Sold Fiserv Inc.

We sold FISV today and redeployed the cash. FISV has had three quarters of declining revenue and earnings growth. See PERT A graph (above). Also, FISV’s market overlaps with two other portfolio holdings — JKHY and SNV. We used the above stock selection guide in making this decision.

(more…)

Sold Johnson Controls, Inc.

We sold JCI today and redeployed the cash. Although a still quality stock, revenue growth has been slowing and the project average return dropped to 6.5%. We used the above stock selection guide in making this decision.

(more…)

Pfizer Inc. (PFE)

SSG and PERT A (07-21-2005) | Google “Stocks: PFE” | Company Website

The stock selection guide for Pfizer has been updated to reflect Q2 earnings. Using a 5-yr projected revenue growth of 6.5% and consevative PEs (high PE of 22 and low PE of 12.5), the projected average return ofor the next five years is 18.1%. PFE remains a high quality stocks and is a buy up to $32.70.

The stock selection guide for Pfizer has been updated to reflect Q2 earnings. Using a 5-yr projected revenue growth of 6.5% and consevative PEs (high PE of 22 and low PE of 12.5), the projected average return ofor the next five years is 18.1%. PFE remains a high quality stocks and is a buy up to $32.70.

(more…)

Investors Fin. Services (IFIN)

SSG and PERT A (07-14-2005) | Google Stocks | Company Website

At the Q2 press conference on July 14, Investors Financial Services Corp. (IFIN) revised is earnings guidance downward for 2005 (10%), 2006 (8-10%), and 2007 and beyond (12-14%). See Q2 press release.

At the Q2 press conference on July 14, Investors Financial Services Corp. (IFIN) revised is earnings guidance downward for 2005 (10%), 2006 (8-10%), and 2007 and beyond (12-14%). See Q2 press release.

We previously had used 16% in our projections for June. The reduced earnings guidance is due in part to reduced interest income. A revised SSG, using 12% expected EPS growth, shows a projected average return PAR of 14.2% and a buy up to $48. However, given the company’s lowered guidance, the may be a stock to consider replacing.

Note: IFIN’s price dropped 17% on July 15 on announcment of the lowered guidance. The SSG was revised after the announcement using a projected EPS growth of 10% and the lowered price. The new projected average return is 15.51%. See revised SSG (07-15-2005). This certainly suggests some efficiency in the market.

The June Investor Advisory Service by IClub had reported IFIN a buy as well:

Investors Financial Services had a surprisingly slow quarter. First quarter revenue grew 8% with core services revenue growth of 16% being partially offset by an 11% drop in ancillary services revenue. EPS rose 11%, but a securities gain in 2005 and a one-time prepayment penalty in 2004 accounted for all of the apparent growth. The company obtained almost 30% of its revenue from net interest income. An analysis of its balance sheet shows that customers are withdrawing low-cost demand and savings deposits while Investors Financial adds to more expensive funding sources like time deposits and borrowed money. The concern is that it must exercise great care to avoid getting pinched by rising interest rates. IFIN (42.74) is a buy up to 65.

(more…)

Sold Commerce Bancorp (CBH)

We sold CBH on June 12, 2007. Primary reason was declining on return on assets.

Lowe’s Companies (LOW)

SSG and PERT A (05-06-2005) | Google Stocks | Company Website

Growth. Value Line (8 April 2005 report) projects revenue growth for LOW to be 14.5% and EPS growth to be 17%. Historic sales growth over the past 10 years has been between 18% and 20%.

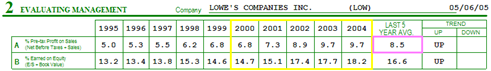

Quality. Two of the key indicators of quality management, pretax profit margin and return on equity have shown steady increases over the past 10 years. See table from Part 2 of the stock selection guide.

|

The Robertson Quality Rating for LOW is 75.6 calculated as follows:

Value Line Financial Strength of A+ = 22.5

Earnings Predictability of 95 = 95 / 4 = 23.8

Projected Sales growth = (14.5 / 11.8) * (25 /2) = 15.4

Projected Profit Margins = (10.6 / 9.4) * (25 / 2) = 14.0

Valuation. 5-year projected EPS is 6.07. With a high PE of 25.1, projected high price is $152.40. With a low PE of 16.3, projected low price is 44.8. Using 25% / 50% / 25% zoning, LOW (currently $53.54) is buy below $71.70.

