General Electric (GE)

We purchased an initial position in General Electric (GE). It took a huge drop on April 11 when it missed its earnings. Historically, GE never missed earnings. With the drop in price, the dividend alone yields 3.87% based on the April 11 closing price. See attached a stock selection guide. This looks like an excellent buying opportunity. Remember, nothing has changed in GE’s underlying business model between April 11 and 12, despite the 14.8% stock price drop on April 12.

Wells Fargo & Company (WFC)

SSG and PERT | Google Finance | Company Website

We purchased an initial position in Wells Fargo & Company on June 13, 2007. This replaces Commerce Bancorp. Here is the stock selection guide we used for the purchase decision.

We purchased an initial position in Wells Fargo & Company on June 13, 2007. This replaces Commerce Bancorp. Here is the stock selection guide we used for the purchase decision.

Microsoft (MSFT)

SSG and PERT | Google Finance | Company Website

We purchased an initial position in Microsoft on June 13, 2007. Here is the stock selection guide we used for the purchase decision.

We purchased an initial position in Microsoft on June 13, 2007. Here is the stock selection guide we used for the purchase decision.

Walgreen Company (WAG)

SSG and PERT | Google Stocks | Company Website

We purchased an initial position in Walgreens on November 22. Here is the stock selection guide we used for the purchase decision.

We purchased an initial position in Walgreens on November 22. Here is the stock selection guide we used for the purchase decision.

Intel Corp. (INTC)

SSG and PERT A | Google “stocks: INTC” | Company Website

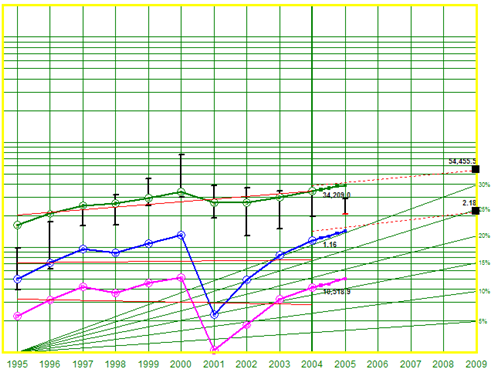

Here is a revised stock selection guide for Intel Corp. Assuming 7.0% revenue growth and 8.8% earnings growth, the projected average return is 17.0%. Intel quality is high with a RQR rating of 71.6. Value Line rates its financial strength A++ but earnings predicatbility is only 50. As the two charts below show, Intel has contined to grow its earnings over the past four years while the market price has remained relatively constant for the last 18 months.

Here is a revised stock selection guide for Intel Corp. Assuming 7.0% revenue growth and 8.8% earnings growth, the projected average return is 17.0%. Intel quality is high with a RQR rating of 71.6. Value Line rates its financial strength A++ but earnings predicatbility is only 50. As the two charts below show, Intel has contined to grow its earnings over the past four years while the market price has remained relatively constant for the last 18 months.

Lower than expected Q4 and year end earnings, and concerns about INTC losing market share to AMD have caused the share price to drop 17.4% YTD. Concern over AMD may be an overreaction (see story). Intel will be supplying CPU andrealtred chipsfor Apple’s new computers.

Intel remains a strong HOLD.

Wal-Mart Stores (WMT)

SSG and PERT A (17 Dec 2005) | Google “stocks: wmt” | Company Website

Wal-Mart Stores, Inc. (WMT) operates retail stores in various formats in the United States and internationally. It has two segments: The Wal-Mart Stores and The SAM’S CLUB. The Wal-Mart Stores segment includes Discount Stores, Supercenters, and Neighborhood Markets in the United States, as well as Walmart.com. As of July 31, 2005, Wal-Mart operated 1,276 Wal-Mart stores, 1,838 Supercenter, 92 Neighborhood Markets, and 556 SAM’s Clubs in 50 states in the United States. The company operates various retail formats in Argentina, Brazil, Canada, Germany, Mexico, Puerto Rico, South Korea, and the United Kingdom.

Growth. Value Line projects 3-5 year revenue growth of 12.5% and EPS growth of 13.5%. Reuters reports an analysts consensus EPS growth of 13.7% (based on 16 analysts). M* projects future growth to decline from 13% to 10%. The attached stock selection guide (SSG) assumes revenue growth of 11% and EPS growth of 11.4%. This resulting in a 5-yr EPS of $4.40.

Quality. Wal-Mart is a high quality company. Part 1 of the SSG shows very consistent revenue and earnings growth. From Part 2 of the SSG we see that Wal-Mart has averaged a 20% return on equity over the last five years. Part 2 of the SSG and the PERT chart, and PERT graph (see attached SSG), show consistent pretax margins slightly over 5%. M* gives Wal-Mart a stewardship grade of A. Value Line rates Wal-Mart financial strength A++ and earnings predictability of 100. That is as good as it gets. The Robertson quality rating is 82.3.

Valuation. Wal-Mart has a projected average return (PAR) of 14.3% and total return of 18.2%. See SSG. (Manifest Investing projects PAR as 14.35%.) U/D ratio for Wal-Mart is 10 to 1 and the buy price using 25%-50%-25% zoning is $60.30. (Current price is $49.27.) M* rates Wal-Mart undervalued with five stars.

Jack Henry & Assoc. (JKHY)

SSG and PERT A (11-18-2005) | Google “stocks: jkhy” | Company Website

Jack Henry & Associates (JKHY) is a stock that frequently shows up in screens for quality growth stocks. Using NAIC criteria, JKHY is a buy up to $22.90 (current price is $19.10). Projected average return over the next 5 years is 15.2%. The SSG assumes a 13.5% revenue growth based on Value Line projections.

Jack Henry & Associates (JKHY) is a stock that frequently shows up in screens for quality growth stocks. Using NAIC criteria, JKHY is a buy up to $22.90 (current price is $19.10). Projected average return over the next 5 years is 15.2%. The SSG assumes a 13.5% revenue growth based on Value Line projections.

Jack Henry & Associates provides integrated computer systems and processes ATM and debit card transactions for banks and credit unions. It describes itself as:

A technology provider for the financial industry. That’s the simplest way to describe what we do. But it hardly describes what Jack Henry & Associates is really about. We’re about solutions and support. We’re about building relationships and making things work. We’re about doing the right things for our customers, no matter what. It began as a vision, and it’s become our tradition.

A substantial amount of JKHY’s revenue, about 60%, comes from recurring sales. The company has a strong customer focus. 92% of its customers renw. Its several corporate aircraft are used to transport customer support teams — not company executives. Great concept!

Value Line rates JHKY’s financial strength “B++” and earnings predictability as 80 (out of 100). Its RQR quality rating is 63 — a little lower than the Moose Pond Investors portfolio average. Given the projected average return above 15% and the that fact that JKHY is a medium size company, the slightly lower quality rating is acceptable. Morningstar gives JKHY a rating of five stars and a wide economic moat. It estimates fair value at $23 assuming a growth in revenue of 12%.

Johnson & Johnson (JNJ)

Current SSG and PERT A (11-29-2004) | Google: “Stocks: JNJ” | Company Website

Stock Selection Guide Updated. The SSG for Johnson & Johnson has been revised. JNJ remains a high quality company and is within the “buy” range.

Stock Selection Guide Updated. The SSG for Johnson & Johnson has been revised. JNJ remains a high quality company and is within the “buy” range.

(more…)