Carnival Corp. & PLC

The October 2005 Better Investing magazine featured Carnival Corp. (CCL) as a stock to study. Here is a PowerPoint presentation and a stock selection guide analyzing Carnival from the NAIC DC monthly stock to study presentation. The presentation is also here in pdf format.

Here is the bottom Line: Carnival is a quality stock. Value Line financial strength is B+ and earnings predictability is 80, and RQR is 69.6 It currently has an upside/downside ratio of 3.5 and a relative value is 110. It has an estimated total return of 17.8% and projected average return (PAR) of 12.8%. Carnival is a hold. It might be a buy if the PAR was a little higher (greater than 15%).

Third Quarter Results

The Moose Pond Investors portfolio increased in value 1.5% for the third quarter of 2005. In comparison, the S&P 500 increased 3.2% and the Russell 3000 Index increased 4%. Overall, the portfolio has a quality rating of 72 (out of 100) and a projected average return of 15.4%. the quality rating is excellent. The PAR is is very good too but could be raised a little. The percent changes this quarter for our five best and worst stocks are listed below.

The Russell 3000 Index is a total market index representing approximately 98% of the U.S. equity market. The S&P 500 Index is a large cap index that includes 500 companies reflecting 80% of the same market.

Q3 Portfolio Winners

Amgen (AMGN) +31.8%

Chevron (CVX) +15.8%

Maxim Integrated Products (MXIM) +11.6%

Lowe’s Companies (LOW) +10.7%

Cardinal Health (CAH) +10.3%

Q3 Portfolio Losers

Investors Financial Services Corp. (IFIN) -13.0%

Patterson Dental (PDCO) -11.2%

Fifth Third Bancorp (FITB) -10.0%

Pfizer (PFE) -9.5%

Wal-mart Stores (WMT) -7.8%

Portfolio Summary Updated

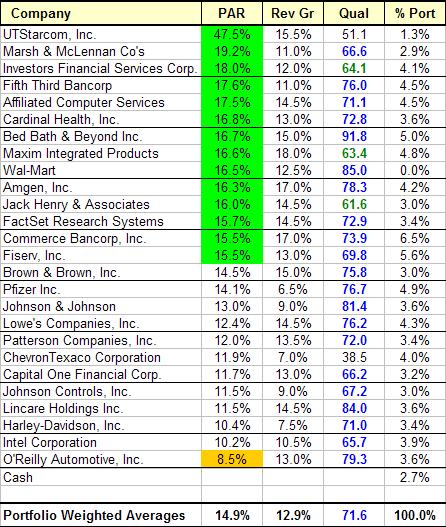

The Moose Pond Investors portfolio has an average projected average return (PAR) of 14.5% and an average quality rating of 72 (out of 100). Both the portfolio summary and the related stock selection guides have been revised. Follow the links on the portfolio summary to open the SSGs.

The PAR for several stocks in the portfolio has fallen to 10% or below. They are Amgen (AMGN), Capital One Financial (COF), Harley Davidson (HDI), Johnson Controls (JCI), Lincare Holdings (LNCR) and O’Reilly Automotive (ORLY). Both COF and HDI face declining revenue growth and might be good candidates to replace soon.

You can cross check our calculations for PAR with the club dashboard from Manifest Investing.

Buying ACS, JKHY and WMT

We purchased additional shares in Affiliated Computer Systems (ACS) this week. ACS has a 5-year projected average return (PAR) of 17.5% and a quality rating of 71. It now is 4.5% of the portfolio. We purchased an initial (3%) position in Jack Henry & Associates (JKHY). JKHY has a PAR of 16% and a quality rating of 61. We plan to purchase an initial position in Wal-Mart Store (WMT) next week. WMT has a PAR of 16.5% and a quality rating of 85. Here are the current stock selection guidess for ACS, JKHY, and WMT. We can compare future results against the assumptions in these SSGs.

The portfolio summary has been updated. The portfolio summary contains links to the related stock selection guides (SSGs). Except for financial service stocks, the SSGs use the preferred procedure. It provides a better guess of future EPS.

Here is the portfolio sorted by projected average return. We need to take a close look at the stocks at the bottom of the sort. O’Reilly Automotive — at the bottom of the stack — remains a quality growth stock. It had a great recent quarter and as a result ORLY is selling near its high average PE. We might want to consider selling it and redeploying the cash.