Negatives. LOW currently has a slightly negative free cash flow (cash flow form operations – capital expenditures). Home Deport (HD) its primary competitor has a positive free cash flow.

What Others Are Saying. A recent Motley Fool article discusses Home Depot and Lowe’s Companies. The author finds both HD and LOW attractive but prefers Home Depot as the market leader and notes it has superior margins and returns, and a lower relative price tag (with comparable bottom-line growth). Morningstar rates LOW with four stars, below average business risk, fair value estimate of $62 and a wide economic moat.

(more…)

FactSet Research Sys (FDS)

SSG and PERT A | Google Stocks | Company Website

5/7/2007: The SSG has been updated. FDS has been a winner. However, its run-up in price has reduced projected average return (PAR) to about 6%. If PAR falls any lower, it might be candiate for replacement. ValueLine rates its financial strength B++ and earnings predictability 100. Morningstar rates it three stars. See stock selection guide. (more…)

5/7/2007: The SSG has been updated. FDS has been a winner. However, its run-up in price has reduced projected average return (PAR) to about 6%. If PAR falls any lower, it might be candiate for replacement. ValueLine rates its financial strength B++ and earnings predictability 100. Morningstar rates it three stars. See stock selection guide. (more…)

Cardinal Health Inc. (CAH)

SSG and PERT A (04-23-2005) | Google Stocks | Company Website

This is an update of the SSG for Cardinal Health. CAH is a buy.

This is an update of the SSG for Cardinal Health. CAH is a buy.

(more…)

Bed, Bath & Beyond (BBBY)

SSG and PERT A (04-01-2005) | Google Stocks | Company Website

Stock Selection Guide Updated. The SSG for Bed, Bath & Beyond has been revised. BBBY remains a high quality company and is within the “buy” range up to a price of $44.90.

Stock Selection Guide Updated. The SSG for Bed, Bath & Beyond has been revised. BBBY remains a high quality company and is within the “buy” range up to a price of $44.90.

There is an excellent article by Mark Robertson at www.fundas.com discussing Bed, Bath and Beyond. His analysis is right on target.

On April 6, BBBY reported its year end results. Sales were up 15% and net earnings increased 26.4%. This shows very positive growth and is in line with past years. Comparable store sales increased by 5.1%.

(more…)

ChevronTexaco (CVX)

SSG and PERT A (07-06-2006) | Google Stocks | Company Website

Growth. ChevronTexaco is not a classic growth company. However, the increasing demand for energy, the increase in energy prices and acquisitions have caused CVX’s revenues to grow at an annualized rate 16.5% over the past ten years. Earnings have grown at 12.2% over the same period. The attached SSG assumes a 5-year revenue and EPS growth rate of 5.7%. Value Line projects 5% revenue growth and 11.5% earnings growth. The First Call consensus projects EPS growth at 7.1%. So the SSG rate of 5.7% is convervative.

Growth. ChevronTexaco is not a classic growth company. However, the increasing demand for energy, the increase in energy prices and acquisitions have caused CVX’s revenues to grow at an annualized rate 16.5% over the past ten years. Earnings have grown at 12.2% over the same period. The attached SSG assumes a 5-year revenue and EPS growth rate of 5.7%. Value Line projects 5% revenue growth and 11.5% earnings growth. The First Call consensus projects EPS growth at 7.1%. So the SSG rate of 5.7% is convervative.

Valuation. Valuing energy companies is a specialty. Classic NAIC-type analysis is helpful but not very. So let’s look at what the experts say. McDep Energy Investment Research makes it energy stock recommendations and investment research available to the public (with a slight time lag from its subscribers). The “McDep” ratio provides a relative measure of whether an energy company is over or under valued using futures prices and assumption about energy reserves. Of the so called “mega caps,” CVX has the lowers McDep ratio (lower is better). See page 5 of the McDep “Meter Reader” report. Also the McDep web site have posted several reports discussing CVX

Bottom line. If energy prices recede, CVX will show a modest return. CVX currently pays an annual dividend $1.60 (3.13% yield) and earnings should grow at about 5%. Under this scenario, the projected average return for CVX is 12.2%. (This assumes a projected high PE of 12.1.) If energy prices remain the same or increase, CVX has considerable price appreciation potential.

(more…)