Walgreen Company (WAG)

SSG and PERT | Google Stocks | Company Website

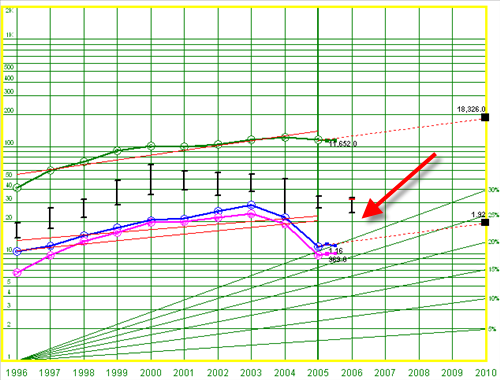

We purchased an initial position in Walgreens on November 22. Here is the stock selection guide we used for the purchase decision.

We purchased an initial position in Walgreens on November 22. Here is the stock selection guide we used for the purchase decision.

Sold Getty Images, Inc. (GYI)

SSG and PERT | Google Stocks | Company Website

We sold our position in GYI on August 28, 2007. The price was $31.04. The reason for selling was declining earnings prospects. GYI is facing stiff competition from other sellers of image.

We purchased an initial position in Getty Images on November 22, 2006. Here is the stock selection guide we used for the purchase decision.

Sold Affiliated Computer Svc

Affiliated Computer Services (ACS)

SSG and PERT A (12-26-2005) | Google “Stocks: ACS” | Company Website

We sold Affiliated Computer Systems on November 11, 2006 at $29.74. We had a long term gain of $13. We originally purchased ACS in November 2003.

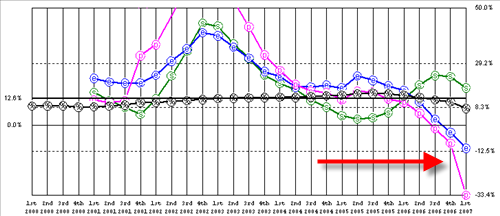

Rationale for sale: ACS seems unable to move forward. Click here for a SSG. As the chart below shows, it seem it has been unable to grow its revenue and earnings in any significant way over the past 4-5 quarters. It is now mired in an options pricing mess and will have to restate its earnings. ACS failed to fully report its current quarter and instead offered up instead “non-GAAP” (GAAP = generally accepted accounting principles) metrics of performance. Its TTM pre-tax margin (10.5%) is below the industry average (15.8%). Morningstar still rates ACS 4-stars but also rates it F for stewardship.

Sold Marsh & McLennan Cos.

SSG and PERT A Graph | Google “stocks: mmc” | Company Website

We sold Marsh & McClennan on November 11 at $32.01. This gave us a long term capital gain of $143.18. We had originally purchased MMC in November 2004.

Rationale for the sale: MMC has not yet recovered from its myriad of regulatory problems. Click here for a SSG. It has failed to re-establish growth in either revenues or earnings. Return on equity and pretax margins have dipped significantly, with no immediate sign of recovery. It may be a good value stock (Morningstar rates it 4-stars) but it currently fails as a quality growth stock. We have replaced it with GYI and WAG.

Getting Ready for Winter

Most of our companies have announced their 3rd quarter results. Here is an updated PERT chart (portfolio evaluation review technique). Also, here is the portfolio summary. The average quality rating for the portfolio is 67.5 (65 is very good) and average projected average return is 13.3%.

In looking across the portfolio, two, possibly three, companies seem like good candidates for replacement. These are Marsh & McClennan (MMC) and Affiliated Computer Systems (ACS). The third possibility is Pfizer (PFE). We may want to consider replacing these companies with smaller quality companies with better growth prospects. Also, we should look at adding to our position in some of our better holdings.

Marsh & McClennan has not yet recovered from its myriad of regulatory problems. Click here for a SSG. It has failed to re-establish growth in either revenues or earnings. Return on equity and pretax margins have dipped significantly, with no immediate sign of recovery. It may be a good value stock (Morningstar rates it 4-stars) but it currently fails as a quality growth stock. MMC is a prime candidate for replacement.

Affiliated Computer Systems seems unable to move forward. Click here for a SSG. As the chart below shows, it seem it has been unable to grow its revenue and earnings in any significant way over the past 4-5 quarters. It is now mired in an options pricing mess and will have to restate its earnings. ACS failed to fully report its current quarter and instead offered up instead “non-GAAP” (GAAP = generally accepted accounting principles) metrics of performance. Its TTM pre-tax margin (10.5%) is below the industry average (15.8%). Morningstar still rates ACS 4-stars but also rates it F for stewardship. ACS may be a decent company about to turn the corner — assuming its options pricing problem doesn’t get worse — but it seems to be another prime candidate for replacement.

Pfizer is no longer a classic growth stock. It’s price has rebounded in the last 12 months up more then 22%. However, both growth and quality of earnings are in doubt gonig forward. Sales projections over the next 5 years vary from 2.6% to 6%. Click here for a SSG. PFE might be a good candidate for replacement.

Quarterly Report

We finally saw decent portfolio gains this quarter in the Moose Pond portfolio. Here are the details.

For the quarter justed ended, our net gain is +3.5%. For comparison, the S&P 500 rose +5.2% for the same period. The five stocks advancing the most were: PFE (+21.9%), SYK (+17.8%), UTSI (+13.9%), AMGN (+15.4%), and JKHY (+11.1%). The five stocks declining the most this quater were: MXIM (-6.0%), COF (-7.9%), LOW (-7.3%), OXY (-5.99), and ITW (5.11).

Looking back over the past 12 months, the portfolio gained +6.3%. (compared to 8.7% for the S&P 500). The big gainers were: FDS (+38.6%), IFIN (+31.2%), OXY (+29.4%), BRO (+23.9%), and CBH (+21.3). The decliners were: MXIM (-33.2%), INTC (-11.4%), PDCO (-14.7%), LOW (-14.2%), and COF (-7.9%).

Overall, we have achieved decent performance this quarter. It would be nice to start beating the S&P 500 once again. We need to do a little fine tuning of the portfolio.