Patterson Cos. (PDCO)

SSG and PERT A | Google “Stocks: PDCO” | Company Website

Patterson has had a somewhat mediocre year but the company seems to be on track to improve sales and earnings in fiscal year 2007. (PDCO’s fiscal year begins on April 1.) PDCO has invested in sales and marketing. With its year-end earnings report, PDCO gave earnings per share guidance for 2007 of $1.61-1.64 (about 13% growth).

Growth. Value Line projects revenue growth of about 12% while Morningstar projects 13%. The revised stock selection guide uses 12%. Future growth will come from a combination of internal growth and small acquisitions. Internally, PDCO sets a goal for growth of 4% above the market. Its dental business is currently growing faster than its other lines of business.

Quality. PDCO remains a high quality stock (although Morningstar gives it a narrow moat). Manifest Investing rates quality at 71.3 (out of 100). Value Line rates PDCO’s financial strength an “A” and it earnings predictability 100.

Valuation. Projected average return is 13.5%. PDCO has always sold at relative high PE. Its current PE is about 24. The stock selection guide uses an average future PE of 24.

We purchased PDCO in March 2003 and have enjoyed an annualized return of 12.5%. It represents 2.25% of the portfolio. This would be a good time to add to our position.

Analysis from December 2, 2005

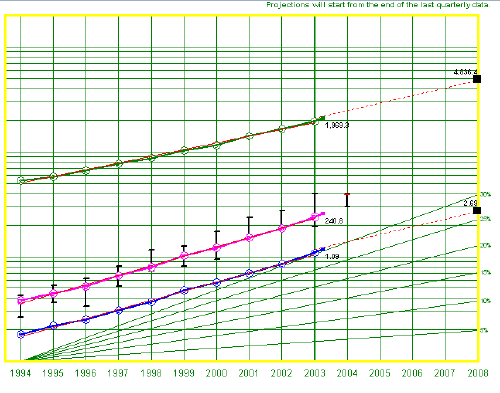

Looking back over the past year, the 18% growth we had projected for Patterson Dental did not materialize. (See summary below.) Both revenue and earnings haved slowed down. PDCO has had several quarters of declining growth. That is troubling. It is unclear whether these reduced growth rates have bottomed out. Look at the PERT A graph in the stock selection guide.

In a November 18 press release, PDCO revised its earnings guidance for the year down from $.35-.37 per share to $.32 per share. Patterson attributed reduced second quarter earnings to weaker than forecasted sales growth of basic dental equipment, including chairs, lights and cabinets. A below-plan performance at the Patterson Medical unit also contributed to the second quarter earnings shortfall. See also the most recent quarterly earnings report.

The weaker earnings thus far this year and the reduced earnings guidance seems to be largely reflected in the current price which is about 35% below its 52 week high.

Let’s review the basics.

Growth. Value Line project 3-5 sales growth of 12.5%. Morningstar projects 13% sales growth. First Call reports the analysts consensus for 5-year EPS growth as 18%. Our current stock selection guide uses a 5-yr projected revenue growth of 12.5%.

The preferred procedure in the stock selection guide assumes a pre-tax margin (PTM) of 12.5%, slightly higher than the current year PTM of 12.1%. Value Line project 14.3%. (PTM = 9% [net margin] / (1 -.375 [tax rate]).

Quality. The company’s quality remains strong with a RQR quality rating of 74.5. Value Line rates PDCO’s financial strength an “A” and its earnings predictability a “100.” Value Line projects a slight decline in return on equity (ROE) from 18% to 15% over the next 3-5 years. The most recent quarterly earnings report show reduced cash flow and free cash flow due to changes in assets and liabilities. We need to watch cash flow closely in the next 10Q and in the next earnings release to see if there is any fundamental change in the business model.

Valuation. The stock selection guide shows PDCO as a buy up to $32.90. The projected average return is 9.1% which assumes an average future PE of 21 ( 26 [high PE] + 16 [low PE] ) / 2 ).

