Updated Portfolio Summary

The portfolio summary has been updated. You can now click on each ticker symbol to see the stock selection guide (SSG), PERT table and PERT graph for that company. By clicking on the title of the portfolio summary, you can download the Excel spreadsheet used to create the portfolio summary. With the Excel spreadsheet, you can sort the portfolio summary by each of the columns.

The portfolio summary has been updated. You can now click on each ticker symbol to see the stock selection guide (SSG), PERT table and PERT graph for that company. By clicking on the title of the portfolio summary, you can download the Excel spreadsheet used to create the portfolio summary. With the Excel spreadsheet, you can sort the portfolio summary by each of the columns.

Pfizer Inc. (PFE)

SSG and PERT A (07-21-2005) | Google “Stocks: PFE” | Company Website

The stock selection guide for Pfizer has been updated to reflect Q2 earnings. Using a 5-yr projected revenue growth of 6.5% and consevative PEs (high PE of 22 and low PE of 12.5), the projected average return ofor the next five years is 18.1%. PFE remains a high quality stocks and is a buy up to $32.70.

The stock selection guide for Pfizer has been updated to reflect Q2 earnings. Using a 5-yr projected revenue growth of 6.5% and consevative PEs (high PE of 22 and low PE of 12.5), the projected average return ofor the next five years is 18.1%. PFE remains a high quality stocks and is a buy up to $32.70.

(more…)

Replace Any Stocks?

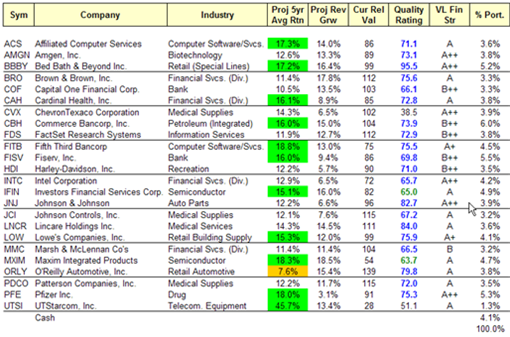

The portfolio summary on July 15 shows an overall projected average return of 14.8% and a quality rating is 71.9 (out of 100). This is excellent (in spite of the less than stellar YTD performance of the portfolio).

(Note the snapshot has changed since this entry. See current snapshot.)

In deciding what we might replace in our portfolio, we need to took at two things: projected average return (PAR) and the quality of each company. PAR is an estimate of the return we can expect if we hold the company for five years (assuming sales and earnings grow as predicted). Although the computer is very precise in its calculations, PAR is still an estimate — an intelligent guess. One or two percentage points difference in PAR between companies is relevant but we should not put too much weight on small differences.

In looking over the portfolio snapshot, we only have one stock with a PAR of less than 10% — ORLY. There is one important mathematical nuance when we calculate PAR. When a company lowers its long term earnings or revenue guidance (like IFIN and HDI), it is usually reflected in the price right away. The PAR calculation shows rate of growth from the present price to the estimated price in five years. This the lower present price causes PAR to increase. (For example, IFIN currently has PAR of 15.1% using 10% growth in EPS and revenue. The 15.1% PAR reflects that fact that price dropped 17% last week. It may also reflect some efficiency on the part of the market)

We also should give considerable weight to a company’s quality. “Quality” means a strong management team, consistent long term earnings and revenue growth, high return on shareholders’ equity (15-20% for at least 5 years), free cash flow, and what Warren Buffet would call a wide moat. We should be slow to sell a high quality stock. (The one exception to this is if the PAR falls below the risk free rate of return, e.g., the 5-year treasury rate or if there has been a negative change in a company’s fundamentals.) A quality company is more likely than a poor quality company to work through problems that might adversely impact future earnings. HDI is an example of high quality company with a strong management team.

As the PAR for a company drops falls below 10%, we need to take a close look at whether we want to continue to hold the company or replace it. I tend to hold high quality companies. However, if the PAR falls below the risk free rate of return or if there has been an adverse change in a company’s fundamentals the decision to sell is much easier.

We have more cash to invest. We can add to our existing holdings (ACS, BBBY, CAH, LOW and PFE all look good) or find a new company. Three watchlist companies that look interesting are Jack Henry (JKHY), Wal-Mart Stores (WMT) and Thomas Nelson, Inc. (TNM). As time permits this week, I’ll post SSGs and summaries for these three companies.

