Lowe’s Companies (LOW)

SSG and PERT A (05-06-2005) | Google Stocks | Company Website

Growth. Value Line (8 April 2005 report) projects revenue growth for LOW to be 14.5% and EPS growth to be 17%. Historic sales growth over the past 10 years has been between 18% and 20%.

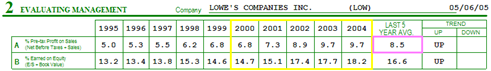

Quality. Two of the key indicators of quality management, pretax profit margin and return on equity have shown steady increases over the past 10 years. See table from Part 2 of the stock selection guide.

|

The Robertson Quality Rating for LOW is 75.6 calculated as follows:

Value Line Financial Strength of A+ = 22.5

Earnings Predictability of 95 = 95 / 4 = 23.8

Projected Sales growth = (14.5 / 11.8) * (25 /2) = 15.4

Projected Profit Margins = (10.6 / 9.4) * (25 / 2) = 14.0

Valuation. 5-year projected EPS is 6.07. With a high PE of 25.1, projected high price is $152.40. With a low PE of 16.3, projected low price is 44.8. Using 25% / 50% / 25% zoning, LOW (currently $53.54) is buy below $71.70.

Negatives. LOW currently has a slightly negative free cash flow (cash flow form operations – capital expenditures). Home Deport (HD) its primary competitor has a positive free cash flow.

What Others Are Saying. A recent Motley Fool article discusses Home Depot and Lowe’s Companies. The author finds both HD and LOW attractive but prefers Home Depot as the market leader and notes it has superior margins and returns, and a lower relative price tag (with comparable bottom-line growth). Morningstar rates LOW with four stars, below average business risk, fair value estimate of $62 and a wide economic moat.

Company Description. Lowe’s Companies, Inc. operates a chain of building materials and home improvement superstores in 44 states. Average store size (sq. ft.): 116,000 for large prototype and 94,000 for smaller store format. Major product categories: appliances, 11%; lumber/ plywood, 8%; outdoor fashion, 7%; millwork, 7%; nursery, 6%; flooring, 6%; fashion electrical, 6%; fashion plumbing, 6%; tools, 6%; hardware, 5%; building materials, 5%. Acquired Eagle Hardware, 4/99. 2003 deprec. rate: 5.2%. Has about 147,000 employees, 19,277 stockholders. Cap’l Res. & Mgmt. owns 10.5% of common stock; State St., 8.2%; FMR, 5.0%. (4/04 Proxy). Chrmn. & CEO: Robert L. Tillman. Inc.: NC. Addr.: Box 1111, North Wilkesboro, NC 28656. Internet: www.lowes.com.