Winners and Losers in 2012

We have had an excellent year thus far in 2012. Our annualized return (with only one week to go) is 19.6%. Our total return would be over 20% if our esteemed Congressional representatives would stop playing chicken with the nation’s “fiscal cliff.”

Here are the stocks that contributed to our return. At the top of the list is Apple, despite its precipitous fall from slightly over $700 per share. Our three index funds–representing asset classes which are difficult to buy on a stock-by-stock basis–are all doing well.

Surprisingly, Intel is in negative territory for the year. However the stock selection guide indicates that it is still a “buy”. It’s too bad that it takes so long for the market to understand what we do!

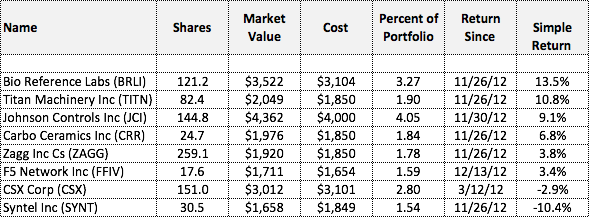

The following table shows our return by stock on an annualized basis. (The actual return your-to-date is slightly lower.) We have held Stryker and Exxon for more than nine months but less than a year.

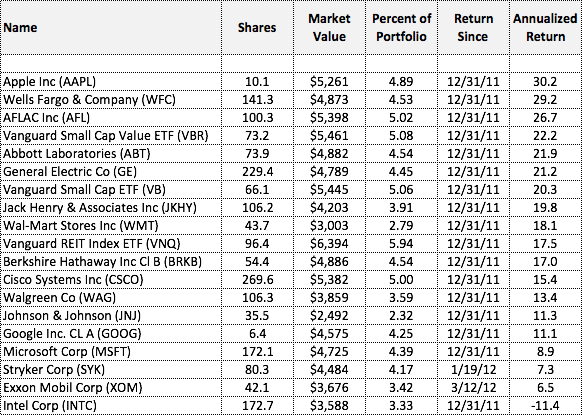

Here is a similar table for the stocks that we have owned for less than 9 months. The table only shows simple return. There are several small stocks in this group. We have taken the approach of buying half positions in small stocks rather than full positions. This gives us some additional diversification by allowing us to hold more small stocks.Â