Investors Fin. Services (IFIN)

SSG and PERT A (07-14-2005) | Google Stocks | Company Website

At the Q2 press conference on July 14, Investors Financial Services Corp. (IFIN) revised is earnings guidance downward for 2005 (10%), 2006 (8-10%), and 2007 and beyond (12-14%). See Q2 press release.

At the Q2 press conference on July 14, Investors Financial Services Corp. (IFIN) revised is earnings guidance downward for 2005 (10%), 2006 (8-10%), and 2007 and beyond (12-14%). See Q2 press release.

We previously had used 16% in our projections for June. The reduced earnings guidance is due in part to reduced interest income. A revised SSG, using 12% expected EPS growth, shows a projected average return PAR of 14.2% and a buy up to $48. However, given the company’s lowered guidance, the may be a stock to consider replacing.

Note: IFIN’s price dropped 17% on July 15 on announcment of the lowered guidance. The SSG was revised after the announcement using a projected EPS growth of 10% and the lowered price. The new projected average return is 15.51%. See revised SSG (07-15-2005). This certainly suggests some efficiency in the market.

The June Investor Advisory Service by IClub had reported IFIN a buy as well:

Investors Financial Services had a surprisingly slow quarter. First quarter revenue grew 8% with core services revenue growth of 16% being partially offset by an 11% drop in ancillary services revenue. EPS rose 11%, but a securities gain in 2005 and a one-time prepayment penalty in 2004 accounted for all of the apparent growth. The company obtained almost 30% of its revenue from net interest income. An analysis of its balance sheet shows that customers are withdrawing low-cost demand and savings deposits while Investors Financial adds to more expensive funding sources like time deposits and borrowed money. The concern is that it must exercise great care to avoid getting pinched by rising interest rates. IFIN (42.74) is a buy up to 65.

(more…)

Mid-Year Portfolio Review

Portfolio review is a constant activity and one that merits more time than the selection of individual stocks. Let’s look at the Moose Pond portfolio at mid-year. (Also, see Mid-Year Performance Report below.)

Diversification. The portfolio includes 24 companies in 5 sectors: consumer discretionary (20.3%), Energy (3.9%), financial (26.1%), healthcare (24.4%), information technology (23.8%). Within these 5 sectors are 16 different industries. Except for UTSI which has declined in value to 1.3% of the portfolio, the individual stock holdings range in value from 3-6%. We are 96% invested.

As to company size (based on revenue), the portfolio includes large companies (58%), medium companies (38%) and small companies (4%). Conventional wisdom would suggest larger holdings in small companies. However, large companies, especially quality companies, currently seem to offer better value. Just look at the number of large quality companies that Morningstar recently has rated as five-star.

Several recent articles have suggested that the near future looks brighter for growth stocks. See the article “Quality Socks Are Now on Sale” by Pat Dorsey of Morningstar (password required). Also, see articles by Jim Jubak and Timothy Middleton of MSN.

Offense and Defense Reports. The offense report generated by Toolkit 5 shows whether the projected return of stocks we hold meet our targets. This report is simply a sort by projected total return. If projected total return is less than the target return, Toolkit highlights the entry in pink. While the current report highlights five stocks, only one of those stocks shows a significant variance. (ORLY has a projected total return of 11.3% against a target return of 15%.) ORLY’s EPS growth has slowed and it currently has a projected average return of 6.9%. We will have to examine ORLY further.

Looking at the defense report (sorted by EPS growth), also generated by Toolkit 5, we see that the portfolio contains a number of stocks for which the earnings have failed to grow in the near term (last 12 months). These include MMC, PFE, LNCR, UTSI, CAH, FITB, PDCO, COF and IFIN. We have looked at each of these stocks individually and consider their long term prospects to be very positive. That’s why we bought them. However, the current problems faced by these companies have driven their price down. This also explains why the Moose Pond portfolio has not kept up with the major indices like the S&P 500 or the Russell 2000 for the first six months of this year.

Changes in Fundamentals. Several stocks in the portfolio need further study. Projected revenue growth has slowed for HDI to 5.7%. This slow down is reflected in the current price. However, the question is whether we should replace HDI with another quality stock with better long term growth prospects. ORLY also appears somewhat over-valued now with a projected average return of 6.9% although it remains a high quality stock with good growth prospects. Finally, JCI’s projected revenue growth has slowed to 7.6%. JCI remains a good quality stock but its projected average return is only 10.5%. It may be better to continue to hold these three stocks but they warrant a close look.

