Are We Diversified?

Are we diversified? The answer is mostly yes. It depends on how you define diversification.

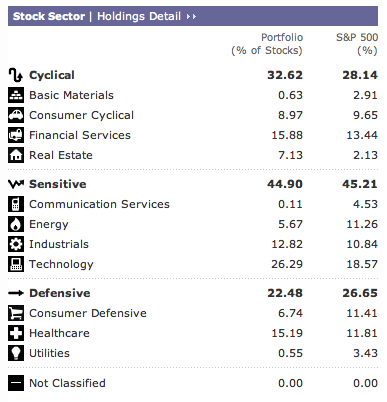

We are reasonably well diversified among the industrial sectors. The following summary from MorningStar X-ray compares our portfolio holdings with the S&P 500.

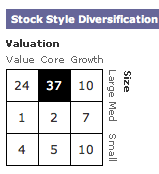

In terms of company size (market capitalization), we are 71% large-cap, 10% mid-cap, and 19% small-cap. In growth vs. value, we are 27% growth, 29% value, and 44% core or blend. Our large-cap holdings lean toward value while our small cap holdings lean toward growth.

We do have 6% of our portfolio in a real estate investment trust ETF (VNQ). This provides some diversification among asset classes. The only international exposure we have is for those US companies in our portfolio that do business overseas.

To sum it up, we are fairly well diversified among US stocks. We could stand to have a little more mid-cap and small-cap representation in the portfolio. We also could have more international equity exposure. This is probably best done through an index ETF.

Winners and Losers in 2012

We have had an excellent year thus far in 2012. Our annualized return (with only one week to go) is 19.6%. Our total return would be over 20% if our esteemed Congressional representatives would stop playing chicken with the nation’s “fiscal cliff.”

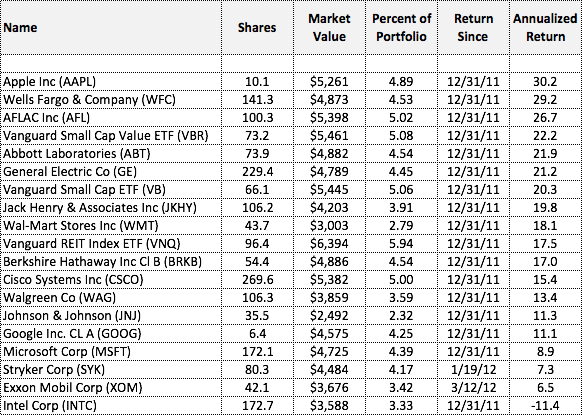

Here are the stocks that contributed to our return. At the top of the list is Apple, despite its precipitous fall from slightly over $700 per share. Our three index funds–representing asset classes which are difficult to buy on a stock-by-stock basis–are all doing well.

Surprisingly, Intel is in negative territory for the year. However the stock selection guide indicates that it is still a “buy”. It’s too bad that it takes so long for the market to understand what we do!

The following table shows our return by stock on an annualized basis. (The actual return your-to-date is slightly lower.) We have held Stryker and Exxon for more than nine months but less than a year.

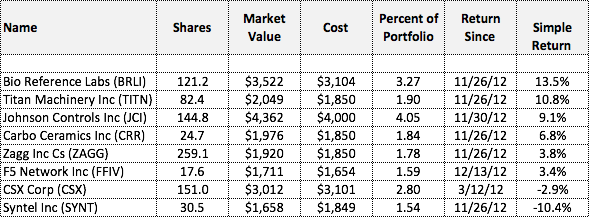

Here is a similar table for the stocks that we have owned for less than 9 months. The table only shows simple return. There are several small stocks in this group. We have taken the approach of buying half positions in small stocks rather than full positions. This gives us some additional diversification by allowing us to hold more small stocks.Â

Market Reaction to Earnings Estimates – SNHY

It is always interesting to watch the market reaction to quarterly earnings reports. Small variances between reported earnings and analyst expectations, especially in growth stocks, frequently result in sharp price fluctuations. More often than not, the change in price has nothing to do with the underlying business model of the company. A case in point is Sun Hydraulics, one of our holdings.

Sun Hydraulics Corp., SNHY, reported Q2 (June) earnings of $0.54 per share, $0.04 better than the First Call consensus of $0.50. Quarterly revenues rose 18.8% year over year to $51.6M vs. the $51.4M analyst consensus. (Q3 earnings press release.)

