Portfolio Summary Updated

The portfolio summary has been updated.

We now have more in cash to invest. Kudos to those members who are saving and investing regularly. With the recent market down trend, we should continue to purchase new shares. It’s always better to buy stocks when they are on sale.

Here are two proposals.

Proposal 1. Replace Federal Home Loan Management Corp (FNM) with Fifth Third Bank Corp (FITB), a well managed mid-west bank. Most of the literature about FITB has been very positive. See attached SSG and related reports (e.g., Morningstar, S&P and Value Line). We would sell FNM and apply the proceeds to FITB.

Proposal 2. Use the remaining funds to purchase additional shares of four of our existing stocks with the best prospects, considering both quality and projected return. We would add to our holdings of each of the following stocks: PFE, FISV, ACS and BBY. (Note there other strong candidates for reinvestment, including LOW, CBH and AMGN.)

Amgen Inc.

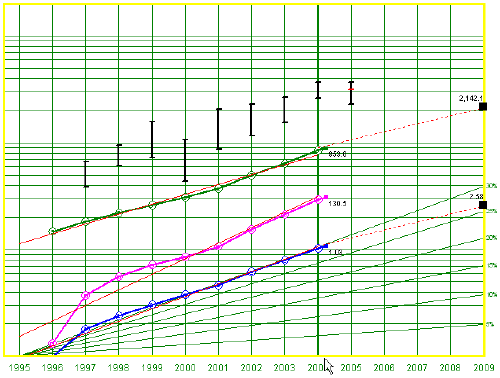

Stock Selection Guide Updated. The SSG for Amgen has been updated. 5-year EPS was projected using the “preferred procuredure” with the following assumptions: revenue growth of 15%, pretax margin 40.4%, tax rate of 26.5% and outstanding shares of 1,175 million. This results in a projected average return of 13.9% using an averate high PE of 29 and average low PE of 16.5. This puts Amgen in the “buy” range. Both IAS and First Call’s analysts consensus project growth at 20%, so the 15% projected growth used in the SSG is conservative.

Stock Selection Guide Updated. The SSG for Amgen has been updated. 5-year EPS was projected using the “preferred procuredure” with the following assumptions: revenue growth of 15%, pretax margin 40.4%, tax rate of 26.5% and outstanding shares of 1,175 million. This results in a projected average return of 13.9% using an averate high PE of 29 and average low PE of 16.5. This puts Amgen in the “buy” range. Both IAS and First Call’s analysts consensus project growth at 20%, so the 15% projected growth used in the SSG is conservative.

For the fifth time, Amgen has been named one of the “100 Best Companies to Work for in America” by Fortune magazine. Also, Amgen ranked fifth in The Scientist’s annual survey of the best workplaces for 2004. Details. Amgen also has an excellent website for investors.

From December 2004 Investor Advisory Service by IClub: IAS also has Amgen in the “buy” range. “Amgen reported continuing solid results for the third quarter of 2004 with total product sales up 23%. On an adjusted basis, excluding one-time factors relating to the company’s acquisition of Tularik, earnings per share growth was 39%. The company also increased guidance for expected earnings per share for the year from about $2.35-$2.40. The sales guidance was also improved to about $10.4 billion for the year. While the company is dependant on a limited number of products, these have continued to grow and sell well. There are also a number of interesting new possibilities in the process of development. Certainly Amgen is the most successful of the world’s biotech companies. AMGN (59.87) is a buy up to 82.”

(more…)

Education Management Corp.

A Company to Consider Buying. Education Management Corporation (EDMC) provides private post-secondary education in North America. EDMC delivers education to students through traditional classroom settings as well as through online instruction. Its educational institutions offer a broad range of academic programs concentrated in the following areas: media arts, education, design, information technology, fashion, Law and legal studies, culinary arts, business, psychology and behavioral sciences, and health sciences. It offers academic programs through four educational systems: The Art Institutes; Argosy University; American Education Centers; and South University.

EDMC acquired AEC and South University during fiscal 2004. As of June 30, 2004, EDMC had 67 primary campus locations in 24 states and two Canadian provinces. Its program offerings culminate with the award of degrees ranging from associate’s to doctoral degrees. It also offer non-degreed programs, some of which result in the issuance of diplomas upon successful completion. Prior to fiscal 2004, The Art Institutes and Argosy University were managed as separate operating segments. During the first quarter of fiscal 2004 we shifted from an educational system approach to a centralized corporate structure utilizing divisions which have been aggregated into one operating segment. EDMC currently has three distinct operating divisions organized by geographic location within North America: the Eastern Division; Central Division; and Western Division.

Looking at the Stock Selection Guide

Quality. Look at Part 1 of the SSG. EDMC has had consistent growth in revenues and earnings over the past seven years. Value Line rates its earnings predictability 100 (out of 100) and its financial strength a “B+”. Section 2 of the SSG shows pretax profit on sales as 13.8% (5-year average) and trending up slightly. ROE is up over the last three years but slightly below the 5-yr average.

One caution is that EDMC has not done as well as its industry competitors over the past five years on return on equity (18.0 vs. 21.9) or net profit margin (8.3 vs. 12.7). Also, it would be better if Value Line financial strength were a B++ or higher. Overall, EDMC is a quality company.

Growth. Value Line projects EPS growth at 21.5 (based on revenue growth of 21.5. Reuters projects EPS growth of 20% (based on 7 analysts). Morningstar also projects 20% growth (based on 11 analysts).

Projected EPS in Five Years. The SSG uses EPS growth RATE of 19%. Resulting in a 5-yr EPS of $2.58. Here is the formula for 5-yr EPS using the trailing twelve months (TTM) EPS of $1.08 and projected growth rate of 19%: [2.58 * (1.19)^5]. Using the “preferred procedures on the SSG (assuming 19% revenue growth, 15% pretax profit margin (Value Line 17.6%), 40% tax rate and 78M shares outstanding, projected 5-yr EPS is 2.47.

Average High and Low PE. The SSG uses an average high PE of 28.5. This PE is 1.5 times the 19% projected growth rate (1.5 * 19 = 28.5). The current PE is 27.3. Relative value of 106.2 and projected relative value is 89.1. Since EDMC is fairly priced relative to its historic PE, gains form PE expansion are unlikely.

Projected 5-year Return (Annualized). Using the data from above, total return for EDMC is 20.1% and projected average return (PAR) is 15.7%. The upside-downside ratio is 4.4.

Sysco Corporation

Sysco Corporation, the food wholesaler–not the manufacturer of computer routers, is another solid buy candidate. SYY is a high quality growth company.

SYY made the Forbes’ 2004 list of the 26 best managed companies in America. Value Line gives SYY its highest ratings for both financial Strength (A++) and earnings persistence (100). SYY is a large company with annual sales of more then $8 billion.

The first call consensus EPS five-year growth rate is 15%. The SSG above uses a more conservative EPS growth rate of 11.9%. Using this lower rate, projected average return over five years is 11.3% and the total return (assuming sale at a high PE) is 14.5%. The upside downside ratio is 3.7.

This would be a particularly good stock for our portfolio since it is in an industry that we don’t hold.

(more…)

Medtronic, Inc.

Medtronic is one of two stocks to consider buying during the month of October. (The other is Health Management Associates.)

(more…)

Health Management Assoc.

Health Management Associates is one of two stocks to consider buying during the month of October. (The other is Medtronic.)

(more…)