SSG Judgment Class

Electronic copies of materials from the class today on stock selection guide judgment skills are available here. The materials include completed stock selection guides and judgment worksheets for INTC, HD, JNJ, MSFT, PFE, and WMT. Since all of these companies are part of the Dow 30, data sheets are available for free at the Value Line website.

More information about educational classes conducted by the D.C Regional Chapter of BetterInvesting can be found on the chapter website.

NAIC Growth Fund

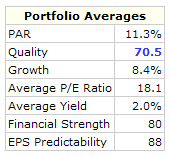

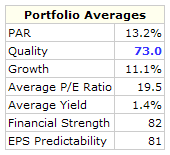

It is always helpful to compare portfolios. Here are summary dashboards for the NAIC Growth Fund and for the Moose Pond Investors portfolios. The NAIC Growth Fund is a closed end fund that was intended to demonstrate NAIC principles. You can click on either summary below for the complete dashboard.

In the past 6 months NAIC growth fund sold its position in Pepsi and Newell Rubbermaid. The fund added to its positions in Abbot Labs, Carlisle Companies, Jack Henry & Associates, Medtronic, Stryker, and Washington Mutual. The total return for the NAIC Growth Fund in 2005, based on change in net asset value, was 1.3% (slightly ahead of our return of 0.3).

| NAIC Growth Fund |

Moose Pond Investors |

|

|

While quality is about the same in both portfolios, the Moose Pond portfolio has higher PAR, higher projected growth, and a higher quality rating. We can probably improve the overall PAR by replacing several of our low PAR companies with higher PAR companies.

Morningstar Bellweather 50

Another list of stocks worthy of further study is the Morningstar Bellweather 50. This is a watch list of large-cap companies that Morningstar rates with a wide economic moat. Morningstar uses its star ratings to show relative valuations of these stocks. A rating of five stars mean the stock is undervalued. The link above shows projected average return and RQR quality rating for each of these stocks.

Stock Screens

One of the challenges when starting a new portfolio or updating an existing one is finding stocks to buy. Here are several public lists of stocks maintained by Manifest Investing. The lists provide both projected average return (PAR) and a quality rating (1-100).

- Manifest 40. These are the top 40 stocks contained in the subscriber portfolios on Manifest Investing.

- Challenge Club. Stocks from an online model investment club.

- Tin Cup Portfolio. A hypothetical portfolio maintained by Manifest Investing.

- Forbes 200. Stocks from the Forbes Top 200 small companies.

- Solomon’s Select. A portfolio of stocks highlighted by Manifest Investing.

- StockFundas Selections. Stocks highlighted on StockFundas.

January Transactions

The stock market drop this past week has provided a buying opportunity. Moose Pond has some cash to invest

Proposed Purchases for January

We recently considered several companies: Stryker [SYK], Microsoft [MSFT], and Kohl’s [KSS], and decided to purchase Stryker.

In addition, three defensive stocks look attractive: Coca-Cola [KO], Gannett [GCI], and Illinois Tool Works [ITW]. These stocks have several things in common. Their prices have gone nowhere or down over the past several years even though their earnings are solid and have continued to grow. Comparing their current price earnings ratio (P/E) to their historical P/E, current P/Es are at an all time low. Value Line rates their financial strength A+ or better, and their earnings predictabillity 85 or better. All three stocks pay dividends, which provides some downside price protection. These three stocks are currently out of favor in spite of their fundamentals. All three have a projected average return of more than 13% which is excellent for a large company.

Coca-Cola has an enormous franchise in its name and also has a strong international marketing and distribution network. Gannett, which publishes USA today, has been suffering from rumors of the early demise of print media and the ascendancy of the Internet. Companies like Gannett will be awash with a Tsunami of political cash as we move into the next presidential election cycle. Illinois Tool Works is a 100+ year old tool company that is the clear leader in almost every market in which it sells tools.

Weeding and Feeding the Stock Garden

These are several good, quality stocks whose prospects are not as good as the others in the portfolio. These are Cardinal Health and Brown & Brown. (Harley Davidson and Capital One Financial are borderline on joining that group.) We are considering selling Cardinal Health and Brown & Brown sometime in the next two or three months after the market recovers from its current bounce down. We plan to reinvest the proceeds in several of the stronger existing stocks.

Summary

Here are the proposals:

- Buy Stryker (taking a full position over 2 months buying half each month)

- Buy Coca-Cola, Gannett, or Illinois Tool Works (talking a full position over two months)

- Sell Cardinal Health and Brown & Brown when the market recovers from last week

- Reinvest the remaining cash in current stocks with a quality rating above 65 and projected average return above 13%

Portfolio Workshop

Here are the slides from the portfolio management class held by the D.C. Chapter of BetterInvesting. The slides are available in PowerPoint and Adobe PDF formats. Also, here are links to the Portfolio Record Keeper reports and the Excel spreadsheet discussed at the workshop.

