Maxim Integ. Prod. (MXIM)

SSG and PERT | Google Stocks | Company Website

Maxim reported earnings for the fiscal year ending June 24, 2006. The company reported revenue growth of 11.2%. However, net income fell (-14.4%)and diluted EPS fell (14.9%) from $1.578 to $1.372. See Maxim’s press release. The expensing of stock based compensation contributed to the poor earnings.

Maxim and Linear Technologies (LLTC) are similar companies with different niches in the semiconducter industry. They had similar results this year, increased revenue growth but declining earnings. LLTC’s EPS did not decline as much as that of MXIM.

Should we sell MXIM? The short answer is no. The company’s fundamentals — the basis on which we buy or hold stocks — still look very good. On Friday, Maxim reported record-high quarterly revenue as bookings. The company has no long term debt. Net profit margins have remained strong. Value Line projects 20% sales growth and 15.5% earnings growth. The analysts consensus for 5-year earnings growth rate is 20%. Morningstar gives Maxim a 5-start rating (meaning it is priced well below fair value), a wide moat, and a stewardship grade of B. Manifest Investing rates its quality 69.

Whenever the earnings of a growth company falter, the price of the stock usually tumbles. Maxim’s stock price is near its three year low even though the company’s fundamentals and business model appear to be intact.

We currently hold 58 shares of Maxim valued at $2,090. It is 4.3% of our portfolio. Our average cost is $35.88 per share. The current share price is $27.94. We have a net loss of $462. (We also have a net loss for Intel, another semiconductor stock.) Revising the stock selection guide for a projected 15% EPS growth, projected average return is 21.5%. At his point, we probably have more to gain than lose by holding Maxim.

Prior Analysis from January 09, 2005

Maxim Integrated Products is one of two semiconductor manufacturers that appear to be timely purchases. The other is Linear Technologies (LLTC).

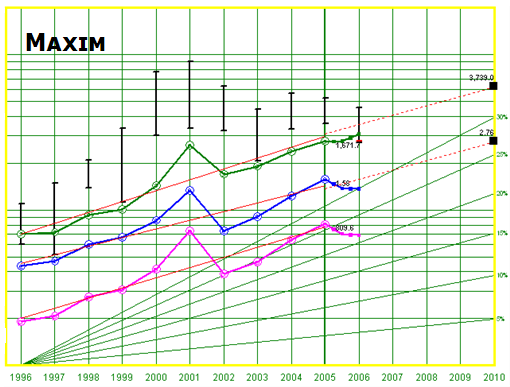

Growth. Although sales and earnings dropped slightly between 2001 to 2002, MXIM is a quality growth company. Over the past ten years, revenues and earnigns have grown at an annualized rate of about 20%. Going forward, the analysts consensus earnings growth is 25% (First Call). Value Line rates MXIM’s financial strength A and earnings predictability 60. The relative quality rating is 75. (Over 60 is good.)

Value. From the SSG, projected average return is 19.9% This assumes five-year EPS of 20% and projected high PE of 36.6. The upside downside ratio is 5.4. MXIM has no long term debt.

Company Description. Maxim Integrated Products, Inc. (the “Company”) designs, develops, manufactures, and markets linear and mixed-signal integrated circuits and is incorporated in the state of Delaware. The Company’s products include data converters, interface circuits, microprocessor supervisors, operational amplifiers, power supplies, multiplexers, delay lines, real-time clocks, microcontrollers, switches, battery chargers, battery management circuits, RF circuits, fiber optic transceivers, sensors, voltage references and T/E transmission products. The Company is a global company with manufacturing facilities in the United States, testing facilities in the Philippines and Thailand, and sales offices throughout the world. The Company’s products are sold to customers in numerous markets, including automotive, communications, consumer, data processing, industrial control, instrumentation and medical imaging.