Report for February 2006

For the first two months of 2006, the Moose Pond Investors portfolio increased in value by 3.1%. In comparison, the S&P 500 index increased 2.6% for the same period.

The best performing stocks were Investors Financial, IFIN (+22.5%), Jack Henry & Associates, JKHY (+15.3%), and Occidental Petroleum, OXY (+15.1%). The worst performing stock was Intel, INTC (-17.5%).

A performance report for 2006 can be downloaded here.

Sold Capital One Financial (COF)

We sold COH on June 12, 2007.

Brown & Brown (BRO)

SSG and PERT A Graph | Google “stocks: bro” | Company Website

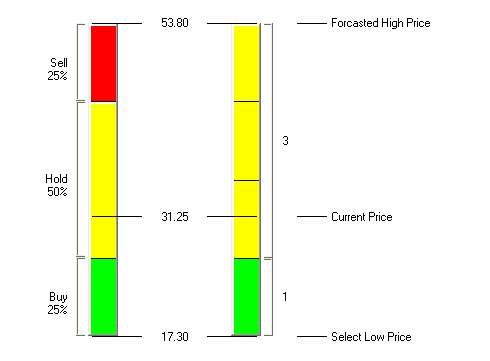

Brown & Brown remains a high quality growth stock. Currently at $31.25, our stock selection guide has BRO a buy up to $26.40 with a projected average return of 8.3%. BRO pays a 0.8% dividend. Its current price makes it a HOLD. We wouldn’t buy more at this price but we are reluctant to exchange this quality company for another.

The Feb 24, 2006, Value Line comments that Brown & Brown has made solid progress

of late and has bright prospects over the coming 3 to 5 years. VL rates BRO’s financial strength as an “A” and earnings predictability as 90. Morningstar also speaks well of the company and projects revenue growth of 16% while Value Line projects revenue growth of 14%. However, Morningstar only gives BRO 2-stars indicating that the current price is high relative to its fair value calculation.

Investor Advisory Service also follows BRO and notes: “Business remains quite solid at insurance broker Brown & Brown. Fourth quarter EPS increased 14%. Sales grew 21%, with internal revenue growth of 5.2%. CEO J. Hyatt Brown notes that 2005 was the thirteenth consecutive year in which Brown & Brown had earnings growth of at least 15%. Acquisitions are clearly an important part of its growth. The past two years were extremely robust in terms of acquisitions, and the company says that its pipeline of new deals is “a strong as ever.” IAS has as a buy up to 28.

NAIC Growth Fund

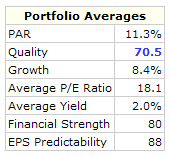

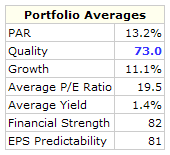

It is always helpful to compare portfolios. Here are summary dashboards for the NAIC Growth Fund and for the Moose Pond Investors portfolios. The NAIC Growth Fund is a closed end fund that was intended to demonstrate NAIC principles. You can click on either summary below for the complete dashboard.

In the past 6 months NAIC growth fund sold its position in Pepsi and Newell Rubbermaid. The fund added to its positions in Abbot Labs, Carlisle Companies, Jack Henry & Associates, Medtronic, Stryker, and Washington Mutual. The total return for the NAIC Growth Fund in 2005, based on change in net asset value, was 1.3% (slightly ahead of our return of 0.3).

| NAIC Growth Fund |

Moose Pond Investors |

|

|

While quality is about the same in both portfolios, the Moose Pond portfolio has higher PAR, higher projected growth, and a higher quality rating. We can probably improve the overall PAR by replacing several of our low PAR companies with higher PAR companies.

Intel Corp. (INTC)

SSG and PERT A | Google “stocks: INTC” | Company Website

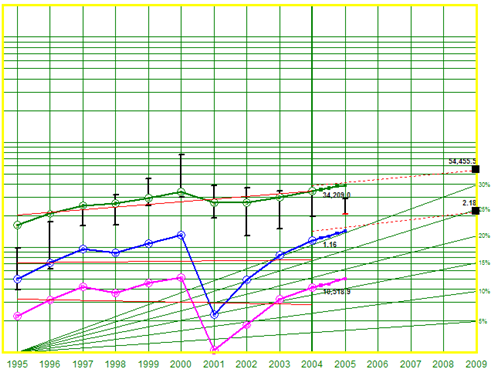

Here is a revised stock selection guide for Intel Corp. Assuming 7.0% revenue growth and 8.8% earnings growth, the projected average return is 17.0%. Intel quality is high with a RQR rating of 71.6. Value Line rates its financial strength A++ but earnings predicatbility is only 50. As the two charts below show, Intel has contined to grow its earnings over the past four years while the market price has remained relatively constant for the last 18 months.

Here is a revised stock selection guide for Intel Corp. Assuming 7.0% revenue growth and 8.8% earnings growth, the projected average return is 17.0%. Intel quality is high with a RQR rating of 71.6. Value Line rates its financial strength A++ but earnings predicatbility is only 50. As the two charts below show, Intel has contined to grow its earnings over the past four years while the market price has remained relatively constant for the last 18 months.

Lower than expected Q4 and year end earnings, and concerns about INTC losing market share to AMD have caused the share price to drop 17.4% YTD. Concern over AMD may be an overreaction (see story). Intel will be supplying CPU andrealtred chipsfor Apple’s new computers.

Intel remains a strong HOLD.

Purchased ITW and SYK

We took an initial position in Illinois Tool Works (ITW) yesterday at a price of $84.56. On January 23, we took an initial position in Stryker (SYK) at a price of $45.34.