Annual Report for 2005

Happy New Year to all! We started Moose Pond Investors a little over five years ago. It is hard to believe that five years have gone by. We now have 18 partners made up of family and friends.

Given the amount of effort that went into research and analysis this year, the results for 2005 were a little disappointing. However our 5-year total return is well ahead the S&P 500 (large stock index) and almost even with the Russell 2000 (small stock index).

Here is our Annual Report for 2005.

Performance for 2005

Given the amount of effort that went into research and analysis this

year, the results for 2005 were a little disappointing. On a

cash flow basis, we finished with a very small gain. While

that is better than losing money, we did not beat either the

S&P 500 or the Russell 2000. They were up 4.9% and

4.6% respectively. On a positive note, we have soundly beaten

the S&P 500 over the past five years and we are almost even

with the Russell 2000.

The table and chart below show the annual return for Moose Pond

Investors over the past five years. The “Stocks

Only” column only shows the return of the stocks we

held. The next column, “Stocks &

Cash,” includes cash awaiting investment and monthly

brokerage fees. As a result, the return is slightly

lower. As our portfolio holdings grow larger, cash on the

sidelines and fees will have less of an impact on overall portfolio

return.

|

Stocks

Only |

Stocks

& Cash |

S&P 500

|

Russell 2000

|

Unit

Value |

|

| 2005 | 0.3% | 0.1% | 4.9% | 4.6% | $13.097 |

| 2004 |

16.1%

|

13.8%

|

10.9%

|

17.0%

|

$13.256

|

| 2003 |

35.1%

|

23.1%

|

28.7%

|

47.3%

|

$11.802

|

| 2002 |

-23.4%

|

-19.1%

|

-22.1%

|

-20.5%

|

$9.707

|

| 2001 |

37.9%

|

13.8%

|

-11.9%

|

2.5%

|

$11.970

|

| 3-year | 10.4% | 9.3% | 12.4% | 22.1% | |

| 5-year | 8.1% | 7.1% | 0.5% | 8.2% |

The annual returns for Moose Pond Investors are calculated using

internal rate of return (IRR). This method is more precise

because it

looks at actual cash flows. It better accounts for partner

investments

and market fluctuations throughout the year. We could have

calculated

annual return using the change in unit value from year to

year.

However, we opted for the more accurate IRR method.

The two

indices that we have been using for comparison, the S&P 500 and

Russell 2000, show the total return for each year including

dividends.

These return calculations do not take into account the actual cash

flows for Moose Pond Investors.

Portfolio Summary Updated

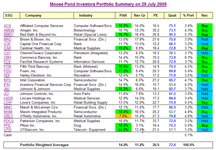

The Moose Pond Investors portfolio has an average projected average return (PAR) of 14.2% and an average quality rating of 72.6 (out of 100). Both the portfolio summary and the related stock selection guides have been revised. Follow the links in the portfolio summary to open the SSGs.

You can cross check our calculations for PAR with the club dashboard from Manifest Investing.

Third Quarter Results

The Moose Pond Investors portfolio increased in value 1.5% for the third quarter of 2005. In comparison, the S&P 500 increased 3.2% and the Russell 3000 Index increased 4%. Overall, the portfolio has a quality rating of 72 (out of 100) and a projected average return of 15.4%. the quality rating is excellent. The PAR is is very good too but could be raised a little. The percent changes this quarter for our five best and worst stocks are listed below.

The Russell 3000 Index is a total market index representing approximately 98% of the U.S. equity market. The S&P 500 Index is a large cap index that includes 500 companies reflecting 80% of the same market.

Q3 Portfolio Winners

Amgen (AMGN) +31.8%

Chevron (CVX) +15.8%

Maxim Integrated Products (MXIM) +11.6%

Lowe’s Companies (LOW) +10.7%

Cardinal Health (CAH) +10.3%

Q3 Portfolio Losers

Investors Financial Services Corp. (IFIN) -13.0%

Patterson Dental (PDCO) -11.2%

Fifth Third Bancorp (FITB) -10.0%

Pfizer (PFE) -9.5%

Wal-mart Stores (WMT) -7.8%

Price Charts

Here are one-year price charts for the stocks in the Moose Pond portfolio and for the S&P 500 and the Russell 2000. If you click on a chart, it will take you to the Yahoo! Finance page for that stock. The charts automatically refresh each time the page is loaded. Placing the cursor over a chart will show the 5-day chart.

Portfolio Summary Updated

The Moose Pond Investors portfolio has an average projected average return (PAR) of 14.5% and an average quality rating of 72 (out of 100). Both the portfolio summary and the related stock selection guides have been revised. Follow the links on the portfolio summary to open the SSGs.

