Patterson Cos. (PDCO)

SSG and PERT A | Google “Stocks: PDCO” | Company Website

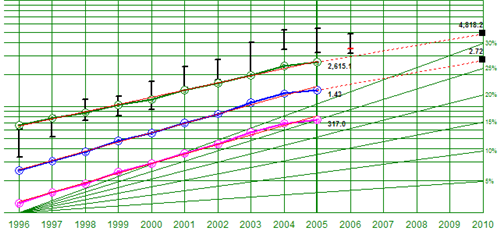

Patterson has had a somewhat mediocre year but the company seems to be on track to improve sales and earnings in fiscal year 2007. (PDCO’s fiscal year begins on April 1.) PDCO has invested in sales and marketing. With its year-end earnings report, PDCO gave earnings per share guidance for 2007 of $1.61-1.64 (about 13% growth).

Growth. Value Line projects revenue growth of about 12% while Morningstar projects 13%. The revised stock selection guide uses 12%. Future growth will come from a combination of internal growth and small acquisitions. Internally, PDCO sets a goal for growth of 4% above the market. Its dental business is currently growing faster than its other lines of business.

Quality. PDCO remains a high quality stock (although Morningstar gives it a narrow moat). Manifest Investing rates quality at 71.3 (out of 100). Value Line rates PDCO’s financial strength an “A” and it earnings predictability 100.

Valuation. Projected average return is 13.5%. PDCO has always sold at relative high PE. Its current PE is about 24. The stock selection guide uses an average future PE of 24.

We purchased PDCO in March 2003 and have enjoyed an annualized return of 12.5%. It represents 2.25% of the portfolio. This would be a good time to add to our position.

More Open-End Mutual Funds

The Wise Investor show (WMAL, Washington, DC) on 06 May 2006 with guest David Teitalbaum discussed mutual funds. Here are some of the more interesting funds. His website at www.moneybalance.com includes back editions of his free newsletters. The following links are for the mutual fund web sites and for the Morningstar analyst summary.

- Value Funds (all caps): Fairholme Fund –> FAIRX and Muhlenkamp Fund –> MUHLX

- Mid Cap Value Funds: Third Avenue Value Fund –> TAVFX and FAM Value Fund –> FAMVX

- Small Cap Value Funds Third Avenue Small Cap Value Fund –> TASCX. The program also discussed the Royce small cap funds but their best open-end fund is currently closed to new investors. The Royce closed-end funds discussed below are probably better alternatives.

- International Funds: Dodge & Cox International Fund –> DODFX and Harbor International Fund –> HAINX.

The program also mentioned www.fundalarm.com a free, non-commerical web site that helps to idenitfy when to sell a mutal fund.

Some Mutual Fund Ideas

Mutual funds can help provide asset class diversification. The following small and mid-cap funds and international funds look interesting. The embedded links are to the funds’ web sites and to the Morningstar summaries (which may require logon to M* to view).

Closed End Funds

- Source Capital –> SOR is a value oriented fund that has outperformed the Russell 2500, S&P 500, and the NASDAQ for the past 1, 3, 5, 10, and 15 years

- Royce & Associates, a manager of portfolios of small- and micro-cap companies, has three closed end funds with excellent track records: Royce Focus Trust (FUND), Royce Micro-Cap Trust (RMT), and Royce Value Trust (RVT)

Some Open-End Mutual Funds (that don’t suck)

- Neuberger Berman International Fund –> NBISK invests primarily in common stocks of foreign companies of all sizes in developed and emerging industrialized markets and has consistently outperformed the EAFE.