Energy Stocks

Natural gas and oil prices have continued their steady increase. Unlike oil shortages in the past that were in large part politically driven, world-wide demand for energy has driven long-term commodity oil prices over $60 a barrel. Oil prices are not likely to come down significantly in the near future.

Natural gas and oil prices have continued their steady increase. Unlike oil shortages in the past that were in large part politically driven, world-wide demand for energy has driven long-term commodity oil prices over $60 a barrel. Oil prices are not likely to come down significantly in the near future.

Since traditional NAIC analysis focuses on earnings growth, it does not work particularly well with energy stocks. The value of an oil or natural gas company depends in large part on the value of the company’s reserves. Proven reserves are the real assets. Kurt Wulff of McDep Associates evaluates and ranks energy stocks based on the value of their reserves. He also computes several other ratios that are helpful in comparing oil and gas producers.

Using information about a company’s reserves, Wulff calculates a “McDep ratio” for each company. A McDep ratio of 1.00 represents a present value that assumes a long-term oil price of $40 per barrel. Companies with a McDep ratio less then 1.00 are undervalued (assuming future prices return to $40 per barrel). They are very undervalued if long term oil prices remain above $40 per barrel.

We currently own one oil stock, Chevron (CVX). It is classified as mega cap company and represents 3.8% of our portfolio. It has appreciated 10.9% since we bought it earlier this year and it pays a 3.1% dividend. We should consider increasing our energy-related holdings, perhaps owning one or two producer/refiners or independent producers. The current edition of McDep Associates’ weekly newsletter, the Meter Reader, ranks oil and gas producers using the McDep ratio. Lukoil Oil Company (LUKOY), Anadarko Petroleum Corp. (APC) and Encore Acquisition Company (EAC) have the lowest McDep ratios in their respective industry categories.

Give some thought to adding energy holdings to the portfolio in the near future. Owning some stocks with proven energy reserves, especially ones that pay a dividend, seems like a prudent investment.

Wal-Mart Stores

Wal-Mart Stores (WMT) is the company that many love to hate, but they still shop there. Wal-Mart frequently shows up in screens for quality growth stocks and is another company to consider buying. Using NAIC criteria, WMT is a buy up to $60.20 (current price is $49.32). Projected average return over the next 5 years is 14.7%. See the annotated stock selection guide for more details. The SSG assumes 11% revenue growth based on Value Line.

Wal-Mart Stores (WMT) is the company that many love to hate, but they still shop there. Wal-Mart frequently shows up in screens for quality growth stocks and is another company to consider buying. Using NAIC criteria, WMT is a buy up to $60.20 (current price is $49.32). Projected average return over the next 5 years is 14.7%. See the annotated stock selection guide for more details. The SSG assumes 11% revenue growth based on Value Line.

About Wal-Mart. The company Sam built has become the world’s largest retailer. Diversification into grocery (Wal-Mart Supercenters and Neighborhood Markets), international operations and membership warehouse clubs (SAM’S Clubs), has created greater opportunities for growth. Wal-Mart notes on its website that unlike some corporations whose financial growth does not translate into more jobs, Wal-Mart’s phenomenal growth has been an engine for making jobs.

As of July 31, 2005, the Company had 1,276 Wal-Mart stores, 1,838 Supercenters, 556 SAM’S CLUBS and 92 Neighborhood Markets in the United States. Internationally, the Company operated units in Argentina (11), Brazil (150), Canada (261), China (48), Germany (88), South Korea (16), Mexico (711), Puerto Rico (54) and the United Kingdom (292).

Quality. Wal-Mart is off the charts — in a good way — on quality. The RQR quality rating is 80.4. Value Line rates Wal-Mart an “A++” for financial strength and 100 for earnings predictability. That is as good as it gets. Section 2 of the SSG shows great consistency in pretax margin and return on equity. Both of these are hallmarks of good management in a quality company.

What Others Are Saying. Standard & Poors rates Wal-Mart five stars with an investibility quotient of 100 and a target price of $59. Morningstar also rates Wal-Mart five stars with a wide economic moat and a fair value of %58.00. It gives management a stewardship grade of A. Morningstar’s bull and bear comments summarize the views of a number of analysts.

