Quality Growth Screen

NAIC publishes an annual survey of the 200 most widely held stocks by investment clubs. Screening that list for stocks for a projected 5-year average return of 12% or more and for an upside /downside ratio of 3 or more, yields 34 stocks. We already own 11 of these stocks. Here is the list of stocks passing the screen.

Amgen Inc.

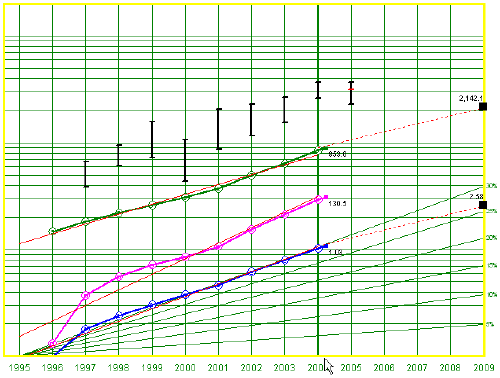

Stock Selection Guide Updated. The SSG for Amgen has been updated. 5-year EPS was projected using the “preferred procuredure” with the following assumptions: revenue growth of 15%, pretax margin 40.4%, tax rate of 26.5% and outstanding shares of 1,175 million. This results in a projected average return of 13.9% using an averate high PE of 29 and average low PE of 16.5. This puts Amgen in the “buy” range. Both IAS and First Call’s analysts consensus project growth at 20%, so the 15% projected growth used in the SSG is conservative.

Stock Selection Guide Updated. The SSG for Amgen has been updated. 5-year EPS was projected using the “preferred procuredure” with the following assumptions: revenue growth of 15%, pretax margin 40.4%, tax rate of 26.5% and outstanding shares of 1,175 million. This results in a projected average return of 13.9% using an averate high PE of 29 and average low PE of 16.5. This puts Amgen in the “buy” range. Both IAS and First Call’s analysts consensus project growth at 20%, so the 15% projected growth used in the SSG is conservative.

For the fifth time, Amgen has been named one of the “100 Best Companies to Work for in America” by Fortune magazine. Also, Amgen ranked fifth in The Scientist’s annual survey of the best workplaces for 2004. Details. Amgen also has an excellent website for investors.

From December 2004 Investor Advisory Service by IClub: IAS also has Amgen in the “buy” range. “Amgen reported continuing solid results for the third quarter of 2004 with total product sales up 23%. On an adjusted basis, excluding one-time factors relating to the company’s acquisition of Tularik, earnings per share growth was 39%. The company also increased guidance for expected earnings per share for the year from about $2.35-$2.40. The sales guidance was also improved to about $10.4 billion for the year. While the company is dependant on a limited number of products, these have continued to grow and sell well. There are also a number of interesting new possibilities in the process of development. Certainly Amgen is the most successful of the world’s biotech companies. AMGN (59.87) is a buy up to 82.”

(more…)

Portfolio “Rack and Stack”

To borrow a military expression, I thought it might be helpful to “rack and stack” our portfolio. We should do this at least quarterly, if not more frequently. It is fairly easy to do with the computer. The attached spreadsheet contains key portfolio management metrics.

To borrow a military expression, I thought it might be helpful to “rack and stack” our portfolio. We should do this at least quarterly, if not more frequently. It is fairly easy to do with the computer. The attached spreadsheet contains key portfolio management metrics.

Out of our 22 stocks, 14 are still in the “buy” range. We have selected good stocks because a number of these stocks have appreciated in price but are still considered “buys”. Our all time winners are LOW (+205%) and JCI (+143%). The other 7 stocks are slightly out of the buy range but are definite “holds.”

In managing a portfolio, we try to identify stocks that no longer meet our objectives (including future earnings prospects) or have declined in quality. We should replace those stocks. There are other factors to consider as the NAIC web article on when to sell points out, but these two are the primary factors.

We should compare stocks in the portfolio to see whether it is possible to replace a low quality stock with a higher quality stock and/or replace a stock with a relatively low projected return with a stock with a higher projected return. Our current portfolio looks fairly good in terms of quality and projected return. I don’t see any immediate candidates for replacement but we need to continue watch closely and reevaluate each quarter.

We can compare relative value and upside downside ratios to see if any stocks in the portfolio have become overvalued. We don’t appear to have any in the overvalued category now.

We also need to look at sector and industry diversification. (Sectors are made up of related industries.) We are diversified across four sectors. We also are diversified by industry within each of these four sectors. Our size diversification breaks down as follows: 42% in large companies, 45% in medium companies and 5% in small companies. (This doesn’t add up to 100% because we also have a small position in a NASDAQ 100 index fund.) We probably ought to be looking harder for small companies.

