Performance for 2004

The following table shows the performance of Moose Pond Investors through December 31, 2004. Total return is the return from the start of the portfolio on October 4, 2000. All returns are shown on an annualized basis.

|

Stocks

Only |

Stocks

& Cash |

VG 500

Fund |

S&P 500

|

Russell 2000

|

Unit

Value |

|

| 2004 |

16.1%

|

13.8%

|

10.3%

|

10.88%

|

17.0%

|

$13.256

|

| 2003 |

35.1%

|

23.1%

|

30.7%

|

28.7%

|

47.3%

|

$11.802

|

| 2002 |

-23.4%

|

-19.1%

|

-21.5%

|

-22.1%

|

-20.5%

|

$9.707

|

| 2001 |

37.9%

|

13.8%

|

-10.3%

|

-11.9%

|

2.5%

|

$11.970

|

| Total |

14.6%

|

10.3%

|

7.8%

|

Since uninvested cash reduces overall return, the table shows both overall performance of the portfolio and, separately, performance of the stocks in the portfolio. Portfolio Record Keeper and bivio.com were used to make these calculations. The table also shows the IRR that would have resulted from making identical investments in Vanguard’s S&P 500 index fund.

Winners and Losers

Our winners for the year have been: FDS (+46.7%), LNCR (+41.2%), COF (+37.0%), PDCO (+36.4%), and CBH (+28.5%). Our losers for same period have been: PFE (-24.8%), PAYX (-10.9%), INTC (-15.3%), UTSI (-5.5%), and FNM (-3.9%).

UTStarcom, Inc. (UTSI)

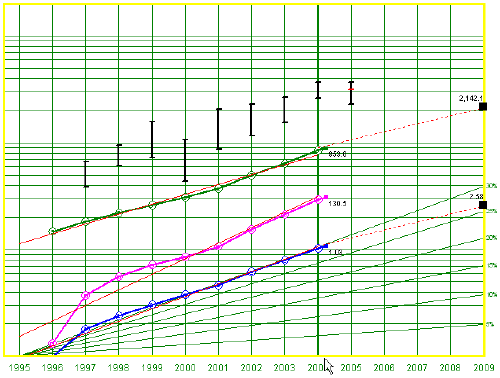

SSG and PERT A (12-19-2004) | Google Stocks | Company Website

Stock Selection Guide Updated. The SSG for UTStarcom has been revised. UTSI is a higher risk company than others in our portfolio but has the potential for significant return if it resumes even part of its historical growth rates. A recent webcast presented at the Lehman Brothers T4 conference on December 10 provides a good current overview.

Stock Selection Guide Updated. The SSG for UTStarcom has been revised. UTSI is a higher risk company than others in our portfolio but has the potential for significant return if it resumes even part of its historical growth rates. A recent webcast presented at the Lehman Brothers T4 conference on December 10 provides a good current overview.

(more…)

Report for November 2004

Annualized Return (IRR): 7.6% YTD and 9.0% since Oct. 5, 2000

Summary Report | PERT | Trend Report | Offense Report | Defense Report

At the end of November, the Moose Pond Investors’ portfolio had the following weighted averages: projected total return of 21.4%, projected average return of 14.7%, upside / downside ratio of 4.1 to 1 and a relative value of 91.8. These are all very good averages. The portfolio has 7.6% of its assets in cash.

Capital One Financial

Stock Selection Guide Updated. The SSG for Capital One Financial has been revised. Capital One Financial remains a quality company. The stock has moved just out of the “buy” range into the “hold” range.

There is a replay of an informative presentation by the Capital One Financial CEO at the Merrill Lynch Banking & Financial Services Conference on November 15 available at the company website. If you listen to the presentation, be sure to view the presentation slides. The presentation explains the strategic direction of Capital One Financial.

(more…)

Affiliated Computer Svc

Affiliated Computer Services (ACS)

SSG and PERT A (11-24-2004) | Google “Stocks: ACS” | Company Website

The Affiliated Computer Services stock selection guide has been updated. Here are the highlights.

Quality. Section 1 of the SSG (the graph on page one), shows consistent growth. For ACS, the correlation coefficient (r^2) is 1.0 for earnings and .95 for sales. This is quite good. Looking at Section 2 of the SSG, the pre-tax profit margin is trending up and return on equity is even. These are both indicators of consistency and excellent management. Overall, ACS is a high quality company.