However, the company reduced its outlook for Q3, projecting EPS of $0.35-0.37 which is slightly lower than the $0.42 analyst consensus. The company also projected Q3 revenues of $45M which is slightly lower than $47.93M analysis consensus. Here is the company’s statement regarding Q3.

“Sun’s products are used in diversified equipment markets around the globe,” stated Carlson. “Many of these markets, such as mining and energy, remain strong and demand is high. In other more obvious markets, such as equipment used in residential and commercial construction, we have begun to see some softening.”

“The diversity of our end markets, both geographically and the segments we participate in, is pivotal to maintaining our growth,” concluded Carlson.

2008 third quarter sales are estimated to be approximately $45 million, a 9% increase over last year. Third quarter earnings per share are estimated to be between $0.35 and $0.37 per share, compared to $0.32 per share last year. EPS estimates for the third quarter include a charge of $775K for U.S. income taxes due on the repatriation of $6 million from Sun Germany in July 2008.

This slightly reduced guidance caused the stock to drop 11.24% on August 5 after it announced its earnings.

Here is an updated stock selection guide that incorporates the Q3 data. It use a conservative estimated of 18% for revenue and sales growth. It also uses a conservative 5-year average average P/E of 16.9. The SSG still shows a projected average return of 13.7%. The fundamental business model of the company has not changed. It is still a strong hold. Despite teh drop in price yesterday, we have a 17.2% annualized return on SNHY.

Transocean Inc. (RIG)

If the current high price of crude oil reflects a fundamental change in the world-wide demand for oil, as many suggest (see Sunday Washington Post article), then prospects may be bright for oil services stocks. We have one oil services stock in our portfolio, Helmerich & Payne (HP). The stock is at $52.90 per share, up from the $33.72 we paid for it last June. HP is 6.8% of our portfolio. HP provides contract drilling services to oil and gas producers primarily in the United States, Argentina, Colombia, Ecuador, and Venezuela.

It might be wise to diversify and include deep water drilling company. Transocean Inc. (RIG) pops up in numerous screens and articles. Value Line describes Transocean as the world’s largest offshore drilling contractor, working in all the major offshore regions, including the Gulf of Mexico, the North Sea, the Middle East, and off the coasts of West Africa, the United Kingdom, Norway, Brazil, and Canada. It specializes in technically demanding deep-water/harsh-environment drilling projects.

Here is a stock selection guide for Transocean. Manifest Investing estimates a projected average return of 19.3%. Morningstar rates Transocean 5-stars (undervalued) and calculates fair vale as $176 (current price is $133). We should consider selling part of our position in HP and buying RIG.

Maxim Integrated Products

Maxim Integrated Products (MXIM or MXIM.PK) has been one of our disappointing holdings. We bought an initial position in February 2005 at $39.44 per share and added to that position in June 2006 at $31.33 per share thinking the worst was over for the stock. The stock is currently priced at $18.35, down from its $55 high in 2004.

Maxim got caught up in an options backdating scandal. Nasdaq delisted it. And it has taken the company a long time to restate its financials, which has resulted in significant legal and accounting fees.

Barron’s reports today:

Now there are signs that the worst may be over. The company, with a market value of $6 billion, has submitted revised financial statements to its auditors. Earnings are expected to pick up next year, as the legal expenses of the probe recede into the past. And conditions in the chip industry could start to improve markedly within a couple of years.

Result: The stock could rocket by more than 40%. The hope is that growth investors, who abandoned the shares over the past couple of years, will start returning in force. What they’ll find is a stock that trades at a sharp discount to its peers and boasts $1.2 billion of cash and no debt.

Value Line stopped covering Maxim when it was delisted. However, Morningstar still follows the company and rates it 5-stars (undervalued) and gives it a fair value estimate of $34. Here are some excerpts from the Morningstar Report from May:

We consider Maxim Integrated Products one of the better long-term semiconductor investments. With attractive products, sought-after talent, and a plausible plan for growth, Maxim should continue generating healthy returns on invested capital for many years. …Â Maxim is well positioned in its core business of high-performance analog (HPA) chips, which are complex and proprietary by nature. Armed with one of the most talented design teams in the industry, Maxim has been able to produce superior designs that command a price premium. … We now expect Maxim to grow sales at a compound annual rate of 8.2% for the next seven years, down from the 13% assumption used in our previous model. Although we expect the consumer business to be highly competitive, we think Maxim’s gross margins will likely remain in the low 60s. … We forecast operating margins in the low 30s.