The PAR for several stocks in the portfolio has fallen to 10% or below. They are Amgen (AMGN), Capital One Financial (COF), Harley Davidson (HDI), Johnson Controls (JCI), Lincare Holdings (LNCR) and O’Reilly Automotive (ORLY). Both COF and HDI face declining revenue growth and might be good candidates to replace soon.

You can cross check our calculations for PAR with the club dashboard from Manifest Investing.

Updated Portfolio Summary

The portfolio summary has been updated. You can now click on each ticker symbol to see the stock selection guide (SSG), PERT table and PERT graph for that company. By clicking on the title of the portfolio summary, you can download the Excel spreadsheet used to create the portfolio summary. With the Excel spreadsheet, you can sort the portfolio summary by each of the columns.

The portfolio summary has been updated. You can now click on each ticker symbol to see the stock selection guide (SSG), PERT table and PERT graph for that company. By clicking on the title of the portfolio summary, you can download the Excel spreadsheet used to create the portfolio summary. With the Excel spreadsheet, you can sort the portfolio summary by each of the columns.

Mid-Year Portfolio Review

Portfolio review is a constant activity and one that merits more time than the selection of individual stocks. Let’s look at the Moose Pond portfolio at mid-year. (Also, see Mid-Year Performance Report below.)

Diversification. The portfolio includes 24 companies in 5 sectors: consumer discretionary (20.3%), Energy (3.9%), financial (26.1%), healthcare (24.4%), information technology (23.8%). Within these 5 sectors are 16 different industries. Except for UTSI which has declined in value to 1.3% of the portfolio, the individual stock holdings range in value from 3-6%. We are 96% invested.

As to company size (based on revenue), the portfolio includes large companies (58%), medium companies (38%) and small companies (4%). Conventional wisdom would suggest larger holdings in small companies. However, large companies, especially quality companies, currently seem to offer better value. Just look at the number of large quality companies that Morningstar recently has rated as five-star.

Several recent articles have suggested that the near future looks brighter for growth stocks. See the article “Quality Socks Are Now on Sale” by Pat Dorsey of Morningstar (password required). Also, see articles by Jim Jubak and Timothy Middleton of MSN.

Offense and Defense Reports. The offense report generated by Toolkit 5 shows whether the projected return of stocks we hold meet our targets. This report is simply a sort by projected total return. If projected total return is less than the target return, Toolkit highlights the entry in pink. While the current report highlights five stocks, only one of those stocks shows a significant variance. (ORLY has a projected total return of 11.3% against a target return of 15%.) ORLY’s EPS growth has slowed and it currently has a projected average return of 6.9%. We will have to examine ORLY further.

Looking at the defense report (sorted by EPS growth), also generated by Toolkit 5, we see that the portfolio contains a number of stocks for which the earnings have failed to grow in the near term (last 12 months). These include MMC, PFE, LNCR, UTSI, CAH, FITB, PDCO, COF and IFIN. We have looked at each of these stocks individually and consider their long term prospects to be very positive. That’s why we bought them. However, the current problems faced by these companies have driven their price down. This also explains why the Moose Pond portfolio has not kept up with the major indices like the S&P 500 or the Russell 2000 for the first six months of this year.

Changes in Fundamentals. Several stocks in the portfolio need further study. Projected revenue growth has slowed for HDI to 5.7%. This slow down is reflected in the current price. However, the question is whether we should replace HDI with another quality stock with better long term growth prospects. ORLY also appears somewhat over-valued now with a projected average return of 6.9% although it remains a high quality stock with good growth prospects. Finally, JCI’s projected revenue growth has slowed to 7.6%. JCI remains a good quality stock but its projected average return is only 10.5%. It may be better to continue to hold these three stocks but they warrant a close look.

Summary. We need to take look further at ORLY, HDI and JCI and decide if any of those stocks should be replaced. Also, note that we have taken something of contrarian position on MMC, PFE, LNCR, UTSI, CAH, FITB, PDCO, COF and IFIN. We are holding them in spite of near term issues with earnings. If our long term assessments for even a majority of these stocks are correct, the Moose Pond portfolio should substantially out perform the indices in the next year or so. The key is patience and keeping the long term view in focus.

Mid-Year Performance Report

At the end of June 2005, the Moose Pond Investors portfolio had declined in value for the first six months of the year by 5.1%. In comparison, the S&P 500 was down 1.7% and the Russell 2000 was down 1.25%. The unit price for the portfolio is exactly where it was at the end of November 2004.

