Parking Your Safe Money

This is a response to a question by one of my young adult children. She was looking for a place to put some safe money (i.e., funds that she might need in the next 1-3 years) and wanted to obtain a better rate of interest than that offered by her bank.

Vanguard money market funds are a good place to park money that you may need in the next 1-3 years. At your tax bracket, I would not worry about finding a tax-free fund. Tax free money market funds don’t become advantageous until you reach the 28% tax bracket or higher. You can ask Vanguard for a check book for your money market account and redeem shares by check. However, the check has to be $250 or more.

Here are three suggestions. The fund are listed with the safest funds first. The spread between the Treasury-based fund and the prime rate fund is very small. It comes out to about a $25 per year difference on $10,000. So you might want to stay with safety (either Treasury or Federal). That way if the world goes nuts, your funds will be secure. (more…)

First Quarter 2007

For the quarter ending March 30, the Moose Pond portfolio increased in value by 2.9%. In comparison, the S&P 500 increased 0.18% for the same period. See the portfolio performance report for the quarter.

The top five advancers for the quarter were SYK (+20.8%), IFIN (+16.9%), GYI (+13.6%).,CAH (+13.4%), and JKHY (+12.7%). The laggards were AMGN (-18.2%), JNJ (-8.4%), INTC (-5.0%), CBH (-5.0), and BRO (-3.9).

Other than normal dividend reinvestment activity, we bought WAG and added to our position in JNJ. We bought more Vanguard total stock market index (an exchange traded fund) as a holding place for funds available to invest. We sold UTSI and IFIN. (IFIN was acquired by another company.)

Annual Report for 2006

In 2006 we had a total return of 6.1%. The value of a unit increased from $13.097 to $13.894. While our return was positive, it lagged behind most of the major market indices. For the first time, we are slightly behind the S&P 500 for a five year period (5.9% vs. 6.2%). Portfolio turnover was about 10%. You can find the annual report for Moose Pond Investors here.

More information about the performance of individual stocks in 2006 can be found in the diversification report and performance report.

Investing Podcasts

Learning about investing is a continuous process. There are several radio programs that are available in digital (MP3) format. These “podcasts” can be downloaded and played at your convenience through a computer or with an MP3 player. Here are several excellent programs.

The Wise Investor Show has been broadcast in the Washington, DC, area for 17 years. The program advocates a conservative, value-oriented approach to investing. The program is always informative and educational. The weekly program can be downloaded from the WMAL.com website. Currently, the program is only archived one week at a time, with the Sunday program becoming available on Monday. The program lasts about 2 hours.

Paul Douglas Boyer, who happens to live near here in Vienna, Virginia, has a blog and a podcast that discusses fun investment topics and reviews the Mad Money recommendations of guru Jim Cramer. His weekly podcast last about 30 minutes and is entertaining and well produced. The program advocates an asset allocation strategy. Both podcasts and model portfolios can be found on the Mad Money Machine.com website.

Jim Cramer is interesting, educational, and, at times, controversial. He has a daily radio program that lasts about 30 minutes. Podcasts for the radio program can be found on the TheStreet.com website. He advocates a trading approach with a small percentage of a portfolio. While his near term trading philosophy differs significantly from an NAIC-approach, he often offers interesting and insightful perspectives. His book Real Money: Sane Investing in an Insane World is well worth reading.

It is easy to become a fan of podcasts. You can find podcasts on many different subjects, not just investing. They allow time shifting. With an inexpensive MP3 player, you can listen to a podcast in the car, while walking, or while exercising. Apple offers a free program called iTunes. It includes a link to a podcast directory maintained by Apple. It can be configured to manage your podcasts by automatically downloading new programs and deleting old ones.

September Observations

In terms of investment return, we been treading water for most of 2006. The value of a unit in the funds is almost where it was when we started the year. We have an excellent portfolio. Although it is weight more heavily with larger growth stocks.

In general terms, stocks that have consistent increases in earnings and revenue, at a rate faster than the growth of the economy, are characterized as growth stocks. In contrast, stocks with a low price-to-book (P/B) ratio and low price-to earings (P/E) ratio are characterized as value stocks. Mutual funds are frequently characterized as either growth, value, or blend (a combination of growth and value). Mutual funds are further characterized as large, medium, or small capitalization. Market capitalization is simply the number of shares issues time the market price of share of stock.

All of this is a leading up to the observation that large capitalization stocks have not done as well as value stocks. Similarly, growth stocks have not done as well as value stocks, in the last 12 months or so. The Callen Periodic Table of Investing Returns shows how different sectors (large, medium, and small capitalization, and growth, value, and blend) have different returns from year to year.

So what do we do at this point? Stay the course. We have an excellent portfolio, even though it is weighted more heavily in larger growth stocks. As we buy more stocks, we should look for opportunities in smaller stocks, especially smaller growth stocks that are cheaply priced.

