Replace Any Stocks?

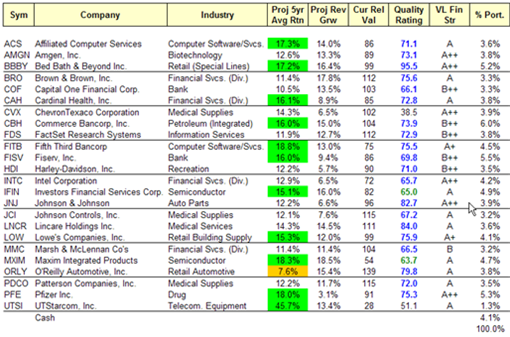

The portfolio summary on July 15 shows an overall projected average return of 14.8% and a quality rating is 71.9 (out of 100). This is excellent (in spite of the less than stellar YTD performance of the portfolio).

(Note the snapshot has changed since this entry. See current snapshot.)

In deciding what we might replace in our portfolio, we need to took at two things: projected average return (PAR) and the quality of each company. PAR is an estimate of the return we can expect if we hold the company for five years (assuming sales and earnings grow as predicted). Although the computer is very precise in its calculations, PAR is still an estimate — an intelligent guess. One or two percentage points difference in PAR between companies is relevant but we should not put too much weight on small differences.

In looking over the portfolio snapshot, we only have one stock with a PAR of less than 10% — ORLY. There is one important mathematical nuance when we calculate PAR. When a company lowers its long term earnings or revenue guidance (like IFIN and HDI), it is usually reflected in the price right away. The PAR calculation shows rate of growth from the present price to the estimated price in five years. This the lower present price causes PAR to increase. (For example, IFIN currently has PAR of 15.1% using 10% growth in EPS and revenue. The 15.1% PAR reflects that fact that price dropped 17% last week. It may also reflect some efficiency on the part of the market)

We also should give considerable weight to a company’s quality. “Quality” means a strong management team, consistent long term earnings and revenue growth, high return on shareholders’ equity (15-20% for at least 5 years), free cash flow, and what Warren Buffet would call a wide moat. We should be slow to sell a high quality stock. (The one exception to this is if the PAR falls below the risk free rate of return, e.g., the 5-year treasury rate or if there has been a negative change in a company’s fundamentals.) A quality company is more likely than a poor quality company to work through problems that might adversely impact future earnings. HDI is an example of high quality company with a strong management team.

As the PAR for a company drops falls below 10%, we need to take a close look at whether we want to continue to hold the company or replace it. I tend to hold high quality companies. However, if the PAR falls below the risk free rate of return or if there has been an adverse change in a company’s fundamentals the decision to sell is much easier.

We have more cash to invest. We can add to our existing holdings (ACS, BBBY, CAH, LOW and PFE all look good) or find a new company. Three watchlist companies that look interesting are Jack Henry (JKHY), Wal-Mart Stores (WMT) and Thomas Nelson, Inc. (TNM). As time permits this week, I’ll post SSGs and summaries for these three companies.