The Coiled Spring Effect

Market forces are not always rational. Sometimes, a company continues to grow its earnings but its stock price gets stuck in a rut, trading within the same price range for several years. Earnings continue to grow but the price stays about the same. This phenomenon can be observed in the graph in Section 1 of the stock selection guide and also in the table in Section 3 (falling high and low PEs). Sooner or later, the market will “discover” the stock and the price will quickly adjust upward and then follow earnings more closely. Patient investors are rewarded. This is the coiled spring effect.

Three quality stocks that fall into this category are Wal-Mart Stores (WMT), Microsoft (MSFT) and the Coca-Cola Company (KO). They are discussed below. Moose Pond currently holds Wal-Mart.

Microsoft Company

Microsoft Corporation (MSFT) engages in the development, manufacture, license, and support of software products for various computing devices worldwide. Its Client segment offers operating systems for servers, personal computers (PCs), and intelligent devices. The company’s Server and Tools segment provides server applications and developer tools, as well as training and certification services.

Microsoft Corporation (MSFT) engages in the development, manufacture, license, and support of software products for various computing devices worldwide. Its Client segment offers operating systems for servers, personal computers (PCs), and intelligent devices. The company’s Server and Tools segment provides server applications and developer tools, as well as training and certification services.

Growth. Value Line projects 3-5 year revenue growth of 12.5% and EPS growth of 13.5%. Reuters reports an analysts consensus EPS growth of 11.5% (based on 20 analysts). M* projects future growth at 10%. The attached SSG assumes revenue growth of 9.5% and EPS growth of 10.9%. This resulting in a 5year EPS of $2.03.

Quality. Microsoft is a high quality company. Part 1 of the SSG shows consistent revenue and earnings growth. From Part 2 of the SSG we see that MSFT has averaged a 17.1% return on equity over the last five years with no debt less.Part 2 of the SSG and the PERT chart, and PERT graph (see attached SSG), show consistent pretax margins over 40%. M* gives Microsoft a stewardship grade of A. Value Line rates Dell’s financial strength A++ and earnings predictability of 90. The Robertson quality rating is 83.2 (a rating above 65 is excellent).

Valuation. MSFT has a PAR of 15.2% and TR of 18.1%. See SSG. (Manifest Investing projects PAR as 17.7%.) U/D ratio for MSFT is 7.7 to 1 and the buy price using 25%-50%-25% zoning is $32.10. M* rates MSFT five stars meaning it is undervalued.

Coca-Cola Company

The Coca-Cola Company (KO) engages in manufacturing, distributing, and marketing nonalcoholic beverage concentrates and syrups worldwide. The company also produces, markets, and distributes juices and juice drinks, as well as water products. It sells beverage concentrates and syrups to bottling and canning operators, distributors, fountain wholesalers, and fountain retailers.

The Coca-Cola Company (KO) engages in manufacturing, distributing, and marketing nonalcoholic beverage concentrates and syrups worldwide. The company also produces, markets, and distributes juices and juice drinks, as well as water products. It sells beverage concentrates and syrups to bottling and canning operators, distributors, fountain wholesalers, and fountain retailers.

Growth. Value Line projects 3-5 year revenue growth of 6% and EPS growth of 75%. Reuters reports an analysts consensus EPS growth of 8.7% (based on 6 analysts). M* projects future growth at 5% and operating margins at 25%. The attached SSG assumes revenue growth of 6% and EPS growth of 6.8%. This resulting in a 5-yr EPS of $3.03.

Quality. Coca-Cola is a quality company. Part 1 of the SSG shows consistent revenue and earnings growth. From Part 2 of the SSG we see that MSFT has averaged a 35.2% return on equity over the last five years. Part 2 of the SSG and the PERT chart, and PERT graph (see attached SSG), show consistent pretax margins around 30%. M* gives Coca-Cola a stewardship grade of C. Value Line rates Coca-Cola’s financial strength A++ and earnings predictability of 90. The Robertson quality rating is 82.1.

Valuation. Coca-Cola has a PAR of 12.7% and TR of 18.1%. See SSG. (Manifest Investing projects PAR as 11.5%.) U/D ratio for Coca-Cola is 7.7 to 1 and the buy price using 25%-50%-25% zoning is $47.60. (Current price is $41.21.) M* rates Coca-Cola undervalued with five stars. While Coca-Cola is not a classic NAIC growth stock, it has the potential for a good return with little risk.

Portfolio Rebalancing

We are finally moving close to positive territory for portfolio return for the year in spite of or losses in UTStarcom and Pfizer. See year-to-date return report. Pfizer will most likely bounce back, but a recovery by UTStarcom is much less certain. Internal rate of return for the portfolio for the year to date is 0.5%. The S&P 500 is up 1.9% for the same period.

Most companies have reported their third quarter earnings. This is a good time to take a close look at the Moose Pond portfolio. The stock selection guides (SSGs) for all holdings have been revised. Go to the portfolio summary and click on the links for each stock to see the individual SSGs. Also, look at the current diversification report.

(more…)