Morningstar Bellweather 50

Another list of stocks worthy of further study is the Morningstar Bellweather 50. This is a watch list of large-cap companies that Morningstar rates with a wide economic moat. Morningstar uses its star ratings to show relative valuations of these stocks. A rating of five stars mean the stock is undervalued. The link above shows projected average return and RQR quality rating for each of these stocks.

Stock Screens

One of the challenges when starting a new portfolio or updating an existing one is finding stocks to buy. Here are several public lists of stocks maintained by Manifest Investing. The lists provide both projected average return (PAR) and a quality rating (1-100).

- Manifest 40. These are the top 40 stocks contained in the subscriber portfolios on Manifest Investing.

- Challenge Club. Stocks from an online model investment club.

- Tin Cup Portfolio. A hypothetical portfolio maintained by Manifest Investing.

- Forbes 200. Stocks from the Forbes Top 200 small companies.

- Solomon’s Select. A portfolio of stocks highlighted by Manifest Investing.

- StockFundas Selections. Stocks highlighted on StockFundas.

January Transactions

The stock market drop this past week has provided a buying opportunity. Moose Pond has some cash to invest

Proposed Purchases for January

We recently considered several companies: Stryker [SYK], Microsoft [MSFT], and Kohl’s [KSS], and decided to purchase Stryker.

In addition, three defensive stocks look attractive: Coca-Cola [KO], Gannett [GCI], and Illinois Tool Works [ITW]. These stocks have several things in common. Their prices have gone nowhere or down over the past several years even though their earnings are solid and have continued to grow. Comparing their current price earnings ratio (P/E) to their historical P/E, current P/Es are at an all time low. Value Line rates their financial strength A+ or better, and their earnings predictabillity 85 or better. All three stocks pay dividends, which provides some downside price protection. These three stocks are currently out of favor in spite of their fundamentals. All three have a projected average return of more than 13% which is excellent for a large company.

Coca-Cola has an enormous franchise in its name and also has a strong international marketing and distribution network. Gannett, which publishes USA today, has been suffering from rumors of the early demise of print media and the ascendancy of the Internet. Companies like Gannett will be awash with a Tsunami of political cash as we move into the next presidential election cycle. Illinois Tool Works is a 100+ year old tool company that is the clear leader in almost every market in which it sells tools.

Weeding and Feeding the Stock Garden

These are several good, quality stocks whose prospects are not as good as the others in the portfolio. These are Cardinal Health and Brown & Brown. (Harley Davidson and Capital One Financial are borderline on joining that group.) We are considering selling Cardinal Health and Brown & Brown sometime in the next two or three months after the market recovers from its current bounce down. We plan to reinvest the proceeds in several of the stronger existing stocks.

Summary

Here are the proposals:

- Buy Stryker (taking a full position over 2 months buying half each month)

- Buy Coca-Cola, Gannett, or Illinois Tool Works (talking a full position over two months)

- Sell Cardinal Health and Brown & Brown when the market recovers from last week

- Reinvest the remaining cash in current stocks with a quality rating above 65 and projected average return above 13%

Portfolio Workshop

Here are the slides from the portfolio management class held by the D.C. Chapter of BetterInvesting. The slides are available in PowerPoint and Adobe PDF formats. Also, here are links to the Portfolio Record Keeper reports and the Excel spreadsheet discussed at the workshop.

Performance for 2005

Given the amount of effort that went into research and analysis this

year, the results for 2005 were a little disappointing. On a

cash flow basis, we finished with a very small gain. While

that is better than losing money, we did not beat either the

S&P 500 or the Russell 2000. They were up 4.9% and

4.6% respectively. On a positive note, we have soundly beaten

the S&P 500 over the past five years and we are almost even

with the Russell 2000.