Summary. We need to take look further at ORLY, HDI and JCI and decide if any of those stocks should be replaced. Also, note that we have taken something of contrarian position on MMC, PFE, LNCR, UTSI, CAH, FITB, PDCO, COF and IFIN. We are holding them in spite of near term issues with earnings. If our long term assessments for even a majority of these stocks are correct, the Moose Pond portfolio should substantially out perform the indices in the next year or so. The key is patience and keeping the long term view in focus.

Mid-Year Performance Report

At the end of June 2005, the Moose Pond Investors portfolio had declined in value for the first six months of the year by 5.1%. In comparison, the S&P 500 was down 1.7% and the Russell 2000 was down 1.25%. The unit price for the portfolio is exactly where it was at the end of November 2004.

Although the portfolio underperformed the major indices, the portfolio remains well positioned with the following weighted averages: projected average return of 15.3%, relative value of 94, (RQR) quality of 71.7 and projected revenue growth of 11.8%. See portfolio snapshot. The portfolio is diversified across five industries: consumer discretionary (20.3%), Energy (3.9%), financial (26.1%), healthcare (24.4%), information technology (23.8%). The portfolio is further diversified among industries in these sectors. See diversification report.

You may be asking the question, if we had such a good portfolio, why did it under perform the market averages for the first half of this year? Great question. The best way to answer that question is to look at the stocks that significantly over or under performed. In the first 6-months of this year, several of stocks in the portfolio declined significantly: UTSI (-66.0%), FNMA (-44.4%), IFIN (-23.2%), HDI (-16.7%), MMC (-14.8%) and ACS (-14.2%). Unfortunately, only one stock strong positive gains during this 6-month period : ORLY (32.4%).

Looking at the past 12-months, we see that several of these same stocks have lagged the market: FNM (-29.3%), HDI (-18.3%) and IFIN (-10.4%). However, we also held a number of stocks that did well during this 12-month period: ORLY (32.0%), LNCR (24.5%), JNJ (18.6%), PDCO (17.9%), COF (17.2%) and CBH (16.0%). The portfolio had a positive return of 1.5% for this 12-month period but still lagged the major indices.

The “rule of five” embodies the conventional wisdom that if you hold five stocks, one stock will perform better than expected, one will perform worse than expected, and the other three will perform about as expected. In our portfolio, we had several more stocks performing worse than those performing better than expected. This should be a passing anomaly. (The “rule of five” is an observation — not an immutable law of nature.)

We need to be careful not to over react and make rash decisions based on poor price performance for one or two quarters. Instead, we should stay focused on company fundamentals (revenue growth, pretax profit margins, return on equity, etc.) across the entire portfolio. The overall portfolio looks strong in terms of both quality (71.7) and projected average return (15.3%).

Let’s take a quick look at the laggards in the portfolio.

UTSI. This was our most speculative stock. (And yes, UTSI aptly demonstrates the price volatility of speculative stocks.) UTSI has had a very poor quarter based on loss of revenues in China. This bad quarter was followed by lowered earnings guidance for 2005. As a result the price tanked. While the near term earnings projection does not look good, Value Line projects the 3-5 year revenue growth at 15.5% and the net profit margin in at 6.9%. Using the preferred procedure (pre-tax margin of 9.2%, tax rate of 25% and 130m shares outstanding) the 5-year EPS would be $3.25. Assuming a 5-year high PE of 22.5 and a low PE of 12, projected average return of 48%. Value Line (July 1, 2005) still rates UTSI’s financial strength an “A” and it has an RQR quality score of 51.1. Although UTSI has declined in value to 1.3% of the portfolio, holding it is probably the right answer unless its fundamentals deteriorate further. See stock selection guide and price chart for UTSI.

FNM. We sold FNM on March 24, 2005 and do not plan to repurchase it.

IFIN. A soft quarter was responsible for much, if not all, of the recent price decline. See recent discussion of IFIN. It has a projected average return of 21.5% and quality rating of 65. The near time price weakness appears temporary. We purchased some additional shares on June 14. Price chart.

MMC has been impacted by the investigation into industry pricing practices but seems to be recovering. Similarly, ACS has seen a near term decline in stock price due in part to a near term softness in revenues. Both companies seem poised to do well. MMC has a projected average return of 11.8% and quality rating of 65 while ACS has a projected average return of 17.5% and quality rating of 71.

In summary, a handful of stocks reduced the performance of the portfolio for the first half of this year. However, these stocks (except FNM) should remain in the portfolio for now. We are going to watch UTSI and the other stocks closely.