Quality. Section 1 of the SSG (the graph on page one), shows consistent growth. For ACS, the correlation coefficient (r^2) is 1.0 for earnings and .95 for sales. This is quite good. Looking at Section 2 of the SSG, the pre-tax profit margin is trending up and return on equity is even. These are both indicators of consistency and excellent management. Overall, ACS is a high quality company.

Growth. Historically, ACS has had very strong growth. It is a little tricky to estimate future ACS growth since recent financial statement reflect the divestiture of most of ACS’ government business and the acquisition of some new businesses. The management discussion in the current 10Q discusses internal revenue growth (measured as total revenue growth less acquired revenue from acquisitions and revenues from divested operations). After excluding the impact of the revenues related to the 2004 divestitures, revenues in the current quarter increased 22%. Internal revenue growth accounted for 11% of the 22%. The above SSG uses a revenue growth of 15.8% based on Value Line.

Valuation. Using the “preferred proceed” in the SSG, the projected 5-yr EPS is $5.88. (See SSG for pre-tax margin, tax rate and shares outstanding.)

The projected average return over five years is 14.5%. Here is how it is calculated:

- Projected 5-yr Price = Projected P/E * Projected EPS Projected 5-yr Price = 19.9 * 5.88 = $117.02Projected Avg Return = [(Future Price / Current Price)^(1/5) + Avg Div Yld – 1] * 100

Projected Avg Return = [(117.01 / 59.53) ^ (1/5) – 1] * 100 = 14.5%

Note: The Toolkit software does this automatically. Reviewing the calculations makes it easier to understand the results.

Summary. ACS (currently $59.53) is in the “buy” range. The upside-downside ratio is 3.9 to 1. The relative value is 100.

(more…)

Marsh & McLennan Cos.

Initial Position in Marsh & McLennan. On November 10, Moosepond Investors bought took an initial position in MMC. The stock selection guide assumes a 9% earnings growth rate and an average high PE of 18. MMC has been in the news recently. The current investigation by the New York State Attorney General into commission practices by the insurance industry and an allegation of bid rigging has caused the MMC’s stock price to drop from $46 per share to its current levels in the high $20s. This presents an excellent buying opportunity, but not one without risk. The October 26 press releases and webcasts on the MMC website give some assurance that management is aggressively working to resolve the issues raised by current investigation. By all traditional measures, MMC remains a high quality company. It remains to be seen whether the investigation will result in a loss of revenue to MMC be customer defection or a reduction in earnings as a result of changed commission practices.

(more…)

Education Management Corp.

A Company to Consider Buying. Education Management Corporation (EDMC) provides private post-secondary education in North America. EDMC delivers education to students through traditional classroom settings as well as through online instruction. Its educational institutions offer a broad range of academic programs concentrated in the following areas: media arts, education, design, information technology, fashion, Law and legal studies, culinary arts, business, psychology and behavioral sciences, and health sciences. It offers academic programs through four educational systems: The Art Institutes; Argosy University; American Education Centers; and South University.

EDMC acquired AEC and South University during fiscal 2004. As of June 30, 2004, EDMC had 67 primary campus locations in 24 states and two Canadian provinces. Its program offerings culminate with the award of degrees ranging from associate’s to doctoral degrees. It also offer non-degreed programs, some of which result in the issuance of diplomas upon successful completion. Prior to fiscal 2004, The Art Institutes and Argosy University were managed as separate operating segments. During the first quarter of fiscal 2004 we shifted from an educational system approach to a centralized corporate structure utilizing divisions which have been aggregated into one operating segment. EDMC currently has three distinct operating divisions organized by geographic location within North America: the Eastern Division; Central Division; and Western Division.

Looking at the Stock Selection Guide

Quality. Look at Part 1 of the SSG. EDMC has had consistent growth in revenues and earnings over the past seven years. Value Line rates its earnings predictability 100 (out of 100) and its financial strength a “B+”. Section 2 of the SSG shows pretax profit on sales as 13.8% (5-year average) and trending up slightly. ROE is up over the last three years but slightly below the 5-yr average.

One caution is that EDMC has not done as well as its industry competitors over the past five years on return on equity (18.0 vs. 21.9) or net profit margin (8.3 vs. 12.7). Also, it would be better if Value Line financial strength were a B++ or higher. Overall, EDMC is a quality company.

Growth. Value Line projects EPS growth at 21.5 (based on revenue growth of 21.5. Reuters projects EPS growth of 20% (based on 7 analysts). Morningstar also projects 20% growth (based on 11 analysts).

