Evaluating Energy Stocks

Energy stocks are difficult to assess. The standard NAIC growth stock methodology does seem not work particularly well with energy companies since their revenues are driven in part by the pricing of the underlying commodity (oil or gas).

Kurt Wulff maintains the “McDeb” website which contains a weekly analysis of energy stocks. He was written up in Barrons earlier this year.

He has developed the McDep ratio which compares a company’s market value and debt to its present value. (“McDep” stands for market cap and debt to present value.) The ratio provides a useful way to compare energy companies and to assess relative market valuation.

In addition to preparing a weekly analysis called the “Meter Reader,” Kurt Wulff also profiles individual energy companies.

The site is free and does not require registration. The information on the site lags a week or two from when he provides it to his paying clients.

ChevronTexaco has a projected average return (PAR) of 10.4% and a quality rating of 64. More importantly, CVX has a McDep ratio of 0.77. This means that CVX is undervalued. A ratio of 1.0 would mean that ChevronTexaco’s market value and debt equaled its its present value. This McDep ratio calculation assumes $37 bbl oil. (This is a conservative assumption since futures contracts over the next six years are currently priced at $51 bbl.) See Wulff’s assessment of ChevronTexaco.

FactSet Research Sys (FDS)

SSG and PERT A | Google Stocks | Company Website

5/7/2007: The SSG has been updated. FDS has been a winner. However, its run-up in price has reduced projected average return (PAR) to about 6%. If PAR falls any lower, it might be candiate for replacement. ValueLine rates its financial strength B++ and earnings predictability 100. Morningstar rates it three stars. See stock selection guide. (more…)

5/7/2007: The SSG has been updated. FDS has been a winner. However, its run-up in price has reduced projected average return (PAR) to about 6%. If PAR falls any lower, it might be candiate for replacement. ValueLine rates its financial strength B++ and earnings predictability 100. Morningstar rates it three stars. See stock selection guide. (more…)

Cardinal Health Inc. (CAH)

SSG and PERT A (04-23-2005) | Google Stocks | Company Website

This is an update of the SSG for Cardinal Health. CAH is a buy.

This is an update of the SSG for Cardinal Health. CAH is a buy.

(more…)

Portfolio Summary Updated

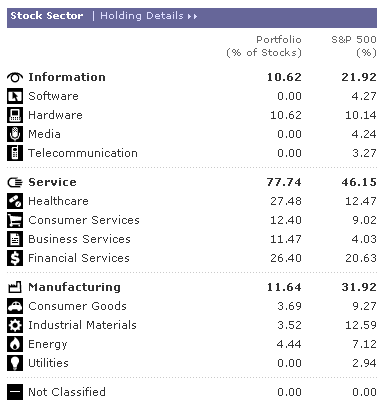

The portfolio summary and quality growth screen have been updated. The Moose Pond portfolio is diversified across eight industries.

Bed, Bath & Beyond (BBBY)

SSG and PERT A (04-01-2005) | Google Stocks | Company Website

Stock Selection Guide Updated. The SSG for Bed, Bath & Beyond has been revised. BBBY remains a high quality company and is within the “buy” range up to a price of $44.90.

Stock Selection Guide Updated. The SSG for Bed, Bath & Beyond has been revised. BBBY remains a high quality company and is within the “buy” range up to a price of $44.90.

There is an excellent article by Mark Robertson at www.fundas.com discussing Bed, Bath and Beyond. His analysis is right on target.

On April 6, BBBY reported its year end results. Sales were up 15% and net earnings increased 26.4%. This shows very positive growth and is in line with past years. Comparable store sales increased by 5.1%.

(more…)

Berkshire Hathaway

The annual reports for Berkshire Hathaway include Warren Buffet’s letters to shareholders. In addition to discussing the state of the company, these letters contain sage investment advice applicable to all investors, including small investors. Here is an excerpt from this year’s letter.

Over the 35 years, American business has delivered terrific results. It should therefore have been easy for investors to earn juicy returns: All they had to do was piggyback Corporate America in a diversified, low-expense way. An index fund that they never touched would have done the job. Instead many investors have had experiences ranging from mediocre to disastrous.

There have been three primary causes: first, high costs, usually because investors traded excessively or spent far too much on investment management; second, portfolio decisions based on tips and fads rather than on thoughtful, quantified evaluation of businesses; and third, a start-and-stop approach to the market marked by untimely entries (after an advance has been long underway) and exits (after periods of stagnation or decline). Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.

Portfolio Summary Updated

The portfolio summary has been updated.

We now have more in cash to invest. Kudos to those members who are saving and investing regularly. With the recent market down trend, we should continue to purchase new shares. It’s always better to buy stocks when they are on sale.

Here are two proposals.

Proposal 1. Replace Federal Home Loan Management Corp (FNM) with Fifth Third Bank Corp (FITB), a well managed mid-west bank. Most of the literature about FITB has been very positive. See attached SSG and related reports (e.g., Morningstar, S&P and Value Line). We would sell FNM and apply the proceeds to FITB.

Proposal 2. Use the remaining funds to purchase additional shares of four of our existing stocks with the best prospects, considering both quality and projected return. We would add to our holdings of each of the following stocks: PFE, FISV, ACS and BBY. (Note there other strong candidates for reinvestment, including LOW, CBH and AMGN.)

Financial Services Outlook

Here is an interesting article by Tom Brown, CEO of Second Curve Capital, discussing the outlook for 2005 for the financial services industry. The article notes that retail branch growth can’t go on indefinitely. The report is positive about Capital One (COF), Investors Financial Services (IFIN), Commerce Bancorp (CBH) and Morgan Stanley (MWD). (We hold three of these four stocks.) His website is www.bankstocks.com.

Quality Growth Screen

NAIC publishes an annual survey of the 200 most widely held stocks by investment clubs. Screening that list for stocks for a projected 5-year average return of 12% or more and for an upside /downside ratio of 3 or more, yields 34 stocks. We already own 11 of these stocks. Here is the list of stocks passing the screen.