Portfolio Summary Updated

The portfolio summary has been updated. The portfolio has a projected average return of 15.0% and a quality rating of 71.4 (out of 100). Three stocks with relatively low PAR are ORLY (7.4%), PDCO (10.1%) and BRO (10.8%). These might be candidates for replacement with companies with higher PAR values.

The portfolio is diversified across five industries but with most of the holdings in four industries. The portfolio has some redundancy in the financial sector (banks – FITB and CBH ), healthcare sector (drugs – PFE and AMGN) and information technology sector (chips – MXIM and LLTC). See diversification report.

Several other NAIC reports are helpful in reviewing a portfolio. See Portfolio Evaluation Review Technique (PERT) Report (sorted by total return), and Trend Report (sorted by percent of portfolio).

Sold Commerce Bancorp (CBH)

We sold CBH on June 12, 2007. Primary reason was declining on return on assets.

Evaluating Management

As Graham and Dodd note in their book, Security Analysis:

Objective tests of managerial ability are few and rather unscientific…. The most convincing proof of capable management lies in a superior comparative record over a period of time….

Sections I and II of the stock selection guide provide tools for evaluating the performance of company management over a ten year period. Section I provides a visual representation of revenues, earnings and pretax profit that shows growth and consistency. Section II shows pretax profit margins and return on equity for the same period. Together, these metrics provide a good indicator of the long term results achieved by management.

Here is a presentation from the DC Chapter of NAIC on Evaluating Company Management. The presentation also discusses calculation of the “Robertson Quality Rating.”

[PowerPoint version of the NAIC DC Chapter presentation on May 7, 2005.]

Lowe’s Companies (LOW)

SSG and PERT A (05-06-2005) | Google Stocks | Company Website

Growth. Value Line (8 April 2005 report) projects revenue growth for LOW to be 14.5% and EPS growth to be 17%. Historic sales growth over the past 10 years has been between 18% and 20%.

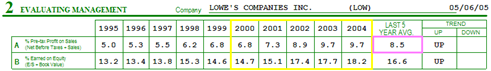

Quality. Two of the key indicators of quality management, pretax profit margin and return on equity have shown steady increases over the past 10 years. See table from Part 2 of the stock selection guide.

|

The Robertson Quality Rating for LOW is 75.6 calculated as follows:

Value Line Financial Strength of A+ = 22.5

Earnings Predictability of 95 = 95 / 4 = 23.8

Projected Sales growth = (14.5 / 11.8) * (25 /2) = 15.4

Projected Profit Margins = (10.6 / 9.4) * (25 / 2) = 14.0

Valuation. 5-year projected EPS is 6.07. With a high PE of 25.1, projected high price is $152.40. With a low PE of 16.3, projected low price is 44.8. Using 25% / 50% / 25% zoning, LOW (currently $53.54) is buy below $71.70.

Negatives. LOW currently has a slightly negative free cash flow (cash flow form operations – capital expenditures). Home Deport (HD) its primary competitor has a positive free cash flow.

What Others Are Saying. A recent Motley Fool article discusses Home Depot and Lowe’s Companies. The author finds both HD and LOW attractive but prefers Home Depot as the market leader and notes it has superior margins and returns, and a lower relative price tag (with comparable bottom-line growth). Morningstar rates LOW with four stars, below average business risk, fair value estimate of $62 and a wide economic moat.

(more…)

Additional Shares Bought

We added to our positions today in PFE, CBH, FISV, BBBY and MXIM. With the additional shares, each company will represent about 6% of the total portfolio.

Using Value Line for PAR

The Value Line Investment Analyzer software can be used to calculate both project average return or “PAR.” The following discussion of PAR builds on several ideas presented by Mark Robertson of Manifest Investing at a class to the Washington, D.C., chapter of NAIC this past April.

PAR can be calculated from Value Line data two ways. First, using the projected 3-5 year EPS growth rate the trailing 12-months EPS can be projected out for five years. Multiplying the Value Line projected 3-5 year average PE by the projected 5-yr EPS provides an estimated 5-yr price. PAR is the compound annual growth rate using the current stock price as the present value (PV) and the estimated 5-yr price as the future value (FV) and adding to it the dividend yield.

PAR also can be calculated by using projected 3-5 year sales growth. The trailing 12-months sales can be projected out for five years. Multiplying by the Value Line projected 3-5 year net margin and dividing by the protected total number of common shares results in an estimated 5-yr EPS. As with the above calculation, multiplying the Value Line projected 5-yr EPS by projected 3-5 year average PE the provides an estimated 5-yr price. PAR is the compound growth rate using the present value and the future value and adding to it the dividend yield.

Here are examples of the above calculations using the 04 Mar 2005 Value Line data sheet for Johnson & Johnson. The data sheet is annotated with an explanation of the sales growth determination. The following key numbers are taken from the data sheet.

From the growth projections on the left side of the data sheet:

Projected Sales growth = 9.5%

Projected EPS growth = 12.0%

From the quarterly data, get the trailing twelve months (TTM) for sales and EPS:

EPS TTM= 3.10

Sales TTM= 47,348

From the projections for ’08 – ’10:

Average Annual PE = 20

Net Profit Margin = 20.7%

Common Shares Outstanding = 2,800

From these numbers, we can calcute PAR. Assume the current price of $65.41 from the data sheet for these calculations.

Using 12% EPS growth:

EPS 5yr = EPS TMM * (1 + EPS growth rate)^5

EPS 5yr = 3.10 * (1.12)^5 = 5.46

FV (price) = EPS 5yr * Avg Annual PE

FV = 5.46 * 20 = 109.20

PAR = (FV / PV) ^ n

where period n is 5 years

PAR = (109.20/65.41)^(1/5) – 1 = 10.8%

Using 9.5% Sales growth:

Sales 5yr = Sales TMM * (1 + sales growth rate)^n

where period n is 5 years

Sales 5yr = 47348 * (1.095)^5 = 74537

EPS 5yr = 74537 * .207 / 2800 = 5.51

Once you have projected five year EPS, the calculation for PAR is the same as for EPS growth.

FV (price) = EPS 5yr * Avg Annual PE

FV = 5.51 * 20 = 110.20

PAR = (FV / PV) ^ n

where period n is 5 years

PAR = (110.20/65.41)^(1/5) – 1 = 11.0%

There are several ways to do these calculations. They can be done with a high school math calculator. Value Line Investment Analyzer allows the creation of user defined fields. The PAR calculations can be done in user defined fields. Alternatively, the Value Line data can be exported to a spreadsheet or data base and the calculations can be done there.

The advantage of calculating PAR is that it can combined with other parameters to screen the Value Line data base. For example, the attached screen is for all stocks in the Value Line 1,700 stock data base with a PAR of more than 15%, a Value Line Financial Quality Rating of B++ or better and an “RQR” quality ratings of 65 or higher. The screen yielded 61 stocks.

PAR is well suited for screening and for comparing stocks within a portfolio, especially when combined with a parameter that measures quality. It provides more consistent results and a better basis for comparison (than Total Return) — assuming that the future average annual PE is estimated in a consistent manner. It also allows for screening of stocks before doing an SSG. The PAR calculation in the SSG is simply based on the high and low PE assigned in Sections 4a and 4b, but that requires some judgment.