A final “rack and stack” consideration is how much each stock represents of the total portfolio value. In our portfolio the average stock is valued at a little more than 4% of the total value of the portfolio. This type of diversification protects our overall portfolio return by limiting the damage any one stock can do to the overall portfolio return. A stock that drops in value by 50% will only reduce total portfolio return by about 2%.

Hope these comments are helpful.

Education Management Corp.

A Company to Consider Buying. Education Management Corporation (EDMC) provides private post-secondary education in North America. EDMC delivers education to students through traditional classroom settings as well as through online instruction. Its educational institutions offer a broad range of academic programs concentrated in the following areas: media arts, education, design, information technology, fashion, Law and legal studies, culinary arts, business, psychology and behavioral sciences, and health sciences. It offers academic programs through four educational systems: The Art Institutes; Argosy University; American Education Centers; and South University.

EDMC acquired AEC and South University during fiscal 2004. As of June 30, 2004, EDMC had 67 primary campus locations in 24 states and two Canadian provinces. Its program offerings culminate with the award of degrees ranging from associate’s to doctoral degrees. It also offer non-degreed programs, some of which result in the issuance of diplomas upon successful completion. Prior to fiscal 2004, The Art Institutes and Argosy University were managed as separate operating segments. During the first quarter of fiscal 2004 we shifted from an educational system approach to a centralized corporate structure utilizing divisions which have been aggregated into one operating segment. EDMC currently has three distinct operating divisions organized by geographic location within North America: the Eastern Division; Central Division; and Western Division.

Looking at the Stock Selection Guide

Quality. Look at Part 1 of the SSG. EDMC has had consistent growth in revenues and earnings over the past seven years. Value Line rates its earnings predictability 100 (out of 100) and its financial strength a “B+”. Section 2 of the SSG shows pretax profit on sales as 13.8% (5-year average) and trending up slightly. ROE is up over the last three years but slightly below the 5-yr average.

One caution is that EDMC has not done as well as its industry competitors over the past five years on return on equity (18.0 vs. 21.9) or net profit margin (8.3 vs. 12.7). Also, it would be better if Value Line financial strength were a B++ or higher. Overall, EDMC is a quality company.

Growth. Value Line projects EPS growth at 21.5 (based on revenue growth of 21.5. Reuters projects EPS growth of 20% (based on 7 analysts). Morningstar also projects 20% growth (based on 11 analysts).

Projected EPS in Five Years. The SSG uses EPS growth RATE of 19%. Resulting in a 5-yr EPS of $2.58. Here is the formula for 5-yr EPS using the trailing twelve months (TTM) EPS of $1.08 and projected growth rate of 19%: [2.58 * (1.19)^5]. Using the “preferred procedures on the SSG (assuming 19% revenue growth, 15% pretax profit margin (Value Line 17.6%), 40% tax rate and 78M shares outstanding, projected 5-yr EPS is 2.47.

Average High and Low PE. The SSG uses an average high PE of 28.5. This PE is 1.5 times the 19% projected growth rate (1.5 * 19 = 28.5). The current PE is 27.3. Relative value of 106.2 and projected relative value is 89.1. Since EDMC is fairly priced relative to its historic PE, gains form PE expansion are unlikely.

Projected 5-year Return (Annualized). Using the data from above, total return for EDMC is 20.1% and projected average return (PAR) is 15.7%. The upside-downside ratio is 4.4.

Bank of America

Bank of America (BAC) is the stock to study in the November 2004 edition of Better Investing magazine. Here is the presentation (470 kb) on BAC given to the NAIC DC Chapter on November 9, 2004. Related files include a SSG and PERT (480 kb) and a presentation (480 kb) presented by Bank of America investor relations personnel at the NAIC Better Investing National Conference this week.

Evaluating Management

“Objective tests of managerial ability are few and rather unscientific. … The most convincing proof of capable management lies in a superior comparative record over a period of time….” – Graham and Dodd, Security Analysis

The attached file (933 kb) contains a presentation on Evaluating Company Managment given to the NAIC DC Chapter on October 30, 2004.

Section 2 of the NAIC stock selection guide (SSG) helps to evaluate how management is performing. It shows the key measures of management quality, pre-tax profits margins and return on equity for the past ten years. It also shows the trends for each of these (up, down or constant). The data in Section 2, when compared to the industry peers for a company, provides a good indicator if management effectiveness.

