Annual Report for 2010

Moose Pond Investors has completed its tenth full year of operation. We have 19 partners made up of family and friends throughout the United States. Here is our Report to the Moose Pond Investors for 2010.

Portfolio Performance

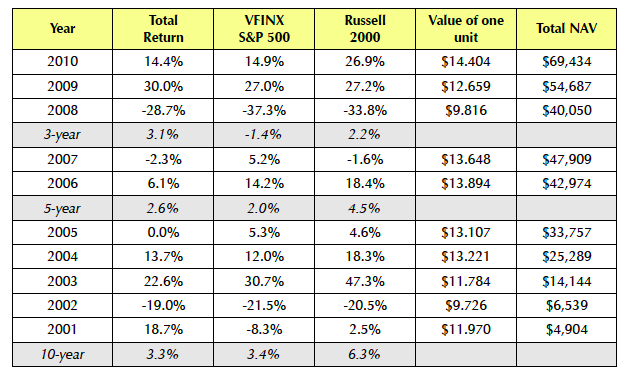

In 2010, we had a total return of 14.4%. The S&P 500 was up 15.06% for the same period. If we had invested in the Vanguard S&P 500 index fund, VFINX, our return would have been 14.9%. The value of a unit increased from $12.659 to $14.404.

Over the past three years, Moose Pond has done significantly better than both the S&P 500 and the Russell 2000. Moose Pond’s annual return for the three-year period was 3.1%. In comparison, the S&P 500 was down 1.4% and the Russell 2000 was up only 2.2%. (The S&P is a large cap index and the Russell 2000 is a small cap index.) Our portfolio has both asset classes.

The annual returns for Moose Pond Investors are calculated using internal rate of return (IRR). This method is more precise because it looks at actual cash flows. It better accounts for partner investments and market fluctuations throughout the year. Calculating annual return using the change in unit value from year to year is a close approximation.

Lessons Learned and Reinforced

By continuing regular monthly investments and by not selling our shares when market prices were down in early 2008, our portfolio has more than fully recovered. We continued to hold stocks until we find a quality replacement that offers a better five-year projected average return using the BetterInvesting methodology. This approach has enabled us to outperform both beat the S&P 500 and the Russell indices over the last three years.

Those who invested regularly each month saw a return between 3.0% and 3.8% over the past five years compared with 2.29% for the S&P 500. This same group of regular monthly investors has an annual return between 4.0% and 4.8% for the past three years compared with a negative 2.86% for the S&P 500. These returns highlight the benefit of dollar cost averaging, especially in a down market.

Actual Returns

Here is a table comparing the 10-year return for Moose Pond with the Vanguard S&P 500 index fund (large cap stocks) and the Russell 2000 (small cap stocks).

Actual Returns 2001-2010

Note: The VFINX comparison is based on actual cash flows and assumes dividend reinvestment. The Russell 2000 just shows total annual return for the index with dividends.

Moose Pond Investors Portfolio

At year end, our portfolio had a market value of $69,434. One unit in Moose Pond Investors was worth $14.404. We were very close to fully invested at that end of the year with a cash position of only $368.33 or 0.5%. We held 21 stocks and 4 ETFs in the portfolio. The ETFs help to round out several asset classes (small cap and REITs). Also, we have been using the Vanguard Total Stock Market Index (VTI) to hold funds waiting reinvestment in order to maintain a fully invested market position.

Winners and Losers

For 2010, 19 of our stocks advanced while 7 declined. Momentum and results were definitely on the up side again this year. We only realized a net gain of $46.07 from sales but we had unrealized gain for the year of $7,108. We received dividends totaling $1,263. Our dividends were automatically reinvested at BuyandHold.com.

Portfolio Turnover

Our sales for the year totaled $9,922. We sold four stocks because their fundamentals had changed for the worse: Garmin, SAP, Superior Energy, and Pfizer. We sold AIG and took our loss. (Only the people at AIG who caused the loss made money.) We sold some of our Vanguard Total Market Index EFT and moved that money into other equities. Total stock purchases including dividends we $17,428. We took a new position in Sanofi-Aventis replacing Pfizer in the drug sector. We also purchased Vanguard Small Cap and Small Cap Values ETFs to increase our exposure to the small cap asset class.

Portfolio turnover is the rate of trading activity in a portfolio. It is calculated by taking the lesser of purchases or sales, for a year, and dividing by the average total assets during that year. Our average net asset value for 2010 was $62,170. Thus our portfolio turnover is calculated as follows:

Turnover = (Sales / avg. NAV) = ($9,922 / $62,170) = 15.95%

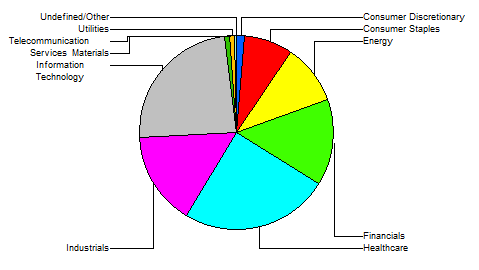

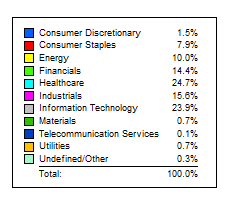

Portfolio Diversification.

The portfolio contains 25 stocks in six major sectors. This provides sufficient diversification to eliminate most of unsystematic risk in the portfolio (changes in individual stocks or sectors that don’t correlate with the overall market). The portfolio has a relatively low RiskGrade rating of 58. Diversification has reduced portfolio risk by 39%. According to RiskGrade, the portfolio is 0.73 times as volatile at the S&P 500 index. (See RiskGrades.com for more information about unsystematic risk.)

The sector diversification in our portfolio does not mirror any particular index. This diversification reflects our purchases of quality growth stocks when they were selling at an attractive valuation.

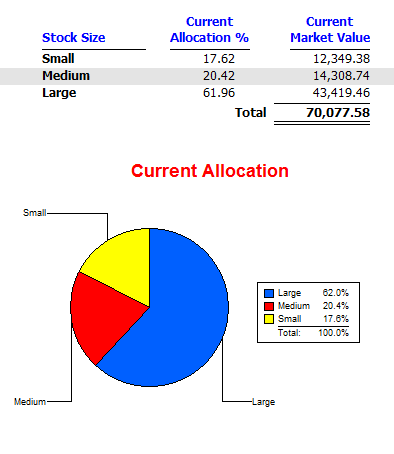

The portfolio is weighted more heavily in large cap stocks. We will continue to look for quality small and medium cap stocks. If we can’t find any, we will increase our small cap exposure with ETFs.

Note: Size and sector data reflects the portfolio on 14 Jan 2011

Summary

It has been a successful year to the partners. We wish all the partners of Moose Pond Investors and their families a prosperous and Happy New Year.