- Brandywine Blue –> BLUEX focuses on mid to large cap growth stocks and limits the portfolio to about 30 holdings

- Forward Hoover Small Cap Equity –> FFSCX has outperformed the Russell 2000 but it has a high expense ratio and has not performred as well as the Royce funds

- Third Avenue Value –> TAVFX is a mid-cap blend with a very good track record

For example, a diversified portfolio might include:

- 50% Large cap (35% Investment Club Units, 15% Source Capital)

- 30% Small- or mid-cap (15% Royce Value, 15% Royce Focus)

- 20% International (20% Neuberger Berman)

Stocks to Study

Here are several companies we are studying this month in the D.C. Model Investment Club. Any of these might be good replacements for the stocks that we are considering selling.

- Wells Fargo & Company (WFC). Key screening parameters: PAR 13.2%, quality 75.6, current PE 14.4, and projected revenue growth 11%. Stock selection guide.

- East West Bank Corp. (EWBC). Key screening parameters: PAR 14.4%, quality 80.1, current PE 18.9, and projected revenue growth 17%. Stock selection guide.

- Medtronic Corporation (MDT). Key screening parameters: PAR 16.6%, quality 87.7, current PE 24.6, and projected revenue growth 13.5%. Stock selection guide.

- William Wrigley Jr. Company (WWY). Key screening parameters: PAR 13.9%, quality 100, current PE 25.2, and projected revenue growth 10%. Stock selection guide.

Quarterly Report

The net asset value for Moose Pond Investors increased +4.1% in the first quarter of 2006. Unit price is up from $13.10 to $13.65. All of the major indices are up as well: the Dow +3.7%, the Nasdaq +6.1%, the S&P 500 +3.7%, and the Russell 2000 +13.7%. See quarterly performance report.

The portfolio summary on this web site has been updated through March 31. (You can find the portfolio snapshot the “Portfolio Summary” section in left side column.) Also, the stock selection guides linked to the portfolio summary has been updated so you can see how we computed projected average return.

Winner and Losers. Winners for the quarter were: Jack Henry & Associates (JKHY) +27.2%, Johnson & Johnson (JNJ) +20.1%, and Occidental Petroleum (OXY) +16.5%. Losers were: UTStarcom (UTSI) -22.0%, Intel (INTC) -21.7, and Amgen (AMGN) -7.8%. Fortunately the winners outflanked the losers and the net gain for the quarter was $1,260.

Transactions. During the quarter, we purchased new positions in Illinois Tool Works (ITW) and Stryker (SYK). We also added to our position on Intel (INTC). We have continued to reinvest dividends as we receive them.

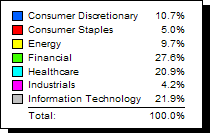

Diversification. Our holdings are spread across six sectors. The financial services sector (27%) remains our largest sector holding, with technology (21.9%) and healthcare (20.9%) the next largest. See diversification report.

Diversification. Our holdings are spread across six sectors. The financial services sector (27%) remains our largest sector holding, with technology (21.9%) and healthcare (20.9%) the next largest. See diversification report.

The Way Ahead. We currently have 26 companies in our portfolio. We only need 17 or so to achieve diversification of nonsystematic risk. Nonsystematic risk results from the volatility of the prices of individual companies. Systematic risk comes from volatility of the overall market (e.g., movement of the market — all or most stocks — as a whole). We can’t diversify for that risk within the portfolio. Some people address systemic risk through asset allocation, i.e., investing in various asset classes. Quality growth stocks might be one such class. This gives us the flexibility to reduce the number of companies, without harming our overall diversification.

Looking at the projected average return (PAR) and the current P/E ratios for the companies listed in the portfolio summary, Brown & Brown (BRO) and Cardinal Health (CAH) appear to be candidates for replacement. Patterson Companies (PDCO) also is a possible candidate for replacement.

SSG Judgment Class

Electronic copies of materials from the class today on stock selection guide judgment skills are available here. The materials include completed stock selection guides and judgment worksheets for INTC, HD, JNJ, MSFT, PFE, and WMT. Since all of these companies are part of the Dow 30, data sheets are available for free at the Value Line website.

More information about educational classes conducted by the D.C Regional Chapter of BetterInvesting can be found on the chapter website.