Conclusion. PDCO remains a hold — for now. We need to monitor the upcoming quarters closely to make sure that lower growth rates for revenues and earnings this year do not reflect a fundamental change in PDCO’s business environment or its business model. Since PDCO remains a high quality company with an excellent track record, we can wait one or two more quarters before deciding whether to exchange PDCO for another quality stock with higher projected average return.

Analysis from November 14, 2004

The PDCO stock selection guide has been updated to reflect the 2 for 1 split on October 22, 2004.

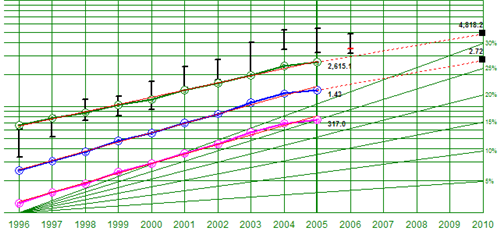

Quality. Section 1 of the SSG (the graphs on page one), shows nearly straight lines. For PDCO, the correlation coefficient (r^2) is 1.0 for earnings and .99 for sales. This obviously is excellent. (Mathematically, a correlation coefficient of 1.0, when using least squares fitting, means that the data points are located on a straight line. See interactive example.)

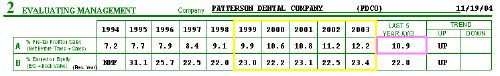

Looking at Section 2 of the SSG, pre-tax profit margin and return on equity are trending up. That also is excellent. Value Line rates PDCO’s financial strength as “A” and earnings persistence as 100 (out of 100). These are both indicators of excellent management. Overall, PDCO is a high quality company.

Growth. PDCO’s historical earnings growth was 22% while sales growth was 15.%. Looking forward, Value Line projects PDCO’s earnings to grow at 17%. Analysts median projected growth is reported as 20% by First Call and 18.8% by Reuters. The PDCO stock selection guide (above) uses 18%.

Valuation. Using an average high PE of 27 (which is 1.5 x the projected growth rate), the potential high price for PDCO is $76.60. Projected average return (i.e., the return if the stock is sold in five years at the average historical PE) is 7.7%. Total return (i.e., the return if the stock is sold in five years at its average high PE)is 12.9%.

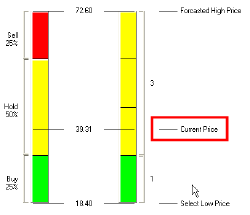

The average five-year PE for PDCO is 25.3. The current PE is 33.7. Thus, the relative value is 25.3 / 33.7 or 133%. Generally, a stock is fairly priced when the RV is between 85% and 110%. PDCO’s current price is outside the buy range. PDCO’s current upside downside ratio is 1.6 which is in the “hold” range.

The average five-year PE for PDCO is 25.3. The current PE is 33.7. Thus, the relative value is 25.3 / 33.7 or 133%. Generally, a stock is fairly priced when the RV is between 85% and 110%. PDCO’s current price is outside the buy range. PDCO’s current upside downside ratio is 1.6 which is in the “hold” range.

Summary. PDCO (currently $39.31) is a “hold.” It is a buy below $31.90. It probably would be a sell if the upside downside ratio fell below 1.0 or if the relative value went above 150%.

Company Description: Patterson Dental Company distr. dental supplies in the U.S. and Can. through more than 1,200 direct sales reps. and equipment specialists. Also offers customers related services, including equip. installation, maintenance and repair, dental office design, and equip. financing. The Colwell Systems div. provides office supplies to medical and dental offices. The Webster Veterinary Supply unit provides companion-pet supplies to veterinary clinics. Canadian bus.: 6.8% of ’02 sls. Has abt. 4,770 empls., 4,244 stkhldrs. Off./dir. own 10.5% of stk.; FMR Corp., 12.9%, U.S. Bancorp, 9.2%. (8/03 Proxy). Chrmn. & CEO: Peter L. Frechette. Pres.: James Wiltz. Inc.: MN. Addr.: 1031 Mendota Heights Rd., St. Paul, MN 55120. Tel.: 612-686-1600. Web: www.pattersondental.com.