Projected EPS in Five Years. The SSG uses EPS growth RATE of 19%. Resulting in a 5-yr EPS of $2.58. Here is the formula for 5-yr EPS using the trailing twelve months (TTM) EPS of $1.08 and projected growth rate of 19%: [2.58 * (1.19)^5]. Using the “preferred procedures on the SSG (assuming 19% revenue growth, 15% pretax profit margin (Value Line 17.6%), 40% tax rate and 78M shares outstanding, projected 5-yr EPS is 2.47.

Average High and Low PE. The SSG uses an average high PE of 28.5. This PE is 1.5 times the 19% projected growth rate (1.5 * 19 = 28.5). The current PE is 27.3. Relative value of 106.2 and projected relative value is 89.1. Since EDMC is fairly priced relative to its historic PE, gains form PE expansion are unlikely.

Projected 5-year Return (Annualized). Using the data from above, total return for EDMC is 20.1% and projected average return (PAR) is 15.7%. The upside-downside ratio is 4.4.

Report for October 2004

Annualized Internal Rate of Return (IRR): 2.2% YTD and 6.7% since Nov. 2000

Summary Report | PERT | Trend Report | Offense Report | Defense Report

At the end of October, the Moose Pond Investors portfolio had the following weighted averages: projected total return of 21.4%, projected average return (PAR) of 16.1%, upside / downside ratio of 4.6 to 1 and a relative value of 92.2. These are all very good averages. The portfolio has 8% of its assets in cash, part of which we will deploy this month.

Defense and offense alerts.* Several of our stocks have fallen short of the sales growth targets for the trailing twelve months. (See defense report above.) These stocks include Fannie Mae, Affiliated Computer Services and Harley-Davidson. One other stock in the portfolio to watch closely is UTStarcom.

* A defense alert means that a stock’s current sales or earnings growth has fallen below the growth rates that were projected for that stock. We look at changes in growth rates for the both current quarter and the trailing twelve months. In both cases, we compare current sales and earnings with the corresponding period on year earlier. An offense alert means that a stock’s projected average return has fallen below our desired return for that stock.

Report for September 2004

Annualized Internal Rate of Return (IRR): -1.5% YTD and 5.37% since Nov. 2000

Summary Report | PERT | Trend Report | Offense Report | Defense Report

At the end of September, the Moose Pond Investors portfolio had the following weighted averages: projected total return of 21.0%, projected average return (PAR) of 16.1%, upside / downside ratio of 4.6 to 1 and a relative value of 92.2. These are all very good averages. The portfolio is nearly fully invested in stocks with 5.2% of assets in cash.

In September, we purchased additional shares of Intel and Pfizer. The big price movers in our portfolio this month were Fannie Mae (-14.8%) and Capital One Financial (+9.1%) and Lowes (+9.4%). (But remember, it’s not price movement but stocks fundamentals that matter in the long term!)

Defense and offense alerts.* Several of our stocks have fallen short of the sales growth targets for the trailing twelve months. These stocks include Capital One Financial (3.0% vs. 14%), Harley Davidson (7.1% vs. 12%), and Affiliated Computer Services (8.4% vs. 14%). Also, Brown & Brown is below our target projected average return (12.3% vs. 15%). Other stocks in the portfolio to watch closely are UTStarcom and Fannie Mae.

* A defense alert means that a stock’s current sales or earnings growth has fallen below the growth rates that were projected for that stock. We look at changes in growth rates for the both current quarter and the trailing twelve months. In both cases, we compare current sales and earnings with the corresponding period on year earlier. An offense alert means that a stock’s projected average return has fallen below our desired return for that stock.

Report for August 2004

Internal Rate of Return (IRR):

2.33% year-to-date and 6.09% since Oct 2000

Summary Report |

PERT |

Trend Report |

Offense Report |

Defense Report

The portfolio has the following weighted averages: total return of 20.7%, projected average return (PAR) of 15.8%, upside / downside ratio of 4.5 to 1 and a relative value of 93.2. These are all good averages. The portfolio is almost fully invested in stocks with only 5% cash.

This month we purchased initial positions in Amgen and Bed, Bath and Beyond. We also purchased additional shares in UTStarcom and Commerce Bank Corp.

All of the club’s transactions have been loaded into NAIC’s Portfolio Record Keeper (v.5). The program calculates internal rates of return accurately and also generates a number of useful reports. See the Appraisal Report and the Performance Report for this month.