Until the SEC approves its revised financial statements, Maxim is limited on the information it may release publicly. This makes analysis of the company difficult.

Maxim will release financial results for the fourth quarter of its 2008 fiscal year on Thursday, August 7, 2008. A video replay of the earnigns conference can be found on the investors section of the Maxim website.

Some Portfolio Adjustments?

Here is the Public Dashboard from Manifest Investing for the Moose Pond portfolio. Overall, the portfolio shows a projected average return of 15.6% and a quality rating of 72.2. The dashboard is forward looking. Manifest Investing uses data from Value Line, Yahoo Finance, and other sources to estimate revenue growth, profit margins, and P/E five years out. From this projected data is is easy to project earnings per share and the future price (P/E x EPS). So the dashboard provides a method of comparing stocks within the portfolio. Note that the amount for a given stock is irrelevant in this analysis. What the company might do going forward counts.

Looking across the Moose Pond portfolio, we see a few stocks that warrant a close look.

- Helmerich & Payne has a PAR of 5.7%. This oil field services company has had a good run and is up 78% since we purchased it last June. It is 6.2% of the portfolio. We could take a small profit and sell some of this stock.

- Brown & Brown has been a relatively unexciting holding. We purchased in March 2004. It is down 10% and represents about 1.4% of the portfolio. We might want to consider replacing it.

- AIG has been the worst performer in the portfolio (and a good example of why diversification is so important). It is down 64% since we bought it last June. This is one of those financial stocks that will turn when the financial sector finally does. At some point we may want to add to our AIG holding, if we don’t purchase Berkshire Hathaway.

- We might want to increase our position on few sticks with high PARs, Lowes (21.6%) and Garmin 26.7%. Lowes is 2.5% of our portfolio and Garmin is 1.4%.

Take a close look at the portfolio dashboard and the portfolio valuation report at Bivio.com. We need to make some adjustments to our portfolio.

Berkshire Hathaway

Berkshire Hathaway is usually categorized by analysts as a property & casualty insurance company. It is actually an incredibly interesting, diverse, and successful holding company made up of 10 insurance companies and 66 non-insurance businesses. These diverse and well managed businesses include See’s Candies, NetJets, Flight Safety Safety International, Borsheim’s Jewery, Fruit of the Loom, GEICO Auto Insurance, Benjamin Moore & Co., Dairy Queen, Clayton Homes, and Johns Manville. (See complete list of Berkshire Hathaway businesses.) Berkshire Hathaway also has an investment portfolio valued in excess of $75B.

In 2007, Berkshire Hathaway’s annual revenues totaled $118B. To put their businesses in perspective, insurance premiums were $31.8B while sales and services revenue from the non-insurance businesses was $58.2B. So calling Berkshire an insurance company is not very accurate, but insurance is one of its core businesses.

At the end of 2007, assets for the various Berkshire insurance companies included $39.8B in cash and $86.8B in equities and fixed maturity instruments. These assets include reserves for anticipated covered losses. For the non-insurance businesses, cash and fixed maturity instruments totaled $8.8B. Together, these assets give Berkshire the ability to internally finance its operations. It provides the cash to acquire new businesses. This cash also gives Berkshire the ability to add substantial positions to its investment portfolio.

The breadth of Berkshire’s business and investment holdings make it difficult for analysts to perform cash flow analysis and to estimate earnings. As you can see from the attached file, the Value Line assessment differs from that of Morningstar. (Morningstar appears to be more on the mark although they don’t do a good job explaining their discounted cash flow analysis.)

Warren Buffet and Charlie Munger have managed Berkshire Hathaway form the beginning in 1964. Integrity, honesty, and business acumen have been the hallmarks of their stewardship over the past 43 years. They have set the gold standard for corporate openness and transparency. Their results are unmatched. Share prices have compounded at rate of 21.1% between 1964-2007.  The sheer size of Berkshire Hathaway today will probably prevent it from achieving this high rate of return in the future. Nonetheless, Berkshire shareholders can expect to do well.

Warren Buffet’s annual letters to shareholders can be found here. They should be mandatory reading for every investor.

