Sold Commerce Bancorp (CBH)

We sold CBH on June 12, 2007. Primary reason was declining on return on assets.

SSG and PERT A (05-09-2005) | Google Stocks | Company Website

Entry from May 5, 2005:Growth. Value Line (25 Feb 2005) projects CBH growth in book value and loans at 18% and EPS growth at 17%. Value Line projects annual share net gains of between 10% and 15% through 2007-2009. Value Line also projects that asset, loan, and deposit growth could reach 20% annually as Commerce continues with its aggressive expansion strategy.

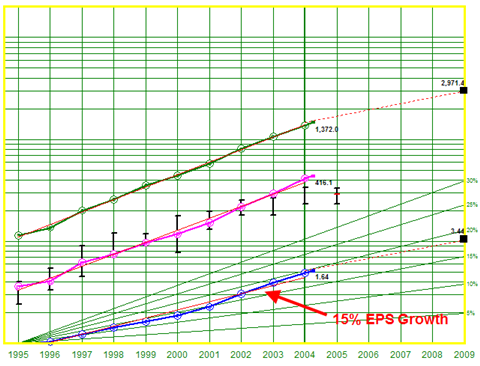

Part 1 of the stock selection guide shows that CBH has grown steadily over the long term.

Quality. Return on shareholder equity has been consistently better than 18%. Return on assets, an important measure of performance for a bank, has remained slightly above 1.0% but is below the industry average of 1.6%. Value Line gives CBH a financial strength rating of B++ and earnings predicatability of 100. The RQR quality rating for CBH is 74.

Valuation. From the SSG, 5-year projected EPS is 3.44. With a high PE of 20.6, projected high price is $70.90. With a low PE of 14.1, projected low price is 24.1. Using 25% / 50% / 25% zoning, CBH (currently $28.09) is a buy below 35.80.

What Others Are Saying. While the analysts’ mean projected EPS growth is 16.6%, the analysts are split in their recommendations of CBH. They breakdown as follows: Buy(8), Outperform(0), Hold(4), Underperform(4) and Sell(2). “Underperform” and probably “Hold” are analyst speak for sell. The Motley Fool made cautious but positive comments about CBH’s growth in a recent article. Standard & Poors gives CBH a 5 Star rating (strong buy).

Morningstar considers CBH fairly valued at $28.00 and only gives CBH 3 stars and a narrow moat. Here are Morningstar’s pros and cons:

Bulls Say

- Although deposit growth will eventually slow, Commerce is accumulating a large, low-cost balance sheet from which it may fund assets and expand product offerings.

- Controversies like political lobbying and related-party transactions have little effect on Commerce’s operating model and might offer investors an opportunity to buy the stock at a discount.

- Commerce Bancorp’s business model has revolutionized retail banking,and its stock performance is a strong indicator of its success.

Bears Say

- Commerce is the subject of an investigation by the U.S. attorney’s office, the National Association of Securities Dealers, and the Securities and Exchange Commission, as well as several shareholder lawsuits. These uncertainties could result in significant penalties and a loss in shareholder value.

- Although an incredible deposit gatherer, Commerce holds more than half its assets in investment securities, which will come under pressure when interest rates rise.

- Issues such as accounting for capital expenditures and municipal underwriting practices have raised concerns over reported results.

Company Description: Commerce Bancorp, Inc. provides personal, commercial, and trust services through its banking subsidiaries, which include Commerce Bank; Commerce Bank/Pennsylvania; and Commerce Bank/Shore. Serves NJ, PA, NY, and DE through 270 banking facilities. Retail svcs. include checking, savings, money markets, and CDs. At 12/03: consumer loans: 34% of gross loans; real estate, 18%; commercial, 48%. Net charge-offs: .16% of avg. loans. At 12/03, loan loss reserve: 1.51% of total loans; nonperforming assets: .10%. Has about 8,200 empls. Off. & dir. own 11.4% of stock (4/04 proxy). Chrmn. & Pres.: Vernon W. Hill, II. Inc.: NJ 08034. Add.: 1701 Route 70 East, Commerce Atrium, Cherry Hill, NJ. Tel.: 888-751-9000. Web: www.commerceonline.com