The table and chart below show the annual return for Moose Pond

Investors over the past five years. The “Stocks

Only” column only shows the return of the stocks we

held. The next column, “Stocks &

Cash,” includes cash awaiting investment and monthly

brokerage fees. As a result, the return is slightly

lower. As our portfolio holdings grow larger, cash on the

sidelines and fees will have less of an impact on overall portfolio

return.

|

Stocks

Only |

Stocks

& Cash |

S&P 500

|

Russell 2000

|

Unit

Value |

|

| 2005 | 0.3% | 0.1% | 4.9% | 4.6% | $13.097 |

| 2004 |

16.1%

|

13.8%

|

10.9%

|

17.0%

|

$13.256

|

| 2003 |

35.1%

|

23.1%

|

28.7%

|

47.3%

|

$11.802

|

| 2002 |

-23.4%

|

-19.1%

|

-22.1%

|

-20.5%

|

$9.707

|

| 2001 |

37.9%

|

13.8%

|

-11.9%

|

2.5%

|

$11.970

|

| 3-year | 10.4% | 9.3% | 12.4% | 22.1% | |

| 5-year | 8.1% | 7.1% | 0.5% | 8.2% |

The annual returns for Moose Pond Investors are calculated using

internal rate of return (IRR). This method is more precise

because it

looks at actual cash flows. It better accounts for partner

investments

and market fluctuations throughout the year. We could have

calculated

annual return using the change in unit value from year to

year.

However, we opted for the more accurate IRR method.

The two

indices that we have been using for comparison, the S&P 500 and

Russell 2000, show the total return for each year including

dividends.

These return calculations do not take into account the actual cash

flows for Moose Pond Investors.

The Coiled Spring Effect

Market forces are not always rational. Sometimes, a company continues to grow its earnings but its stock price gets stuck in a rut, trading within the same price range for several years. Earnings continue to grow but the price stays about the same. This phenomenon can be observed in the graph in Section 1 of the stock selection guide and also in the table in Section 3 (falling high and low PEs). Sooner or later, the market will “discover” the stock and the price will quickly adjust upward and then follow earnings more closely. Patient investors are rewarded. This is the coiled spring effect.

Three quality stocks that fall into this category are Wal-Mart Stores (WMT), Microsoft (MSFT) and the Coca-Cola Company (KO). They are discussed below. Moose Pond currently holds Wal-Mart.

Jack Henry & Assoc. (JKHY)

SSG and PERT A (11-18-2005) | Google “stocks: jkhy” | Company Website

Jack Henry & Associates (JKHY) is a stock that frequently shows up in screens for quality growth stocks. Using NAIC criteria, JKHY is a buy up to $22.90 (current price is $19.10). Projected average return over the next 5 years is 15.2%. The SSG assumes a 13.5% revenue growth based on Value Line projections.

Jack Henry & Associates (JKHY) is a stock that frequently shows up in screens for quality growth stocks. Using NAIC criteria, JKHY is a buy up to $22.90 (current price is $19.10). Projected average return over the next 5 years is 15.2%. The SSG assumes a 13.5% revenue growth based on Value Line projections.

Jack Henry & Associates provides integrated computer systems and processes ATM and debit card transactions for banks and credit unions. It describes itself as:

A technology provider for the financial industry. That’s the simplest way to describe what we do. But it hardly describes what Jack Henry & Associates is really about. We’re about solutions and support. We’re about building relationships and making things work. We’re about doing the right things for our customers, no matter what. It began as a vision, and it’s become our tradition.

A substantial amount of JKHY’s revenue, about 60%, comes from recurring sales. The company has a strong customer focus. 92% of its customers renw. Its several corporate aircraft are used to transport customer support teams — not company executives. Great concept!

Value Line rates JHKY’s financial strength “B++” and earnings predictability as 80 (out of 100). Its RQR quality rating is 63 — a little lower than the Moose Pond Investors portfolio average. Given the projected average return above 15% and the that fact that JKHY is a medium size company, the slightly lower quality rating is acceptable. Morningstar gives JKHY a rating of five stars and a wide economic moat. It estimates fair value at $23 assuming a growth in revenue of 12%.

Synovus Fin. Corp. (SNV)

SSG and PERT A (11-12-2005) | Google “stocks: snv” | Company Website

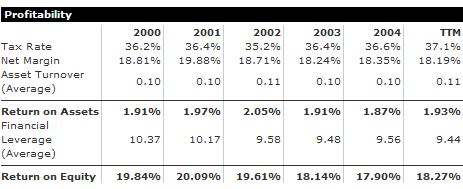

We took an initial position today in SNV. It has a projected average return of 18.7% and a RQR quality rating of 70.1. The director of investor relations spoke at the Better Investing National Conference in Atlanta. Two key points from the presentation were that SNV is well managed and the price of banks have been driven down based on concern about bank profitability due to the increase in long term interest rates. SNV has maintained very solid profitability with an return on assets (a key metric for banks) of about 1.9%. Return on equity has been steady aroud 18%. See Morningstar profitability summary below.

|

Business Description. Synovus Financial Corp., a holding company, provides various financial services. It operates in two segments, Financial Services and Transaction Processing Services (TPS).