Morningstar rates Berkshire Hathaway five-stars with a fair market value of $5,100 (for the class B shares, BRK.B). Current price as of this posting is $3,914. Manifest Investing estimates projected average return of 17.5%. Here is a completed stock selection guide for Berkshire Hathaway.

Note: Berkshire Hathaway has two classes of shares. The “B” share ($3,914) is valued at 1/30 of the “A” share ($117,290). Berkshire Hathaway has never paid a dividend or authorized a stock split, so the 21.1% compound annual growth is reflected in the high price of the stock.

Berkshire Hathaway is an excellent core holding. We should consider purchasing purchasing one of the “B” shares with our available cash.

Sun Hydraulics (SNHY)

One of the excellent companies that caught in the market downdraft last week is Sun Hydraulics (SNHY). It is a small industrial company in Sarasota, Florida, that designs and manufacturers screw-in hydraulic cartridge valves and manifolds, which control force, speed and motion as integral components in fluid power systems.

SNHY has a global network with 53% of its sales overseas. It is not dependent on any one customer, with its largest customer accounting for 7% of revenues. Insiders hold hold 32% of the shares. If you listen to its last quarter earnings conference (found on the company website), you get a sense of a well managed company with a closely knit team.

Analysts predict 20% EPS growth. We assumed 18% growth in the stock selection guide and used conservative PEs. Manifest Investing rates the quality 79.9 and projected average return 19.9%. The PE to growth (PEG) ratio is approximately 1. With $149 million in revenue for the TTM, this company has room to grow. Propose we buy this company now.

- Link to the company website

- Link to stock section guide and data sheet

Investors Financial Services

Investors Financial Services Corp. (IFIN) declined 13% for the quarter and 33.2% year to date. It is our second worst performing stock for the year. UTSI is the worst. The drop in IFIN stock price resulted from declining earnings growth. We looked at IFIN two months ago. This is a relook.

On July 17, Investors Financial cut its earnings forecast. The company gave 2005 earnings guidance of $2.30 a share, with core earnings flat with the year-ago $2.09. The company said 2006 core earnings would rise 8%-10%. Analysts had forecast earnings of $2.50 a share for 2005 and $2.98 for 2006. See page 2 of the second quarter earnings report for the companies explanation.

The announcement predictably drove the stock price down, although the market had already discounted the decline in earnings growth with the stock price slowly declining since February. See IFIN price chart. The bottom feeders of the securities bar immediately filed multiple class actions alleging that management had misled shareholders with false optimism prior to the reduced earnings guidance. The filing of class actions under the Securities Exchange Act of 1934 whenever a company announces bad news has become a cottage industry that ought to be closed. The litigating attorneys frequently settle these class actions for their fees and expenses and some minimal compensation to the shareholders. Most of these class actions are a wasteful drain on an overburdened legal system and on the finances of the targeted companies.

Morningstar rates IFIN with three stars, a narrow moat, and a “D” in stewardship, and concludes that it is fairly valued at $35. (It’s current price is $32.90). Manifest Investing gives IFIN a quality rating of 64 and estimates a PAR as 21.2%. The Investors Advisory service also has IFIN as a buy up to $53.

The company’s core business offers a wide range of administration services to mutual fund complexes, investment advisors, family offices, banks, and insurance companies. That business seems to be solid although it operates in a very competitive environment. The company’s banking services have suffered the same slow down as other banks due to flatter yield curve and narrower investment spreads. The market has probably over reacted to the news in July. Our current stock selection guide shows a projected average return of 19.4%. IFIN is a hold for now. However, we have four financial stocks, CBH, FITB, COF and IFIN. We may want to consider pruning back.

Berkshire Hathaway

The annual reports for Berkshire Hathaway include Warren Buffet’s letters to shareholders. In addition to discussing the state of the company, these letters contain sage investment advice applicable to all investors, including small investors. Here is an excerpt from this year’s letter.

Over the 35 years, American business has delivered terrific results. It should therefore have been easy for investors to earn juicy returns: All they had to do was piggyback Corporate America in a diversified, low-expense way. An index fund that they never touched would have done the job. Instead many investors have had experiences ranging from mediocre to disastrous.

There have been three primary causes: first, high costs, usually because investors traded excessively or spent far too much on investment management; second, portfolio decisions based on tips and fads rather than on thoughtful, quantified evaluation of businesses; and third, a start-and-stop approach to the market marked by untimely entries (after an advance has been long underway) and exits (after periods of stagnation or decline). Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.