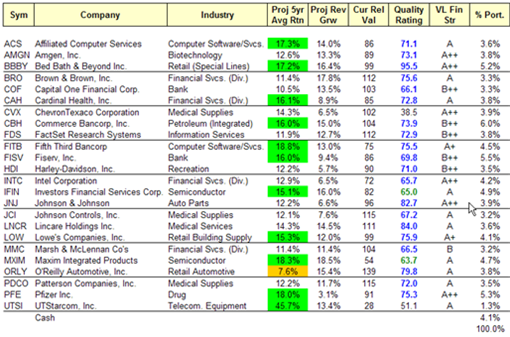

The portfolio summary on July 15 shows an overall projected average return of 14.8% and a quality rating is 71.9 (out of 100). This is excellent (in spite of the less than stellar YTD performance of the portfolio).

(Note the snapshot has changed since this entry. See current snapshot.)

In deciding what we might replace in our portfolio, we need to took at two things: projected average return (PAR) and the quality of each company. PAR is an estimate of the return we can expect if we hold the company for five years (assuming sales and earnings grow as predicted). Although the computer is very precise in its calculations, PAR is still an estimate — an intelligent guess. One or two percentage points difference in PAR between companies is relevant but we should not put too much weight on small differences.

In looking over the portfolio snapshot, we only have one stock with a PAR of less than 10% — ORLY. There is one important mathematical nuance when we calculate PAR. When a company lowers its long term earnings or revenue guidance (like IFIN and HDI), it is usually reflected in the price right away. The PAR calculation shows rate of growth from the present price to the estimated price in five years. This the lower present price causes PAR to increase. (For example, IFIN currently has PAR of 15.1% using 10% growth in EPS and revenue. The 15.1% PAR reflects that fact that price dropped 17% last week. It may also reflect some efficiency on the part of the market)

We also should give considerable weight to a company’s quality. “Quality” means a strong management team, consistent long term earnings and revenue growth, high return on shareholders’ equity (15-20% for at least 5 years), free cash flow, and what Warren Buffet would call a wide moat. We should be slow to sell a high quality stock. (The one exception to this is if the PAR falls below the risk free rate of return, e.g., the 5-year treasury rate or if there has been a negative change in a company’s fundamentals.) A quality company is more likely than a poor quality company to work through problems that might adversely impact future earnings. HDI is an example of high quality company with a strong management team.

As the PAR for a company drops falls below 10%, we need to take a close look at whether we want to continue to hold the company or replace it. I tend to hold high quality companies. However, if the PAR falls below the risk free rate of return or if there has been an adverse change in a company’s fundamentals the decision to sell is much easier.

We have more cash to invest. We can add to our existing holdings (ACS, BBBY, CAH, LOW and PFE all look good) or find a new company. Three watchlist companies that look interesting are Jack Henry (JKHY), Wal-Mart Stores (WMT) and Thomas Nelson, Inc. (TNM). As time permits this week, I’ll post SSGs and summaries for these three companies.