Bulls Say

- Wal-Mart still has plenty of room to grow. Roughly half its Supercenter stores are in a dozen Southern states, leaving plenty of room to expand in the Northeast and California.

- The company plans to boost margins by focusing on global sourcing, especially in China. This could serve to offset potential increases in labor costs.

- International operations have strong growth potential. We expect this area to contribute one third of Wal-Mart’s growth over the next five years.

Bears Say

- While Wal-Mart still has plenty of room to grow, it is possible that the company has grown so large that it will be difficult to manage that growth.

- Wal-Mart’s ability to undersell its competitors stems partially from its low labor costs. Unionization could have dire consequences for the company.

- New-store growth could be pinched as the company digs deeper into urban areas where real estate is more expensive and wage costs are higher. Additionally, the company could face resistance from activists as it tries to move into choice urban areas.

- A federal judge recently approved a class-action sexual-discrimination lawsuit against Wal-Mart. This doesn’t mean that the courts are siding with the plaintiffs, and the case could drag out for years. Still, investors should be cognizant that a Wal-Mart loss could result in a big cash payout and potentially raise the company’s labor costs.

Bottom Line. Wal-Mart is one of the highest quality growth companies and is a buy up t0 $60.20.

Jack Henry & Associates

Jack Henry & Associates (JKHY) is a stock that frequently shows up in screens for quality growth stocks and is another company to consider buying. Using NAIC criteria, JKHY is a buy up to $23.10 (current price is $18.52). Projected average return over the next 5 years is 18.3%. See annotated stock selection guide for more details. The SSG assumes a 13.5% revenue growth based on Value Line.

Jack Henry & Associates (JKHY) is a stock that frequently shows up in screens for quality growth stocks and is another company to consider buying. Using NAIC criteria, JKHY is a buy up to $23.10 (current price is $18.52). Projected average return over the next 5 years is 18.3%. See annotated stock selection guide for more details. The SSG assumes a 13.5% revenue growth based on Value Line.

Jack Henry & Associates provides integrated computer systems and processes ATM and debit card transactions for banks and credit unions. It describes itself as:

A technology provider for the financial industry. That’s the simplest way to describe what we do. But it hardly describes what Jack Henry & Associates is really about. We’re about solutions and support. We’re about building relationships and making things work. We’re about doing the right things for our customers, no matter what. It began as a vision, and it’s become our tradition.

A substantial amount of JKHY’s revenue, about 60%, comes from recurring sales. The company has a strong customer focus. Its several corporate aircraft are used to transport customer support teams — not company executives. Great concept!

Value Line rates JHKY’s financial strength “B++” and earnings predictability as 75 (out of 100). Its RQR quality rating is 61 — a little lower than the Moose Pond Investors portfolio average. Given the high projected average return and the that fact that JKHY is a medium size company, the lower quality rating is acceptable. Morningstar gives JKHY a rating of five stars and a wide economic moat. It estimates fair value at $22 assuming a growth in revenue of 11.5%. (Lowering the sales growth rate in the SSG to 11.5% results in a PAR of 16.3%).

Bottom Line. JKHY is a strong buy up to $23.10.

Kohl’s Corporation

Here is one of several stocks for consideration. Kohl’s Corporation (KSS) keeps popping up on screens for quality growth companies. Kohl’s operates 669 family-oriented specialty department stores in virtually all areas of the U.S. except the Pacific Northwest and Florida. It sells name-brand merchandise with emphasis on value pricing. The fundamentals look good for Kohl’s with a projected average return over the next five years of 16.2%. Value Line rates Kohl’s financial strength “A” and earnings predictability 85 (out of 100). Value Line also projects revenue growth at 17%. Kohl’s has an RQR quality rating of 80.4. See annotated stock selection guide.

Here is one of several stocks for consideration. Kohl’s Corporation (KSS) keeps popping up on screens for quality growth companies. Kohl’s operates 669 family-oriented specialty department stores in virtually all areas of the U.S. except the Pacific Northwest and Florida. It sells name-brand merchandise with emphasis on value pricing. The fundamentals look good for Kohl’s with a projected average return over the next five years of 16.2%. Value Line rates Kohl’s financial strength “A” and earnings predictability 85 (out of 100). Value Line also projects revenue growth at 17%. Kohl’s has an RQR quality rating of 80.4. See annotated stock selection guide.

