Sold Capital One Financial (COF)

We sold COH on June 12, 2007.

From February 6, 2006:

SSG and PERT A Graph | Google “Stocks: COF” | Company Website

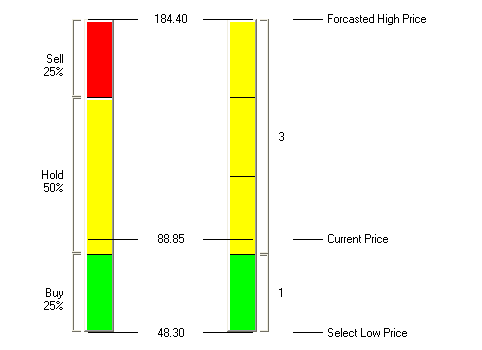

Capital One Financial remains a high quality growth stock. Currently at $31.25, our stock selection guide has COF a buy up to $88.85 with a projected average return of 11.4%. COF pays a very small (0.1%) dividend. Its current price makes it a strong HOLD.

The Feb 24, 2006, Value Line rates COF’s financial strength as an “A+” and earnings predictability as 95. VL estimates projected growth in the 14% range. Morningstar also speaks well of the company and projects revenue growth of 10% while Value Line loan growth of 12% and earnings growth of 14.5%. Morningstar only gives COF 3-stars which means that the current price is close to Morningstar’s estimate of fair value.

Here is an upside/downside chart that shows the current price just outside of the buy range.

Investor Advisory Service also follows COF and notes: “Going into the fourth quarter, there were several legitimate concerns about Capital One Financial’s short-term outlook. It had recently completed the acquisition of Hibernia, a large bank in hurricane-stricken Louisiana, and had a surge in bankruptcy filings before new bankruptcy legislation took effect. Fourth quarter results came as quite a relief. EPS rose 26%, and would have been slightly better excluding some minor one-time items. Revenue increased 17%, but would have been 10% even without the Hibernia acquisition. Loan losses increased significantly because of the bankruptcy legislation, but delinquencies decreased significantly. Capital One plans to re-brand Hibernia under the Capital One name, and is accelerating its strategy of building new branches in Texas. Capital One expects reasonable growth in 2006, which is remarkable given the expense of integrating Hibernia and the cost of expensing stock options. We remain enthusiastic about the company, its prospects and valuation.” IAS has COF as a buy up to 92.