Purchased ITW and SYK

We took an initial position in Illinois Tool Works (ITW) yesterday at a price of $84.56. On January 23, we took an initial position in Stryker (SYK) at a price of $45.34.

Rebalancing Completed

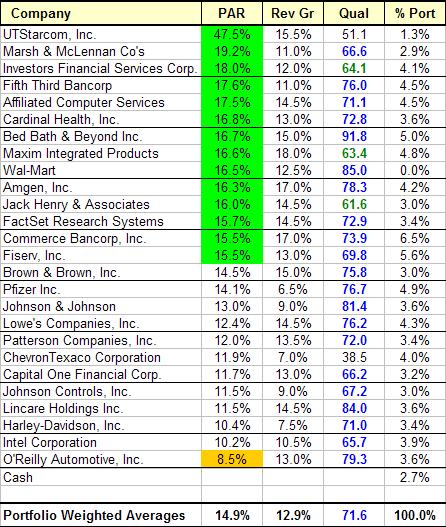

We rebalanced the portfolio this week. We sold our positions in JCI, FISV, LNCR, and ORLY. None of these are bad stocks. However, we were trying to reduce the overall number of stocks in the portfolio to about 20. Someone had to be voted off the island. We also were trying to raise the overall projected average return (PAR) of the portfolio by replacing low PAR stocks with equal or better quality stocks with higher PAR.

We took a new position in Synovus Financial Corp. (SNV). We increased our position in Chevron (CVX) and purchased a second energy stock, Occidental Petroleum Corp. (OXY). We also added to our positions in ACS, PFE, FTB, JKHY, BBY, and WMT.

Sold O’Reilly Automotive

SSG and PERT A (11-08-2005)

|

Google “stocks: orly”

|

Company Website

Reluctantly, we sold ORLY and redeployed the cash. It has been a good performer but we needed to reduce the number of stocks in the portfolio (moving torward a total of 20 stocks). Although ORLY remains a quality company, the project average return dropped to 7.5%. We have replaced it with a stock of comparable quality and higher return.

Reluctantly, we sold ORLY and redeployed the cash. It has been a good performer but we needed to reduce the number of stocks in the portfolio (moving torward a total of 20 stocks). Although ORLY remains a quality company, the project average return dropped to 7.5%. We have replaced it with a stock of comparable quality and higher return.

(more…)

Sold Lincare Holdings

We sold LNCR today and redeployed the cash. LNCR’s revenue and earnings growth has declined over the past two years. See PERT A graph (above). Lower federal reimbursement for supplemental oxygen has cut into its margins. We used the above stock selection guide in making this decision.

(more…)

Sold Fiserv Inc.

We sold FISV today and redeployed the cash. FISV has had three quarters of declining revenue and earnings growth. See PERT A graph (above). Also, FISV’s market overlaps with two other portfolio holdings — JKHY and SNV. We used the above stock selection guide in making this decision.

(more…)

Sold Johnson Controls, Inc.

We sold JCI today and redeployed the cash. Although a still quality stock, revenue growth has been slowing and the project average return dropped to 6.5%. We used the above stock selection guide in making this decision.

(more…)

Bought More JKHY & WMT

We purchased additional shares of Jack Henry & Associates (JHKY) at $17.85 and Wal-Mart (WMT) at $45.09. This increases our holdings in these companies to 4.4% for each. We are 97% invested.

Buying ACS, JKHY and WMT

We purchased additional shares in Affiliated Computer Systems (ACS) this week. ACS has a 5-year projected average return (PAR) of 17.5% and a quality rating of 71. It now is 4.5% of the portfolio. We purchased an initial (3%) position in Jack Henry & Associates (JKHY). JKHY has a PAR of 16% and a quality rating of 61. We plan to purchase an initial position in Wal-Mart Store (WMT) next week. WMT has a PAR of 16.5% and a quality rating of 85. Here are the current stock selection guidess for ACS, JKHY, and WMT. We can compare future results against the assumptions in these SSGs.

The portfolio summary has been updated. The portfolio summary contains links to the related stock selection guides (SSGs). Except for financial service stocks, the SSGs use the preferred procedure. It provides a better guess of future EPS.

Here is the portfolio sorted by projected average return. We need to take a close look at the stocks at the bottom of the sort. O’Reilly Automotive — at the bottom of the stack — remains a quality growth stock. It had a great recent quarter and as a result ORLY is selling near its high average PE. We might want to consider selling it and redeploying the cash.

Additional Shares Bought

We added to our positions today in PFE, CBH, FISV, BBBY and MXIM. With the additional shares, each company will represent about 6% of the total portfolio.

Recent Transactions

We sold all of our shares in Fannie Mae (FNM) at $54.23. Fannie Mae still might be a good contrarian long term investment, however, we decided to exchange the shares for a more stable, high quality bank. We bought Fifth Third Bancorp (FITB) at $42.93

We purchased additional shares of Pfizer Inc. (PFE) at $26.35.

We also purchased additional shares in Commerce Bancorp Inc. (CBH) at $29.86.