You can see how growth, value, and market capitalization interact, using this spreadsheet. The spreadsheet calculates return for a portfolio over the last 15 years based on the asset classes in the portfolio. The S&P 500 is a good surrogate for large capitalization stocks. Similarly, the Russell 2000 is a good proxy for small capitalization stocks.

To compare investment returns, enter a number, e.g., “100” in the blue column for the asset class you want to examine and “0” for all others. You can also look at the return of various combination of asset classes. You might find this spreadsheet helpful if you are trying to decide how to allocate long term savings.

After a great deal of research, I see considerable merit in having a substantial amount of core savings allocated among index funds that represent these asset classes. I am paying much closer attention to asset classes. (Moose pond Investors is really a large/medium cap, growth asset class.) Asset allocation might be the subject of a future posting if there is any interest. But for now, the returns of the various asset classes will help explain why the Moose Pond returns have not been stellar this year.

More Open-End Mutual Funds

The Wise Investor show (WMAL, Washington, DC) on 06 May 2006 with guest David Teitalbaum discussed mutual funds. Here are some of the more interesting funds. His website at www.moneybalance.com includes back editions of his free newsletters. The following links are for the mutual fund web sites and for the Morningstar analyst summary.

- Value Funds (all caps): Fairholme Fund –> FAIRX and Muhlenkamp Fund –> MUHLX

- Mid Cap Value Funds: Third Avenue Value Fund –> TAVFX and FAM Value Fund –> FAMVX

- Small Cap Value Funds Third Avenue Small Cap Value Fund –> TASCX. The program also discussed the Royce small cap funds but their best open-end fund is currently closed to new investors. The Royce closed-end funds discussed below are probably better alternatives.

- International Funds: Dodge & Cox International Fund –> DODFX and Harbor International Fund –> HAINX.

The program also mentioned www.fundalarm.com a free, non-commerical web site that helps to idenitfy when to sell a mutal fund.

Some Mutual Fund Ideas

Mutual funds can help provide asset class diversification. The following small and mid-cap funds and international funds look interesting. The embedded links are to the funds’ web sites and to the Morningstar summaries (which may require logon to M* to view).

Closed End Funds

- Source Capital –> SOR is a value oriented fund that has outperformed the Russell 2500, S&P 500, and the NASDAQ for the past 1, 3, 5, 10, and 15 years

- Royce & Associates, a manager of portfolios of small- and micro-cap companies, has three closed end funds with excellent track records: Royce Focus Trust (FUND), Royce Micro-Cap Trust (RMT), and Royce Value Trust (RVT)

Some Open-End Mutual Funds (that don’t suck)

- Neuberger Berman International Fund –> NBISK invests primarily in common stocks of foreign companies of all sizes in developed and emerging industrialized markets and has consistently outperformed the EAFE.

- Brandywine Blue –> BLUEX focuses on mid to large cap growth stocks and limits the portfolio to about 30 holdings

- Forward Hoover Small Cap Equity –> FFSCX has outperformed the Russell 2000 but it has a high expense ratio and has not performred as well as the Royce funds

- Third Avenue Value –> TAVFX is a mid-cap blend with a very good track record

For example, a diversified portfolio might include:

- 50% Large cap (35% Investment Club Units, 15% Source Capital)

- 30% Small- or mid-cap (15% Royce Value, 15% Royce Focus)

- 20% International (20% Neuberger Berman)

SSG Judgment Class

Electronic copies of materials from the class today on stock selection guide judgment skills are available here. The materials include completed stock selection guides and judgment worksheets for INTC, HD, JNJ, MSFT, PFE, and WMT. Since all of these companies are part of the Dow 30, data sheets are available for free at the Value Line website.

More information about educational classes conducted by the D.C Regional Chapter of BetterInvesting can be found on the chapter website.

NAIC Growth Fund

It is always helpful to compare portfolios. Here are summary dashboards for the NAIC Growth Fund and for the Moose Pond Investors portfolios. The NAIC Growth Fund is a closed end fund that was intended to demonstrate NAIC principles. You can click on either summary below for the complete dashboard.

In the past 6 months NAIC growth fund sold its position in Pepsi and Newell Rubbermaid. The fund added to its positions in Abbot Labs, Carlisle Companies, Jack Henry & Associates, Medtronic, Stryker, and Washington Mutual. The total return for the NAIC Growth Fund in 2005, based on change in net asset value, was 1.3% (slightly ahead of our return of 0.3).

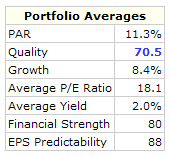

| NAIC Growth Fund |

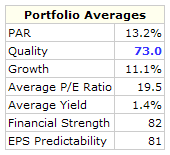

Moose Pond Investors |

|

|

While quality is about the same in both portfolios, the Moose Pond portfolio has higher PAR, higher projected growth, and a higher quality rating. We can probably improve the overall PAR by replacing several of our low PAR companies with higher PAR companies.

Purchased ITW and SYK

We took an initial position in Illinois Tool Works (ITW) yesterday at a price of $84.56. On January 23, we took an initial position in Stryker (SYK) at a price of $45.34.