The Financial Services segment provides commercial banking services, including commercial, financial, agricultural, and real estate loans; retail banking services, including accepting demand and savings deposits; individual, consumer, installment, and mortgage loans; safe deposit services; leasing services; automated banking and fund transfer services; and bank credit card services. It also provides portfolio management services; securities brokerage; trust services; insurance agency services; financial planning services; asset management services; and investment advisory services.

The TPS segment primarily provides electronic payment processing services in the United States, Canada, Mexico, Honduras, Puerto Rico, and Europe. It also provides back-end processing services to support merchant processing and offers other products and services to support its processing services. In addition, the TPS segment provides commercial printing and related services; programming support and assistance with the conversion of card portfolios to TS2; recovery collections, bankruptcy process and legal account management, and skip tracing services; Internet, Intranet, and client/server software solutions for commercial card management programs; targeted loyalty consulting, as well as travel, gift card, and reward programs; gift card processing services to Japanese clients; prepaid card solutions; and sells and leases computer related equipment associated with its electronic payment processing services. As of April 26, 2005, Synovus operated 41 banks and other Synovus’ offices in Georgia, Alabama, South Carolina, Florida, and Tennessee. The company was formed in 1888 and was formerly known as CB&T Bancshares, Inc. It changed its name to Synovus Financial Corp. in 1989. Synovus is headquartered in Columbus, Georgia.

Portfolio Rebalancing

We are finally moving close to positive territory for portfolio return for the year in spite of or losses in UTStarcom and Pfizer. See year-to-date return report. Pfizer will most likely bounce back, but a recovery by UTStarcom is much less certain. Internal rate of return for the portfolio for the year to date is 0.5%. The S&P 500 is up 1.9% for the same period.

Most companies have reported their third quarter earnings. This is a good time to take a close look at the Moose Pond portfolio. The stock selection guides (SSGs) for all holdings have been revised. Go to the portfolio summary and click on the links for each stock to see the individual SSGs. Also, look at the current diversification report.

(more…)

Investors Financial Services

Investors Financial Services Corp. (IFIN) declined 13% for the quarter and 33.2% year to date. It is our second worst performing stock for the year. UTSI is the worst. The drop in IFIN stock price resulted from declining earnings growth. We looked at IFIN two months ago. This is a relook.

On July 17, Investors Financial cut its earnings forecast. The company gave 2005 earnings guidance of $2.30 a share, with core earnings flat with the year-ago $2.09. The company said 2006 core earnings would rise 8%-10%. Analysts had forecast earnings of $2.50 a share for 2005 and $2.98 for 2006. See page 2 of the second quarter earnings report for the companies explanation.

The announcement predictably drove the stock price down, although the market had already discounted the decline in earnings growth with the stock price slowly declining since February. See IFIN price chart. The bottom feeders of the securities bar immediately filed multiple class actions alleging that management had misled shareholders with false optimism prior to the reduced earnings guidance. The filing of class actions under the Securities Exchange Act of 1934 whenever a company announces bad news has become a cottage industry that ought to be closed. The litigating attorneys frequently settle these class actions for their fees and expenses and some minimal compensation to the shareholders. Most of these class actions are a wasteful drain on an overburdened legal system and on the finances of the targeted companies.

Morningstar rates IFIN with three stars, a narrow moat, and a “D” in stewardship, and concludes that it is fairly valued at $35. (It’s current price is $32.90). Manifest Investing gives IFIN a quality rating of 64 and estimates a PAR as 21.2%. The Investors Advisory service also has IFIN as a buy up to $53.

The company’s core business offers a wide range of administration services to mutual fund complexes, investment advisors, family offices, banks, and insurance companies. That business seems to be solid although it operates in a very competitive environment. The company’s banking services have suffered the same slow down as other banks due to flatter yield curve and narrower investment spreads. The market has probably over reacted to the news in July. Our current stock selection guide shows a projected average return of 19.4%. IFIN is a hold for now. However, we have four financial stocks, CBH, FITB, COF and IFIN. We may want to consider pruning back.