Brown & Brown (BRO)

SSG and PERT A Graph | Google “stocks: bro” | Company Website

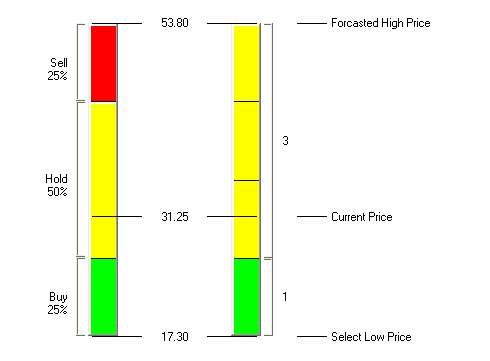

Brown & Brown remains a high quality growth stock. Currently at $31.25, our stock selection guide has BRO a buy up to $26.40 with a projected average return of 8.3%. BRO pays a 0.8% dividend. Its current price makes it a HOLD. We wouldn’t buy more at this price but we are reluctant to exchange this quality company for another.

The Feb 24, 2006, Value Line comments that Brown & Brown has made solid progress

of late and has bright prospects over the coming 3 to 5 years. VL rates BRO’s financial strength as an “A” and earnings predictability as 90. Morningstar also speaks well of the company and projects revenue growth of 16% while Value Line projects revenue growth of 14%. However, Morningstar only gives BRO 2-stars indicating that the current price is high relative to its fair value calculation.

Investor Advisory Service also follows BRO and notes: “Business remains quite solid at insurance broker Brown & Brown. Fourth quarter EPS increased 14%. Sales grew 21%, with internal revenue growth of 5.2%. CEO J. Hyatt Brown notes that 2005 was the thirteenth consecutive year in which Brown & Brown had earnings growth of at least 15%. Acquisitions are clearly an important part of its growth. The past two years were extremely robust in terms of acquisitions, and the company says that its pipeline of new deals is “a strong as ever.” IAS has as a buy up to 28.