Different analysts have different expectations for Kohl’s. For example, the First Call analysists’ consensus for the 5-year earnings growth rate is 19.2%. In contrast, Morningstar only gives Kohl’s a mediocre rating. MS rates Kohl’s with three star and puts it’s fair value at $51.00 (below its current price of $55.63.) MS has assumed 12% revenue growth. The attached SSG assumes 17% based on the Value Line estimate. (Note: PAR on the SSG would drop to 11.2% with 12% sales growth.) More interesting are MS’ bull and bear comments.

Bulls Say

- Kohl’s has recovered after its 2003 missteps. Although revenue growth continues to be a little disappointing, margins and inventory levels recovered nicely.

- Kohl’s still has plenty of room to expand into new and existing markets, so it should be able to open stores at a brisk pace over the next few years.

- Earnings have grown faster than sales, thanks to widening margins. MS expects the company to continue to leverage its SG&A spending as the store base expands, but increasing competition may make it tougher to expand gross margins.

- Kohl’s off-the-mall format distinguishes it from the rest of the department-store industry, which is dominated by mall-based stores that consumers have found less convenient in recent years.

Bears Say

- Recent lackluster same-store sales results illustrate that Kohl’s is not immune to slowdowns in consumer spending.

- Some traditional department-store chains have copied elements of the firm’s strategy in an effort to regain lost share, so competition may continue to heat up.

- Retail powerhouse Wal-Mart is coming on strong in apparel retail. Wal-Mart’s operational efficiency trounces that of Kohl’s.

- The company stumbled in late 2003, cluttering stores with excessive inventory and creating a less-pleasant shopping environment. Management is correcting the problem, but this shows that smart executive teams can still falter.

Bottom line. KSS is a quality growth stock. Whether it falls into the buy zone depends on the assumed revenue growth. Based on the Value Line estimates for growth and net profit margins, KSS is a buy up to $62.

Updated Portfolio Summary

The portfolio summary has been updated. You can now click on each ticker symbol to see the stock selection guide (SSG), PERT table and PERT graph for that company. By clicking on the title of the portfolio summary, you can download the Excel spreadsheet used to create the portfolio summary. With the Excel spreadsheet, you can sort the portfolio summary by each of the columns.

The portfolio summary has been updated. You can now click on each ticker symbol to see the stock selection guide (SSG), PERT table and PERT graph for that company. By clicking on the title of the portfolio summary, you can download the Excel spreadsheet used to create the portfolio summary. With the Excel spreadsheet, you can sort the portfolio summary by each of the columns.

Investors Fin. Services (IFIN)

SSG and PERT A (07-14-2005) | Google Stocks | Company Website

At the Q2 press conference on July 14, Investors Financial Services Corp. (IFIN) revised is earnings guidance downward for 2005 (10%), 2006 (8-10%), and 2007 and beyond (12-14%). See Q2 press release.

At the Q2 press conference on July 14, Investors Financial Services Corp. (IFIN) revised is earnings guidance downward for 2005 (10%), 2006 (8-10%), and 2007 and beyond (12-14%). See Q2 press release.

We previously had used 16% in our projections for June. The reduced earnings guidance is due in part to reduced interest income. A revised SSG, using 12% expected EPS growth, shows a projected average return PAR of 14.2% and a buy up to $48. However, given the company’s lowered guidance, the may be a stock to consider replacing.

Note: IFIN’s price dropped 17% on July 15 on announcment of the lowered guidance. The SSG was revised after the announcement using a projected EPS growth of 10% and the lowered price. The new projected average return is 15.51%. See revised SSG (07-15-2005). This certainly suggests some efficiency in the market.

The June Investor Advisory Service by IClub had reported IFIN a buy as well:

Investors Financial Services had a surprisingly slow quarter. First quarter revenue grew 8% with core services revenue growth of 16% being partially offset by an 11% drop in ancillary services revenue. EPS rose 11%, but a securities gain in 2005 and a one-time prepayment penalty in 2004 accounted for all of the apparent growth. The company obtained almost 30% of its revenue from net interest income. An analysis of its balance sheet shows that customers are withdrawing low-cost demand and savings deposits while Investors Financial adds to more expensive funding sources like time deposits and borrowed money. The concern is that it must exercise great care to avoid getting pinched by rising interest rates. IFIN (42.74) is a buy up to 65.

(more…)