Pretax Profit Margin. Pre-tax profit margin represents how much of each sales dollar a company keeps before taxes. The SSG focuses on pre-tax profit margin rather than net profit margin because tax rates change from time to time. It is easier to compare pre-tax profit margins over a long period of time.

Look for consistency in pretax earnings, e.g., a consistent (flat) or upward trend that is above average for the industry. Be skeptical of above pre-tax profit margins that make a big jump. Consistent pre-tax profit margins might mean that a company has reached peak efficiency or it might mean that management has stopped improving efficiency. Do some additional research. See how the company’s pretax profit margins compare to its competitors.

Pre-tax profit margins can provide an early warning indicator of trouble. A decline in pre-tax profit margins often shows up in the income statement before earnings growth starts to decline. Both NAIC Investor Toolkit and Stock Analyst contain graphs that plot quarterly pre-tax profit margins and trailing twelve month pre-tax profit margins.

Return on Equity (ROE). ROE is a measure of how well a company has used reinvested earnings to generate additional earnings. ROE is a key financial factor in defining the growth potential of the company from internal sources.

ROE can be used to calculate the the “implied” or “sustainable growth rate” of a company. This is the potential earnings growth rate a company can maintain without borrowing. The calculation is simple, Return on Equity x Earnings Retention Rate. It usually better to a an average ROE (such as the 5-year average). The Earnings Retention Rate is how much the retains after taxes (1 – tax rate).

Barrons — Drug Industry

In an article this week, Barrons notes that the big drug stocks trade today for just 12 to 14 times projected 2004 profits. The last time the drug stocks saw valuations like these was in 1993-94 when Wall Street feared President Clinton’s health-care proposals would lead to industry price controls.

Pfizer and Merck are two of the stocks mentioned in the article. The consensus earnings projection for PFE over the next 12 months is $2.33. Using Friday’s closing price of $28.50, the forward PE is (28.50/2.33) or 12.2. PFE’s historical 10-year average PE is 32.6.

The consensus earnings projection for MRK over the next 12 months is $2.77. Using Friday’s closing price of $30.50, the forward PE is (30.50/2.77) or 11.0. MRK’s historical 10-year average PE is 22.6.

Return on Equity Screen

There seems to be a correlation between stocks that have a good return on equity (ROE) year after year and quality growth stocks.

Here is a screen using AAII SI Pro with the following parameters:

– ROE for each of the last seven years > 15%

– Current PE < 5-year average PE

- (PE / EPS growth) < 1.5

- 5-year (diluted) EPS growth > 10%

– Projected long term EPS growth > 10%

– positive EPS growth for each of last 4 quarters

Using data from October 8, the screen yielded 22 stocks.

17 of the 22 stocks have an U/D ratio > 3.0, total return > 15%, and a relative value < 110. In an equally weighted portfolio, all of these stocks together would have a total return of 20.1%, a PAR of 15.1%, an U/D ratio of 4.7, and a relative value of 89.1. The attached PDF file contains a PERT chart (sorted by total return) and a trend report (sorted by PAR) with the stocks passing the screen. The PERT chart uses First Call data for projected EPS and 5-year growth.

NAIC

The National Association of Investors Corporation (NAIC) teaches individuals how to become successful strategic long-term investors. NAIC investors use fundamental analysis to study common stocks and mutual funds. Information about NAIC and its investor resources can be found at http://www.better-investing.org. Volunters throughout the United States work with local chapters to teach individuals and clubs how to invest.

Unfortunately, NAIC has found itself at the center of a controversy and the subject of an investigation by the Finance Committee of the U.S. Senate. The core allegation is that the officers have abused the tax exempt of NAIC to enrich themselves at the expense of the members and the volunteers of the organization. A CNBC investigative report frames the issues. It remains to be seen whether the organization will remain viable as the controversy unfolds.

Brown and Brown

From the August IAS: Brown & Brown’s second quarter results indicate continued execution of its growth strategy. Total earnings and revenue each increased 15%, including 5% internal revenue growth with the balance coming from acquisitions. EPS expanded 12%. The company also raised $200 million in the debt market at fixed coupon rates of 5.7-6%, which management refers to as “dry powder†for future acquisitions. Going forward, the company is expecting lower internal growth, as the improving economy will fail to compensate for nationwide price declines in the commercial property insurance industry. With internal growth slowing, Brown’s success becomes more dependent on its proven ability to acquire and integrate good companies. BRO (44.75) is a buy up to 39.

(more…)