Education Management Corp.

A Company to Consider Buying. Education Management Corporation (EDMC) provides private post-secondary education in North America. EDMC delivers education to students through traditional classroom settings as well as through online instruction. Its educational institutions offer a broad range of academic programs concentrated in the following areas: media arts, education, design, information technology, fashion, Law and legal studies, culinary arts, business, psychology and behavioral sciences, and health sciences. It offers academic programs through four educational systems: The Art Institutes; Argosy University; American Education Centers; and South University.

EDMC acquired AEC and South University during fiscal 2004. As of June 30, 2004, EDMC had 67 primary campus locations in 24 states and two Canadian provinces. Its program offerings culminate with the award of degrees ranging from associate’s to doctoral degrees. It also offer non-degreed programs, some of which result in the issuance of diplomas upon successful completion. Prior to fiscal 2004, The Art Institutes and Argosy University were managed as separate operating segments. During the first quarter of fiscal 2004 we shifted from an educational system approach to a centralized corporate structure utilizing divisions which have been aggregated into one operating segment. EDMC currently has three distinct operating divisions organized by geographic location within North America: the Eastern Division; Central Division; and Western Division.

Looking at the Stock Selection Guide

Quality. Look at Part 1 of the SSG. EDMC has had consistent growth in revenues and earnings over the past seven years. Value Line rates its earnings predictability 100 (out of 100) and its financial strength a “B+”. Section 2 of the SSG shows pretax profit on sales as 13.8% (5-year average) and trending up slightly. ROE is up over the last three years but slightly below the 5-yr average.

One caution is that EDMC has not done as well as its industry competitors over the past five years on return on equity (18.0 vs. 21.9) or net profit margin (8.3 vs. 12.7). Also, it would be better if Value Line financial strength were a B++ or higher. Overall, EDMC is a quality company.

Growth. Value Line projects EPS growth at 21.5 (based on revenue growth of 21.5. Reuters projects EPS growth of 20% (based on 7 analysts). Morningstar also projects 20% growth (based on 11 analysts).

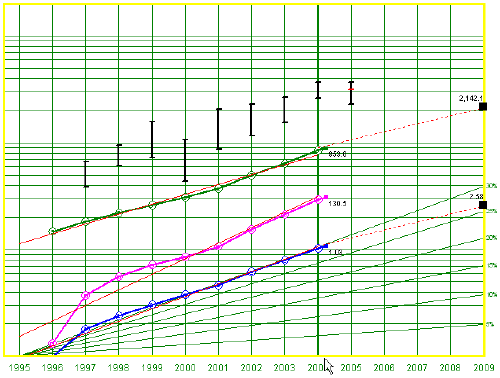

Projected EPS in Five Years. The SSG uses EPS growth RATE of 19%. Resulting in a 5-yr EPS of $2.58. Here is the formula for 5-yr EPS using the trailing twelve months (TTM) EPS of $1.08 and projected growth rate of 19%: [2.58 * (1.19)^5]. Using the “preferred procedures on the SSG (assuming 19% revenue growth, 15% pretax profit margin (Value Line 17.6%), 40% tax rate and 78M shares outstanding, projected 5-yr EPS is 2.47.

Average High and Low PE. The SSG uses an average high PE of 28.5. This PE is 1.5 times the 19% projected growth rate (1.5 * 19 = 28.5). The current PE is 27.3. Relative value of 106.2 and projected relative value is 89.1. Since EDMC is fairly priced relative to its historic PE, gains form PE expansion are unlikely.

Projected 5-year Return (Annualized). Using the data from above, total return for EDMC is 20.1% and projected average return (PAR) is 15.7%. The upside-downside ratio is 4.4.