Although the portfolio underperformed the major indices, the portfolio remains well positioned with the following weighted averages: projected average return of 15.3%, relative value of 94, (RQR) quality of 71.7 and projected revenue growth of 11.8%. See portfolio snapshot. The portfolio is diversified across five industries: consumer discretionary (20.3%), Energy (3.9%), financial (26.1%), healthcare (24.4%), information technology (23.8%). The portfolio is further diversified among industries in these sectors. See diversification report.

You may be asking the question, if we had such a good portfolio, why did it under perform the market averages for the first half of this year? Great question. The best way to answer that question is to look at the stocks that significantly over or under performed. In the first 6-months of this year, several of stocks in the portfolio declined significantly: UTSI (-66.0%), FNMA (-44.4%), IFIN (-23.2%), HDI (-16.7%), MMC (-14.8%) and ACS (-14.2%). Unfortunately, only one stock strong positive gains during this 6-month period : ORLY (32.4%).

Looking at the past 12-months, we see that several of these same stocks have lagged the market: FNM (-29.3%), HDI (-18.3%) and IFIN (-10.4%). However, we also held a number of stocks that did well during this 12-month period: ORLY (32.0%), LNCR (24.5%), JNJ (18.6%), PDCO (17.9%), COF (17.2%) and CBH (16.0%). The portfolio had a positive return of 1.5% for this 12-month period but still lagged the major indices.

The “rule of five” embodies the conventional wisdom that if you hold five stocks, one stock will perform better than expected, one will perform worse than expected, and the other three will perform about as expected. In our portfolio, we had several more stocks performing worse than those performing better than expected. This should be a passing anomaly. (The “rule of five” is an observation — not an immutable law of nature.)

We need to be careful not to over react and make rash decisions based on poor price performance for one or two quarters. Instead, we should stay focused on company fundamentals (revenue growth, pretax profit margins, return on equity, etc.) across the entire portfolio. The overall portfolio looks strong in terms of both quality (71.7) and projected average return (15.3%).

Let’s take a quick look at the laggards in the portfolio.

UTSI. This was our most speculative stock. (And yes, UTSI aptly demonstrates the price volatility of speculative stocks.) UTSI has had a very poor quarter based on loss of revenues in China. This bad quarter was followed by lowered earnings guidance for 2005. As a result the price tanked. While the near term earnings projection does not look good, Value Line projects the 3-5 year revenue growth at 15.5% and the net profit margin in at 6.9%. Using the preferred procedure (pre-tax margin of 9.2%, tax rate of 25% and 130m shares outstanding) the 5-year EPS would be $3.25. Assuming a 5-year high PE of 22.5 and a low PE of 12, projected average return of 48%. Value Line (July 1, 2005) still rates UTSI’s financial strength an “A” and it has an RQR quality score of 51.1. Although UTSI has declined in value to 1.3% of the portfolio, holding it is probably the right answer unless its fundamentals deteriorate further. See stock selection guide and price chart for UTSI.

FNM. We sold FNM on March 24, 2005 and do not plan to repurchase it.

IFIN. A soft quarter was responsible for much, if not all, of the recent price decline. See recent discussion of IFIN. It has a projected average return of 21.5% and quality rating of 65. The near time price weakness appears temporary. We purchased some additional shares on June 14. Price chart.

MMC has been impacted by the investigation into industry pricing practices but seems to be recovering. Similarly, ACS has seen a near term decline in stock price due in part to a near term softness in revenues. Both companies seem poised to do well. MMC has a projected average return of 11.8% and quality rating of 65 while ACS has a projected average return of 17.5% and quality rating of 71.

In summary, a handful of stocks reduced the performance of the portfolio for the first half of this year. However, these stocks (except FNM) should remain in the portfolio for now. We are going to watch UTSI and the other stocks closely.

Portfolio Summary Updated

The portfolio summary has been updated. The portfolio has a projected average return of 15.0% and a quality rating of 71.4 (out of 100). Three stocks with relatively low PAR are ORLY (7.4%), PDCO (10.1%) and BRO (10.8%). These might be candidates for replacement with companies with higher PAR values.

The portfolio is diversified across five industries but with most of the holdings in four industries. The portfolio has some redundancy in the financial sector (banks – FITB and CBH ), healthcare sector (drugs – PFE and AMGN) and information technology sector (chips – MXIM and LLTC). See diversification report.

Several other NAIC reports are helpful in reviewing a portfolio. See Portfolio Evaluation Review Technique (PERT) Report (sorted by total return), and Trend Report (sorted by percent of portfolio).